In recent years, many retail and institutional investors have been opening up to the possibility of holding cryptocurrencies to achieve a well-balanced portfolio. Hedge funds, banks, mutual funds, and individuals all add cryptocurrency to their portfolios due to its present value and the future potential of blockchain technology, and you, too, should not be left out.&

Crypto investment strategy refers to the set of techniques and approaches investors use to maximize profits while minimizing risks when investing in digital currencies. The crypto world is highly volatile and complex, with numerous factors influencing cryptocurrencies' prices.

As such, investors need a solid understanding of the volatile market and crypto trading strategies, combined with the tools for fundamental and technical analysis to make informed investment decisions. By employing a successful cryptocurrency investment strategy, investors can mitigate risks and take advantage of opportunities in the ever-evolving digital currency space.

If you have little to no idea about how to get started and how to invest money in cryptocurrencies, this article is for you. It will delve deep into various cryptocurrency investing strategies and discuss their advantages and disadvantages to help you get started.

Let’s get right to it!&

A crypto investing strategy depends on your personal preferences, investment goals, and risk tolerance. We will cover some of the most used and proven strategies for crypto investing, namely:

- Buy and hold

- Dollar-cost averaging (DCA)

- Early-bird investing

- Copy trading

- Following trading hype and narratives

- Buying micro-cap altcoins

- Participating in airdrops

- Technical analysis trading

- Arbitrage trading

- High-frequency trading

Here's a closer look into the best crypto investing strategies:

Buy and Hold Strategy

The phrase “buy low, sell high” succinctly encapsulates the buy-and-hold strategy. Also called position trading, the buy-and-hold strategy is one of the best investing strategies to earn passive income. This crypto investment strategy enables traders not to feel concerned about short-term market fluctuations but buy and store their crypto for a longer timeframe.&

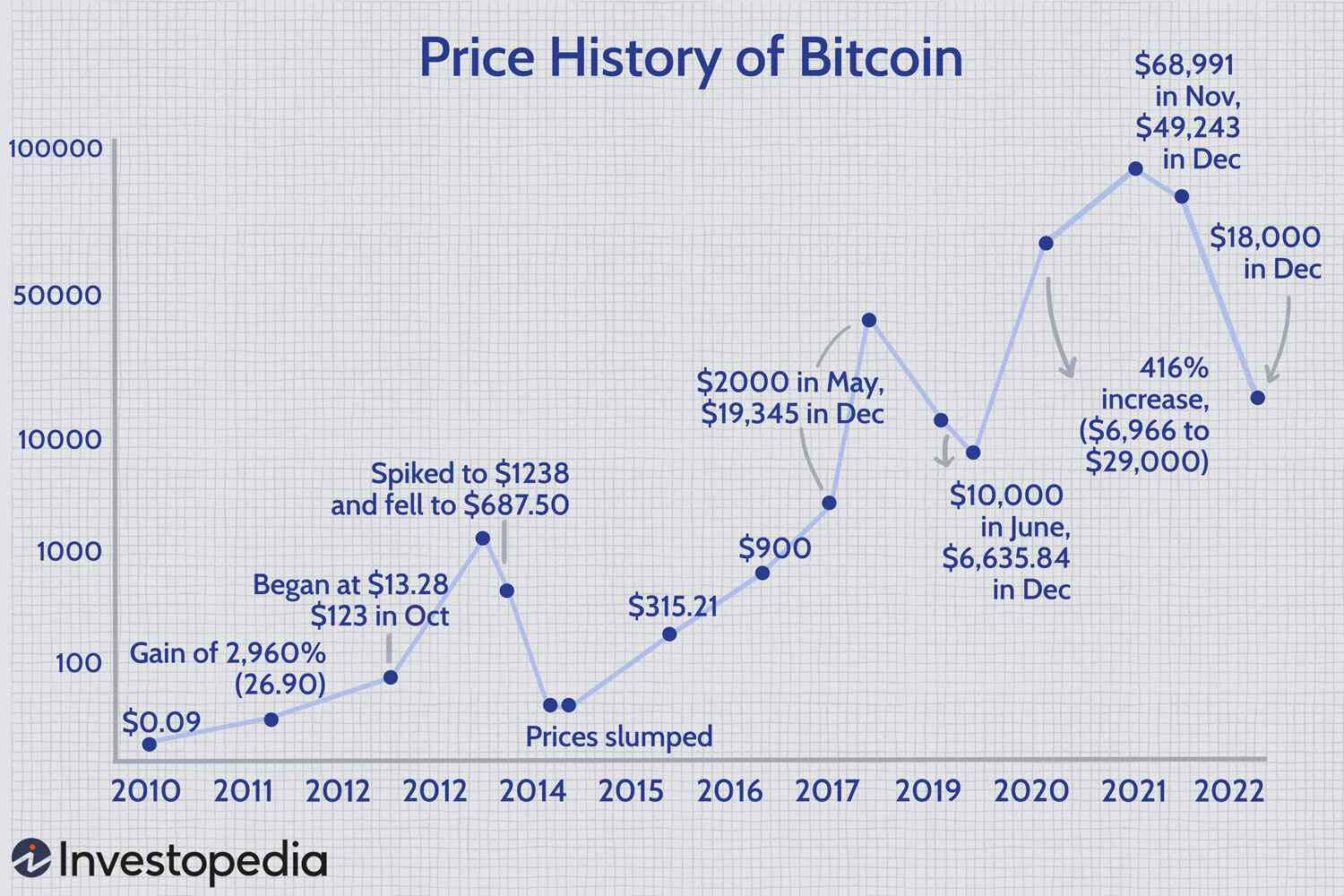

For example, if you'd invested $100 in Bitcoin in 2012 and didn't sell, you could have roughly $50 million today. Bitcoin has had multiple corrections and crashes during this period, but the investor using the buy and hold strategy wouldn't be concerned with those depending on the timeframe of the trade.&

This strategy is best for investors who believe in projects with strong fundamentals and can afford not to see any returns for a few years. They buy crypto and hold it long-term to profit from a future price increase.

Advantages

- The buy-and-hold strategy helps filter out the noise with any investment.

- Capital gain taxes can be deferred for long-term investments.&

- The likelihood of a badly timed decision is slim.

Disadvantages

- Investors are not immune to losses.

- Often, one bad timing can affect the whole portfolio.

- There might be more opportunities for profit in a trading session, leading to more gains for an active investor.&

Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a popular investment strategy used across different asset classes. The strategy involves an automatic system of making fixed dollar amount investments (crypto allocation strategy), regardless of a token’s price.

It involves leveraging the ups and downs of a crypto price to achieve a favorable average price when the crypto price skyrockets. For example, people who bought a fixed amount of Bitcoin on crypto exchanges every month between $1 and $1000 would have made a significant profit when the price hit $60,000.&

A more significant improvement to the DCA is a strategy called value investing when a value investor will start investing in a particular cryptocurrency if they believe it's underpriced compared to their perceived value.

Advantages

- The investor is not affected by short-term volatility.

- It's easy to implement for both beginners and experienced traders in the crypto space.

- The DCA process can be automated.&

Disadvantages

- This crypto investing strategy does not pay off long term unless there is a strong bull run.

Early-Bird Investing

When new projects need funds to launch a product, they usually perform some sort of funding rounds. In the case of crypto projects, investors are often given the option to invest in initial coin offerings (ICOs) or similar crowdfunding-type offerings. This is a way to offer stakes in the project’s native token for investing in the project, similar to the Initial Public Offering (IPO) for traditional assets in the stock market.

ICOs can be very profitable but carry significant risks due to their unregulated nature, so performing due diligence before investing in an ICO is a must.&

Some of the things to find out before investing include:

- Ensure clarity of purpose

& Check if the project needs an ICO or if it can perform just as well without one. Also, determine what the funds will be used for and their allocations.&

- Research about the team&

Are the team members new to the crypto space, or do they have prior experience with crypto projects? Check the previous projects they have been engaged with and their roles and success in these projects. This will make the chances of losing money slimmer.&

- Check the ICO’s legal document&

Investors should perform due diligence and check the project's proof of authenticity.

Advantages

- Token prices in ICOs are often the lowest an investor can get.&

Disadvantage

- A project might fail after the ICO, leaving investors with worthless tokens.

Copy Trading

Copy trading is an investment strategy that involves copying the trades of a more experienced or successful trader on a crypto exchange. In essence, you're entrusting your investments to another trader with a proven track record of successful trades.

The process usually involves a social trading platform with a list of experienced traders whose trades you can choose to replicate. Copy trading is an excellent choice for people wanting to earn while learning the intricacies of the crypto market or not having time to trade consistently.& &

Advantages

- It enables investors to benefit from the knowledge of an experienced investor, potentially leading to better investment returns.&

- Copy trading through a user-friendly social platform interface/crypto exchange is relatively simple.

Disadvantages

- The trader you're copying may experience losses or may not perform as well as you had hoped.&

- Social trading platforms often charge fees that can impact your overall returns.

- In the crypto world, past performance is not indicative of future returns.&

Following Trading Hype and Narratives

Investing in cryptocurrencies based on hype and narratives is becoming increasingly popular as a trading strategy. Hype and narratives refer to the stories, rumors, and news surrounding a cryptocurrency that can affect its price and trading volume.

Crypto investors using this strategy invest in crypto, which generates a lot of buzz and media coverage. They use hype and narratives to identify undervalued and overvalued coins to buy when the hype is low and sell when it's high.

The idea behind this strategy is that hype and narratives can create a self-fulfilling prophecy. If enough people start talking about a particular coin, it can create a buzz that attracts more buyers, increasing the price. Similarly, if negative rumors start circulating, it can cause panic and sell-offs, driving the price down.

A crypto investor using this strategy must be vigilant in monitoring the news and social media for any signs of changes in sentiment or narratives. This can involve tracking specific keywords, hashtags, and mentions related to a particular coin to identify emerging trends or developments.

Advantages

- The potential for short-term profit is immense.&

Disadvantages

- Narratives and hype can be unpredictable and subjective.

- It's highly prone to rug pulls and manipulations by insiders.

- It needs constant monitoring of news and sentiments.

- Not advisable for new traders as many coins don't have inherent utility.

Buying Micro-Cap Altcoins

As the crypto markets evolve, more investors consider micro-cap altcoins as a viable investment strategy. Micro-cap altcoins are digital assets with a small market capitalization, usually below $50 million, often overlooked by mainstream investors but have the potential for high returns if their projects succeed.

The primary rationale behind buying these coins is that Bitcoin might gain 10,000% on its current price, but many cryptocurrencies are well primed to rally by at least 3,000%. Since they are undervalued and largely overlooked, an early crypto investor is often the rally's best beneficiary.&

Other reasons people use this crypto investing strategy include the following:

1. Diversification

Investing in micro-cap altcoins can help diversify your crypto portfolio, reducing your overall risk and potentially increasing your returns.

2. Emerging technology

Micro-cap altcoins are often tied to emerging technologies and trends with long-term growth potential. Micro-cap altcoins could become the early adopters of new industries and technologies.

Advantages

- & Suitable for long-term investments.

- Small-cap crypto investments could be a gem in a few years.

- Often, large projects fall within the market cap of micro-cap projects due to some corrections. This can signal a good buy if there is nothing fundamentally wrong with the project.&

Disadvantages

- These coins are often highly volatile and can go through significant price fluctuations.&

- They can be perfect for pump and dump schemes.

- Many small-cap projects have hazy roadmaps and inexperienced teams.&

Participating in Airdrops

An airdrop is a marketing technique crypto companies use to attract investors to their projects. Airdrops involve giving away free crypto coins to users for completing minimal tasks or meeting specific requirements. For example, a company may offer free crypto coins to anyone who follows them on social media or signs up for their email newsletter.

Investors can take advantage of airdrops as an investment strategy by carefully researching the projects offering airdrops and completing the required tasks to receive free tokens. Once you receive the crypto assets, you can hold onto them and wait for their value to increase before selling them for a profit.

However, it's important to note that not all airdrops are created equal. Some airdrops are scams, while others may not be worth your time and effort. As an investor, you must do your own research and only invest in projects with a solid track record and good potential for growth.

You can search online for lists of upcoming airdrops, join crypto communities on social media platforms like Telegram and Reddit, and follow crypto influencers to stay updated on new airdrops.

& Advantages

- It's free to implement.

- No start-up cost and great potential returns.

- Popular projects like OP and Aptos have airdropped some of their tokens.&

Disadvantages

- Many airdrops are scams.

- People who use airdrops are mostly after gains, not because they believe in the project. This can hamper long-term holdings.

Technical Analysis Trading

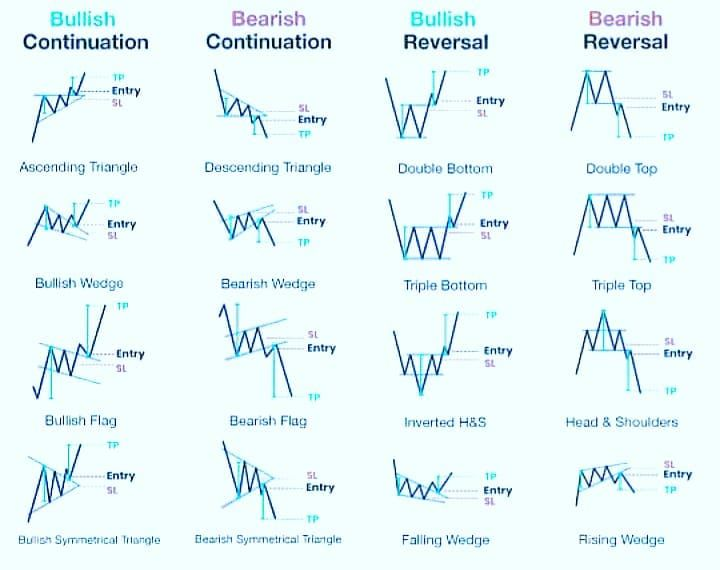

Technical analysis is an investment strategy that involves analyzing past market data and using it to predict future price movements. When applied to cryptocurrencies, it can help traders make informed decisions about when to buy and sell their digital assets.

One of the most common types of technical analysis is chart analysis, which involves examining charts of past price movements to identify patterns and trends. Other techniques include indicators like moving averages to identify trends in market data and oscillators to measure the momentum of price movements. Combining these techniques with your market knowledge enables you to make informed decisions about when to buy or sell a specific digital asset.

Advantages

- Technical analysis is based on data rather than subjective opinions or speculation. This makes it a valuable tool for traders looking to make rational decisions based on actual market data.

- Investors can profit from common patterns.

Disadvantages

- Market conditions can change, making chart patterns irregular.

Arbitrage Trading

Arbitrage trading is a cryptocurrency investing strategy that involves buying and selling the same asset on different exchanges to take advantage of price differences. Cryptocurrency prices can vary significantly across different exchanges, presenting a unique opportunity for investors to profit from the price differences.

Arbitrage trading involves purchasing a cryptocurrency on one exchange for a lower price and selling it on another for a higher price. The difference in prices is the profit earned by the trader. The investor's goal is to execute trades quickly and take advantage of the price differences before they disappear.

Advantages

- It's a low-risk strategy. Since the trader is buying and selling the same asset in the same period, the risk of loss is minimal.

- It doesn't depend on market trends or long-term price movements but relies on short-term price fluctuations.

Disadvantages

- It can be challenging to execute as it requires a deep understanding of the cryptocurrency market and the ability to identify price discrepancies quickly.&

- It may involve significant transaction fees.

- Not suitable for new traders.&

High-Frequency Trading

High-frequency trading (HFT) is a trading strategy that utilizes advanced algorithms to execute trades at lightning-fast speeds. This trading approach is prevalent in crypto, where volatile and rapidly changing market conditions require fast and accurate decision-making.

As a cryptocurrency investing strategy, HFT aims to generate profits by taking advantage of tiny price movements within milliseconds. HFT traders leverage advanced technologies, such as high-speed data feeds, powerful computers, and complex algorithms, to analyze market trends and execute trades at breakneck speeds.

Advantages

- Processing vast amounts of data and executing trades in real-time allows traders to capitalize on even the smallest price changes, generating significant profits over time.

Disadvantages

- The cryptocurrency market's high volatility can result in significant losses for HFT traders, especially in instances of unexpected market movements.&

- The prevalence of high-frequency trading in cryptocurrency markets can lead to increased market instability and manipulation.&

Additional trading strategies include yield farming strategy (a combination of providing liquidity to a decentralized exchange, staking, and depositing your crypto into a lending platform) and swing trade crypto strategy (in which traders stay in their position for a short or medium time frame)

Conclusion

In conclusion, crypto investing is a high-risk, high-reward endeavor requiring careful consideration and planning before entering the decentralized finance (DeFi) world. Various strategies investors can use include buying and holding for the long term, day trading, margin trading using borrowed funds, and diversifying their portfolio.

Remember that there is no one-size-fits-all approach to crypto investing, and what works for one investor may not work for another. Additionally, staying informed about market trends and developments is essential, as the cryptocurrency market is constantly evolving. By staying disciplined and informed, investors can make informed decisions and potentially reap the rewards of this exciting and dynamic asset class.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments