Data of an on-chain indicator suggests the majority of the altcoins have now dropped into the historical “danger zone,” a sign that could be bearish.

Altcoins May Be Overbought Currently As Trader Profits Have Shot Up

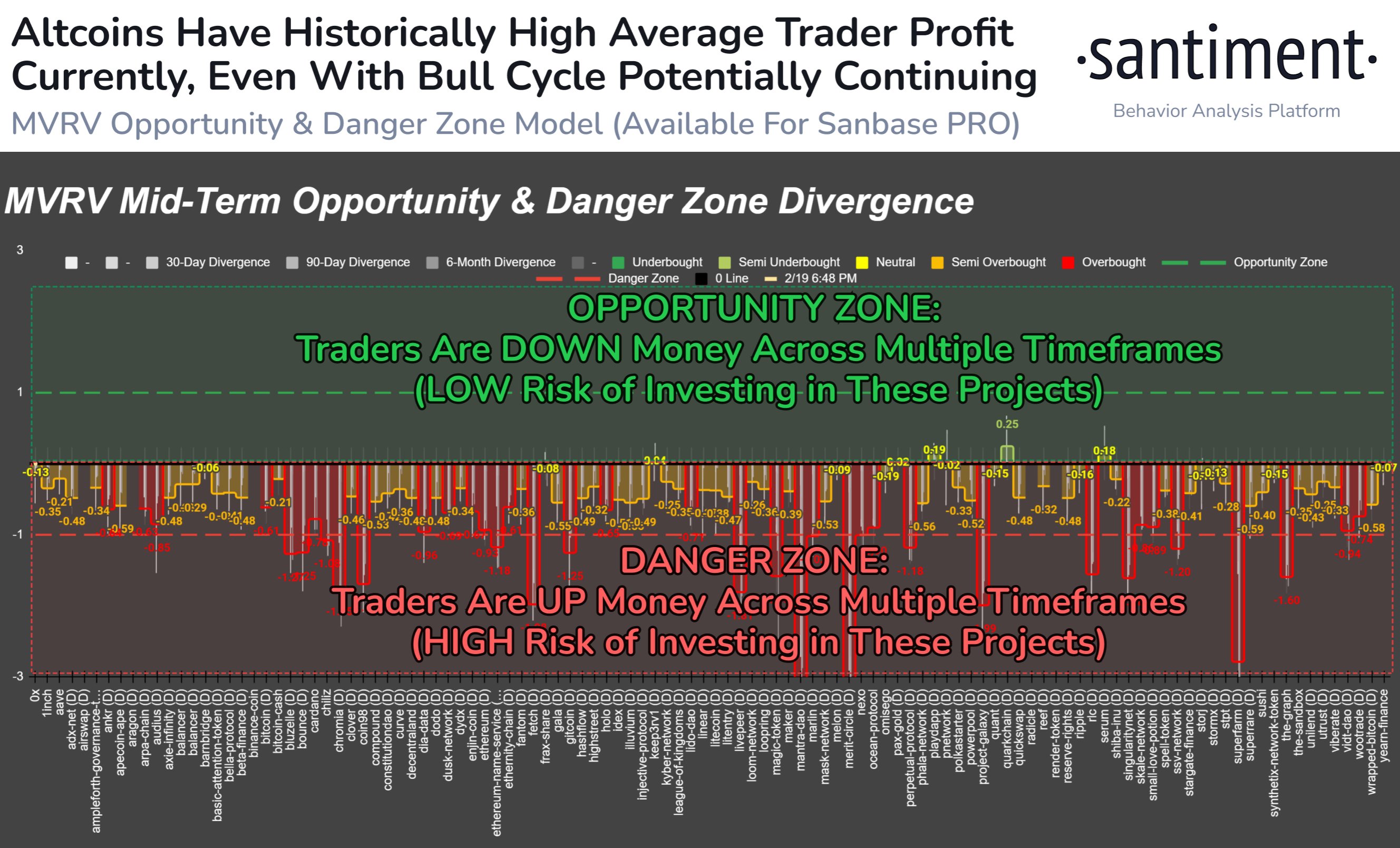

In a new post on X, the on-chain analytics firm Santiment has discussed how the altcoins as a whole have been observing high profits recently based on the MVRV ratio.

The “Market Value to Realized Value (MVRV) ratio” is an indicator that keeps track of the ratio between the market cap and realized cap for any given cryptocurrency.

The “realized cap” here refers to a capitalization model that assumes the real value of any token in circulation is not the current spot price of the asset, but rather the value at which it was last moved on the blockchain.

As the previous transaction for any token was likely the point at which it last changed hands, this previous price would serve as its current cost basis. As such, the realized price essentially accounts for the cost basis of every investor in the market.

Since the MVRV ratio compares the market cap of an asset (that is, the total value the investors are holding right now) with its realized cap (the value that the holders as a whole put into the coin), it can tell us about the profitability ratio for the average investor of the cryptocurrency.

Historically, the investors holding large amounts of profits (that is, a high MVRV ratio) have been a signal that the asset is overheated, while the investors being in losses have suggested an underbought status. Based on this historical pattern, Santiment has defined “opportunity” and “danger” zones for the market.

The chart below shows a measure of the divergence of the MVRV ratio for different timeframes and for various altcoins:

According to Santiment’s model, the MVRV ratio diverging to the -1 mark (from its normal 0% value) suggests the asset in question is inside the danger zone where traders carry high profits. From the graph, it’s visible that most of the altcoins are inside this region right now.

“Outside of a few lagging altcoins, the vast majority of crypto projects have generated profits for the average wallet on a mid to long term timescale,” explains Santiment. “This means that our model is indicating a fair bit of ‘overbought’ signals.”

Similar to the danger zone but opposite to it is the opportunity zone, where the indicator’s divergence reaches the 1 level. In this zone, few investors are carrying high profits, so coins inside this zone may present a ripe opportunity for accumulation. Currently, though, no asset is present in this region.

“This certainly doesn’t mean that cryptocurrency is on the verge of a massive correction,” says the analytics firm. “But based on history, the highly reputable MVRV metric is revealing there is a higher risk than average in buying or opening new positions while markets are in the midst of a 4+ month surge.”

ETH Price

Ethereum has seen a decoupling from Bitcoin recently as the coin has registered a fresh surge above the $2,900 mark, while the original cryptocurrency has slumped sideways.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments