Originally published on Unchained.com.

Unchained is the official US Collaborative Custody partner of Bitcoin Magazine and an integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

For newcomers, especially those in and around retirement age, the idea of investing in or owning bitcoin can evoke reactions from skepticism to disbelief. If you look beyond the popular narratives, however, you might find there is more to the story than first impressions suggest. Here are six reasons to consider owning at least some bitcoin during retirement.

1. Bitcoin helps broaden your asset allocation base

Traditionally, investors use a strategy called asset allocation to distribute and shield funds from investment risk over time. A sound asset allocation strategy is the antidote to putting all of your eggs in one basket. There are several types of asset “classes” or categories over which to distribute risk. Customarily, advisors seek to establish a dynamic mix between debt instruments (i.e., bonds), equities (i.e., stocks), real estate, cash, and commodities.

The more categories you employ to distribute your assets and the less correlated those categories are, the better your chances of balancing your risk, at least theoretically. Recently, due to unintended consequences caused by the aggressive expansion of societal debt and the money supply, assets that were previously less correlated now tend to behave more in kind with one another. When one sector gets hammered today, several sectors often suffer together.

Regardless of these present-day conditions, asset allocation remains a well-conceived strategy for moderating risk. While still in its relative infancy, bitcoin represents an entirely new asset class. Because of this, owning at least some bitcoin, especially due to its distinct properties when compared to other “cryptocurrencies,” provides an opportunity to broaden your asset base and more effectively distribute your overall risk.

2. Bitcoin offers a hedge against inflation and currency debasement

As a retiree, protecting yourself from inflation is crucial to preserving your long-term purchasing power. In the asset allocation discussion above, we referenced the recent and aggressive money supply expansion. Everyone who has lived long enough to approach retirement age knows that a dollar no longer buys what it used to. When the government issues large amounts of new money, it debases the value of the dollars already in circulation. This generally pushes prices higher as newly created dollars begin to chase the existing limited supply of goods and services.

Our own Parker Lewis touched on this extensively in his Gradually, Then Suddenly series:

In summary, when trying to understand bitcoin as money, start with gold, the dollar, the Fed, quantitative easing and why bitcoin’s supply is fixed. Money is not simply a collective hallucination or a belief system; there is rhyme and reason. Bitcoin exists as a solution to the money problem that is global QE and if you believe the deterioration of local currencies in Turkey, Argentina or Venezuela could never happen to the U.S. dollar or to a developed economy, we are merely at a different point on the same curve.

In contrast to fiat currencies, no one can increase the supply and arbitrarily reduce bitcoin’s value. There are no centralized authorities that govern its monetary policy. Despite arguments to the contrary, bitcoin is similar to gold—but not exactly, because gold miners continue to inflate the supply of gold each year at a rate of 1-2%.

As bitcoin is slowly introduced to the circulating supply (i.e., mined), its inflation rate decreases and will eventually cease. This fact makes bitcoin uniquely scarce among global monetary assets. Ultimately, this scarcity, along with bitcoin’s other monetary properties, should safeguard its purchasing power. As such, owning bitcoin during retirement offers you a hedge against inflation.

3. Bitcoin offers an opportunity for asymmetric returns

Bitcoin’s capacity to mitigate many of the challenges we discuss here rests on its ability to achieve asymmetric returns. Its supply is fixed (there will only ever be 21,000,000 bitcoin), and demand for the asset is growing steadily. As this limited supply collides with increased store-of-value adoption from individuals, institutions, and governments, bitcoin has the potential to dwarf the returns of nearly every competing asset class.

It’s worth noting that people generally improve their returns with bitcoin when they hold it for the long term. In the modern era, retirements lasting decades or more are increasingly common. Over such time periods, even a limited allocation to bitcoin offers ample opportunity to benefit from its upside potential. You just need time to hold through the short-term volatility, which contrary to popular belief, is not evidence of it being a poor store of value.

Sequestering a portion of funds solely for appreciation during retirement runs somewhat counter to conventional wisdom. Modern retirement planning generally optimizes for the liquidation of portfolio funds to provide income. However, setting aside a small amount of bitcoin—kept steadfastly gated from funds earmarked for income—opens the door to benefit from the monetization of bitcoin’s limited supply.

4. Bitcoin offers protection from the risk of long-term bonds

Conventionally, high-grade bonds—held directly or as fund shares—make up a significant part of most retirement portfolios due to their low risk levels and tendency toward capital preservation. However, things have changed.

Monetary expansion and increases in societal debt have forced bond yields—or the amount of interest paid (i.e., coupon)—to historically low levels. The yields on most bonds today fall well below the rate of inflation. This “negative real yield” means that owning a bond can cost you money. But the difficulty doesn’t end there.

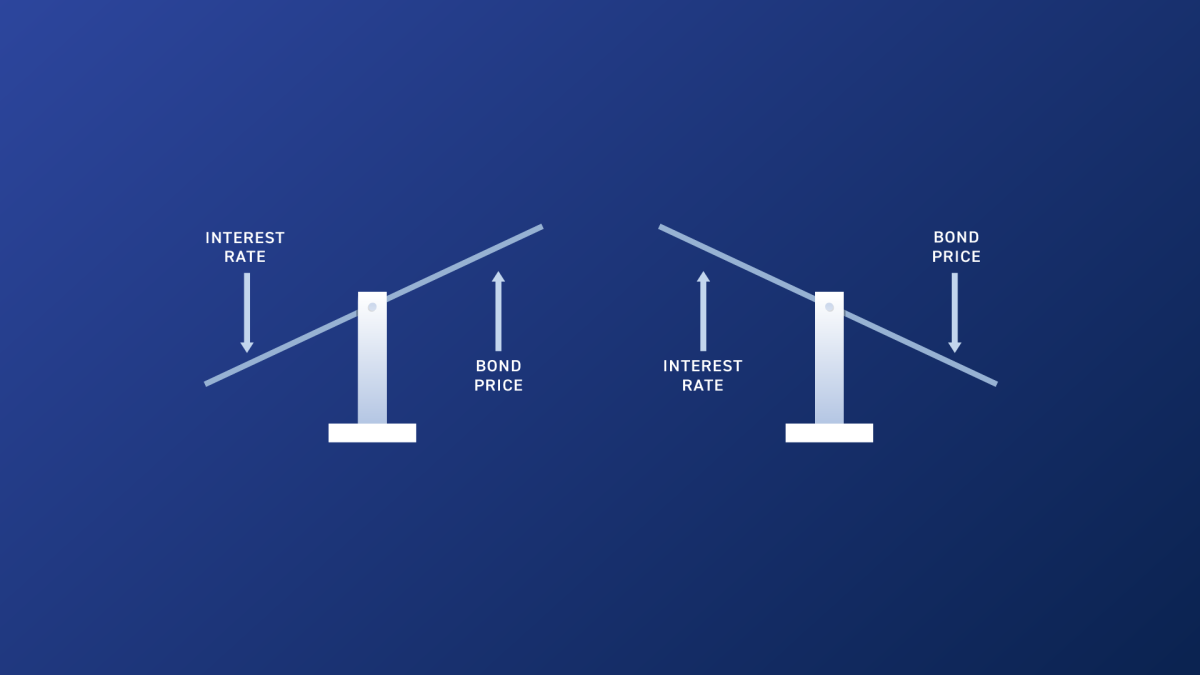

Because retirees need funds from their portfolios to pay bills, they generally must sell assets at current market rates to derive income throughout retirement. In the case of bonds, at present, this can be very problematic. Consider the following equations.

- How much money does it take for a bond paying a 2% rate to yield $20? Answer: $1,000. ($1,000 x 2% = $20)

- How much money does it take for a bond paying a 4% rate to yield $20? Answer: $500. ($500 x 4% = $20)

These two equations reveal that to yield the same $20 return, the market value of the underlying bond changes based on the interest rate promised.

- When interest rates go up, the market value of bonds goes down.

- When interest rates go down, the market value of bonds goes up.

The market value of bonds has an inverse relationship to interest rates. Consider that interest rates today hover near historic lows. Over the next twenty to thirty years, what will happen to the market value of bonds held by retirees if interest rates increase substantially? The answer: the market value of their bonds will collapse.

This changes the entire risk paradigm for bonds in retirement portfolios and potentially makes them far less safe than typically imagined. Bitcoin exists in a separate asset class from bonds; it is a bearer instrument that is not exposed to the same money market risks. As such, owning bitcoin may help you offset at least some of the potential risk incurred from owning bonds in retirement.

5. Bitcoin offers a potential solution for long-term healthcare risk

Another area of concern for retirees is the cost of healthcare. Here, I am not referring so much to ordinary medical bills but rather to the potential to incur long-term care expenses in later age. Insurance is available for long-term care, but it has some unique and increasingly difficult challenges to overcome.

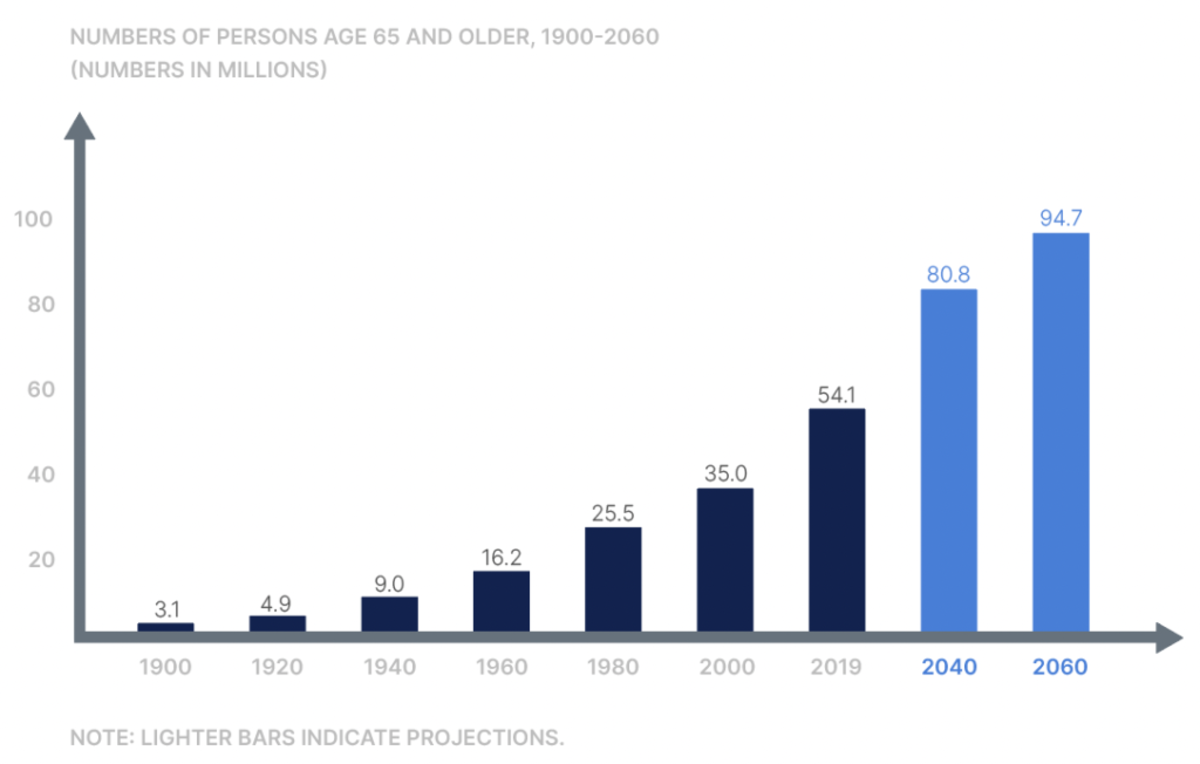

Healthcare, in general, takes a double-hit when it comes to price inflation. Not only do healthcare costs rise due to monetary debasement, but healthcare faces additional headwinds from demand spurred by growth in the aging population.

States regulate insurance for long-term care. To keep policyowners safe, insurers face scrutiny over where and how they invest policy premiums. To preserve capital required for future claims, insurers generally rely on low-risk, intermediate and long-term bonds. However, as our discussion above on bonds reveals, low yields and the potential for rising rates complicate this practice. One immediate fallout is that premiums for long-term care insurance policies have risen substantially.

We noted earlier bitcoin’s usefulness as an inflation hedge and its potential for long-term price appreciation. As it relates to long-term healthcare, it may make sense to set aside some bitcoin explicitly dedicated as a hedge for this rapidly increasing expense.

6. Bitcoin offers you individual sovereignty

The final reason we’ll consider for owning bitcoin in retirement is that it offers you increased individual sovereignty. Bitcoin provides you a level of ownership that is not achievable with other assets. It can easily be carried across borders with a hardware wallet or seed phrase, for example, or transferred peer-to-peer anywhere in the world at low cost.

If you hold bitcoin securely in a wallet you control, no central bank can steal the value of your bitcoin by printing it into oblivion. No CEO can dilute its value by issuing more of its “shares.” Nor can a bank arbitrarily block access to or confiscate your funds. Unlike centralized financial custodians, which can be ordered to freeze or withhold funds on the whims of government or other third-party authorities, bitcoin with keys properly held is resistant to these kinds of overreach.

Specifically for retirement purposes, you can also hold your own keys for bitcoin in an IRA. Products like the Unchained IRA are a robust tool for building and saving your wealth on a tax-advantaged basis. And holding your bitcoin keys in the form of a multisig collaborative custody vault allows you to eliminate all single points of failure while you do so.

Sound financial principles and owning bitcoin

Benefitting from bitcoin does not require committing to wild speculation or thoughtless abandonment of sound financial principles. In contrast, the more you look at bitcoin through sound financial principles and apply them to your thinking, the greater the opportunities it provides. One steadfast financial principle that coincides with bitcoin ownership is prudence.

Macro-economic investment strategist Lyn Alden often speaks of establishing a “non-zero position” in bitcoin (i.e., owning at least some). The risk of losing a few portfolio percentage points in a worst-case scenario is, in my estimation, worth the potential upside. But to be clear, each person’s situation is unique. You must do your own research and make the best decisions you can about what works in your particular scenario.

Originally published on Unchained.com.

Unchained is the official US Collaborative Custody partner of Bitcoin Magazine and an integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments