Key Takeaways

- Bitcoin has historically performed robustly in the year following a halvening event

- However the sample size is small, meaning care should be taken in assessing past performance

- Halvening cycles have also coincided with global liquidity cycles, offering an alternate theory for Bitcoin’s strong post-halvening performances

- The next halvening is slated for April 2024

- The question of whether halvenings are priced in is an intriguing one to analyse

Perhaps nothing sums up Bitcoin’s enigmatic, mysterious and unique makeup like the halvening events. As time goes on, these events have become the subject of fierce debate as to how they affect Bitcoin’s price. Will the sudden dip in new supply boost Bitcoin’s price, as it has in the past? Or are these scheduled events, by definition, already priced in?

Before analysing this question, let us quickly explain the halvenings for the uninitiated. These events refer to the phenomenon by which the block reward for Bitcoin is cut in half every four years (or every 210,000 blocks, to be exact). In such a way, the rate at which new Bitcoins are released suddenly drops 50% every four years. Currently, each new block appended to the end of the blockchain results in 6.25 Bitcoin being released, equating to 900 extra Bitcoin in circulation. Upon the next halvening, this will fall to 3.125 Bitcoin per block, and 1.5625 four years after that, and so on.&

The first halvening occurred in 2012, the second in 2016 and the third in 2020. The next halvening should occur in April 2024. These halvenings will continue approximately every four years until the 64th and final halvening will occur in the year 2140, after which miners will live off transaction fees alone, and no more Bitcoin will be released into circulation.&

This halving schedule means that, despite Bitcoin only being 14 years old, over 92% of the final supply of 21 million Bitcoin is already mined. It also creates the seductive hard supply cap so often referenced by Bitcoin enthusiasts: there will only ever be 21 million Bitcoin, and we know the schedule at which they will hit the market.&

This is set and stone and is familiar to most Bitcoin investors. Where it gets interesting and things open up for debate, however, is how these halvening events affect the price.&

Previous halvenings have preceded aggressive rises in the Bitcoin price. Some point towards the simple effect of supply and demand: as the rate of new supply suddenly cuts in half, the price should rise, all else equal. We will deal with this after this chart, which demonstrates how the Bitcoin price has indeed moved in accordance with these four year cycles.&

While the above chart looks seductive, there are three glaring counterpoints to the argument that halvenings will be a positive influence on price going forward (afterwards, we will assess why there could also be an intriguing argument that these cycles will hold). &

- Given the 50% supply cut is known in advance, it should be priced in already

- Small sample space

- Global liquidity cycles line up with halvenings

Simply put, the efficient market hypothesis dictates that these halvening events should not bump up price because they are known in advance. This is a compelling argument and one that is hard to discount.&

One must also remember, when assessing the seemingly formidable relationship between these four-year cycles and Bitcoin to date, that there have only been three halvenings. That is an absolutely tiny sample size and means, quite simply, that we don’t know. Not to mention, Bitcoin’s liquidity was still so low at the first halvening in 2013 (some could even argue that the second halvening was not exactly liquid either) that it is hard to even put much weight in the effect of the few halvenings we have seen.&

The fact we have scarcely a decade of Bitcoin price history with any sort of liquidity to analyse is what makes the asset so befuddling, unique and, ultimately, difficult to model via any sort of legacy valuation framework.&

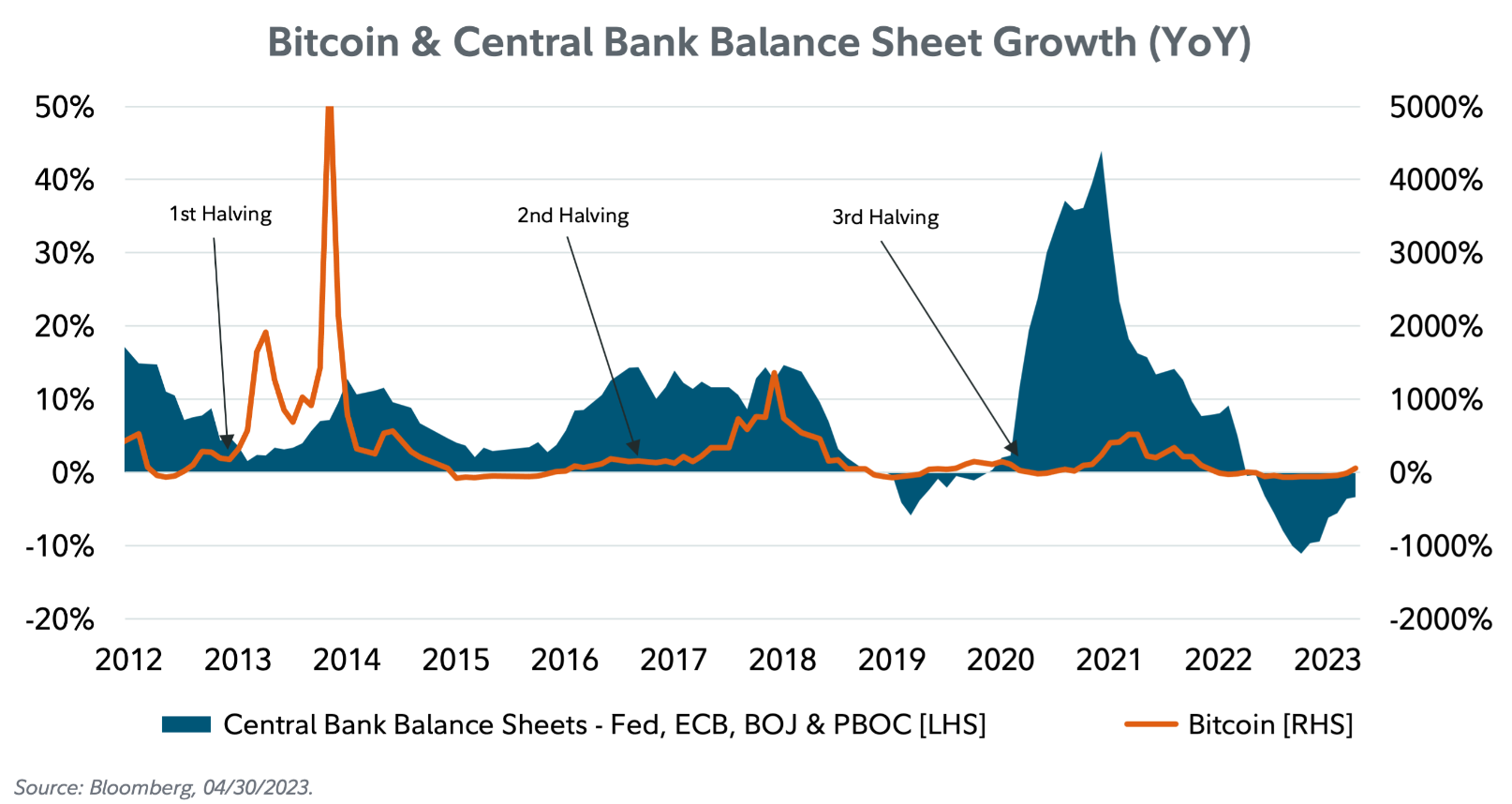

In addition to the small sample size, there is also the matter of global liquidity cycles, which have coincidentally lined up incredibly well with the halvening cycles. The below chart from Fidelity Digital Assets demonstrates this well by plotting the growth of central bank balance sheets against Bitcoin’s growth while marking the halvening events.

The argument that Halvenings will increase price

While the above arguments surrounding the small sample size and the matching with global liquidity cycles are compelling, especially for anyone looking at this as a non-crypto native reared on the efficient market hypothesis, there is one intriguing theory which points to why halvenings may not be priced in &- and one that is very specific to the intricacies of the Bitcoin blockchain. Which, again given its brief history, means it can only be a theory at this point in time.&

Namely, it is derived out of the difficulty adjustment which is programmed into the underlying blockchain; as more miners join the network, the difficulty automatically adjusts so that blocks are validated at the same pace as before (i.e. ten-minute intervals) and hence the supply of new Bitcoins holds steady at the pre-determined pace, regardless of how high the hash rate is on the network. In other words, it becomes more difficult to validate blocks as more miners join the network, meaning a higher cost of energy is required to mine Bitcoin.&

The converse also holds true &- if miners leave the network, it becomes easier to mine and hence lower energy/costs are required to mine. This means that, theoretically, the cost of production for Bitcoin should be driven towards its market price. Otherwise, in theory at least, an arbitrage opportunity would open up if a gap emerged between the cost of production and the market price.

Look at it from a miner’s point of view: if the price of Bitcoin jumps above the cost of production, the miner will allocate their energy towards mining the Bitcoin at the lower cost of production, leading to an upward difficulty adjustment until the delta closes. Similarly, if the cost of production was above the market price, the miner would stop mining as it would be cheaper to obtain Bitcoin on the market, and the cost of production would fall, again until it reaches a natural equilibrium.&

Because the market also has the ability to shift its funds into Bitcoin itself or miners (via publicly traded mining companies and other related investment vehicles), it is essentially faced with the same decision as our hypothetical miner regarding where to allocate their capital.

This is an argument against the thought that the market has priced in the halvening, because if it had, then the price of Bitcoin would be far above the cost of production and the above equilibrium would be violated. An example may illustrate this with more clarity:

Let us take the current market price and production cost of one Bitcoin as $30,000. To use an extreme scenario, if the price of Bitcoin then doubles to $60,000, what would you do as a miner? You would sell your Bitcoin at $60,000 in order to finance your energy cost to mine Bitcoin at $30,000. Other miners will do the same, driving both the hash rate (difficulty) of mining up and the spot price in the market down until convergence is found. It doesn’t just have to be miners &- speculators will realise that Bitcoin may be overpriced relative to its cost and launch their own sell orders, adding to the momentum until convergence is found.&

While the above example overlooks the fact that the hash rate may lag price because it takes time to set up a mining rig / increase mining capacity as opposed to simply clicking a button on a bitcoin spot order, it sums up the predicament. Ironically, this theory argues that efficient markets ensure that the halvening cannot be priced in, otherwise there would be an arbitrage opportunity. Or course, this is ironic because it means that an event which is guaranteed and publicly known cannot be priced in, which is the very definition of the efficient markets hypothesis.&

All in all, the prior theory may be a bit oversimplified, and it is difficult to overlook the influence of global liquidity cycles.&

At the end of the day, with only three halvenings to date and arguably only one with reasonable liquidity, we are all stabbing in the dark &- Bitcoin still carries a lot of mystique from a valuation perspective and it is very challenging to put a formal framework around it. But it shows the power of narratives and how the investors can create them as they please. Either way, we will find out in the near future, as one thing is for certain: we know that halvening is coming, and its ticking closer every ten minutes.

The post Are Bitcoin halvenings priced in? Understanding the price effects of Bitcoin’s supply cut appeared first on CoinJournal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments