Are you planning to invest in the crypto sector, but you don’t know which is the best cryptocurrency to invest in during the 2022 bear market? If so, we’ve made it easy with our complete guide with the best cryptocurrencies to try.

Additionally, we have provided you with our exclusive wallet and exchange user portfolio data in order to help you assess what other crypto users are doing in order to make an educated investment decision.&

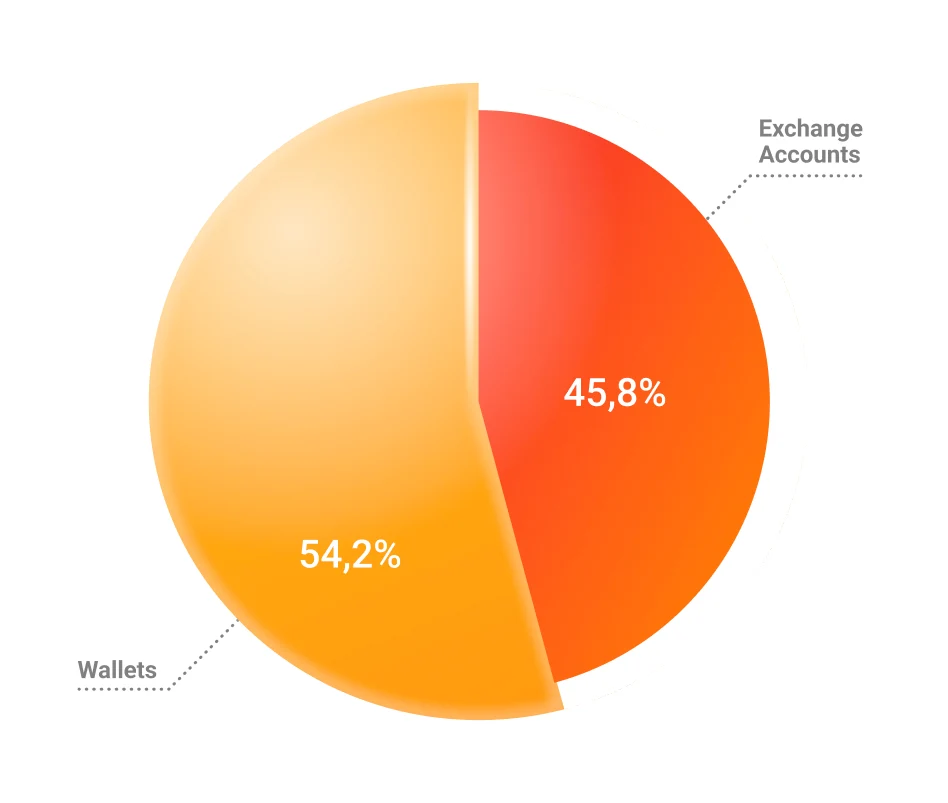

Crypto Holders: Wallets vs. Exchanges

Before we get into which cryptos to buy now, it's important to understand the difference between wallets and exchanges, both in definition and what they are used for.

A wallet is a decentralized tool that allows you to store your cryptocurrencies. Wallets are used for long-term cryptocurrency holding, but also for participating in decentralized finance (DeFi).

On the other hand, an exchange is a platform where you can buy, sell, or trade cryptocurrencies. They are centralized entities that are highly convenient for traders and people that want to quickly and cost-effectively exchange one crypto for another. However, exchanges don't allow you to hold keys to your wallet account, therefore making them less safe for long-term holders - as they say in the crypto space, "not your keys, not your crypto."

It's important to note that wallets and exchanges are used by different people and for different purposes, which is precisely why the average exchange user and the average wallet user portfolios differ.

CoinStats provides over 1,000,000 monthly active users with the ability to view and manage their cryptocurrency holdings in real-time from over 300 exchange and wallet providers, all in one place.

Our user base consists of wallet users, which account for 54.2% of the total user count, while 45.8% of our users have their exchange accounts connected to CoinStats. This means that both wallets and exchange accounts are used equally by our users, so we will have a proper and precise outlook regarding user preferences.& &

Now that we've clarified that, let's take a look at some of the best cryptos to buy now based on the cumulative exchange and wallet portfolios.

If you are interested in investing in crypto but don’t know which exchange or wallet to pick, check out our top wallets and exchanges review!

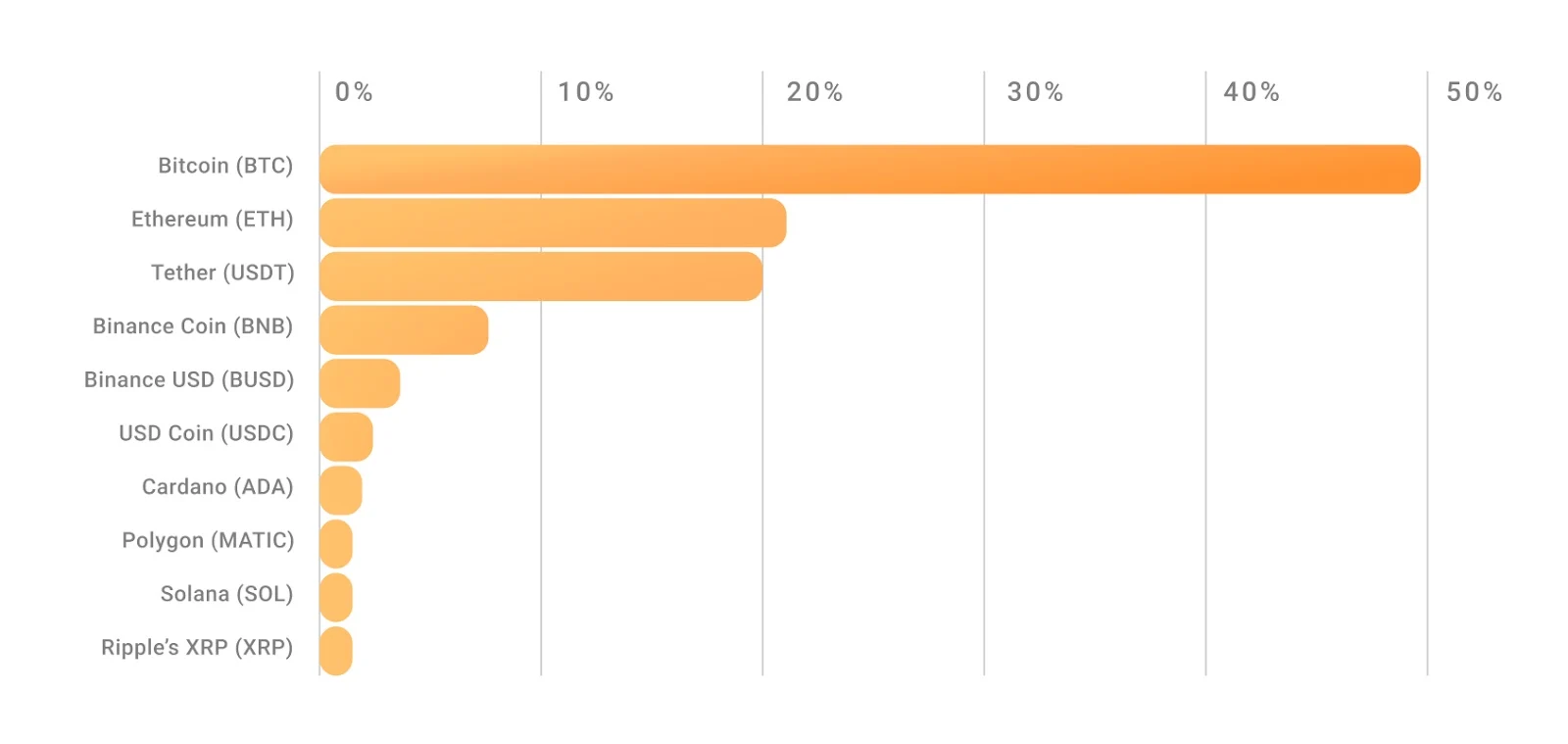

Crypto Exchange User Portfolios

When it comes to crypto exchange users, it goes without saying that BTC is their most held asset. In fact, according to our data, Bitcoin (BTC) accounts for almost 50% of the total holdings of our users on exchanges.&

After that, their portfolios contain Ethereum (ETH) with around 21%, and Tether (USDT), which accounts for around 20%. Binance Coin (BNB) comes fourth with 7.75%, with Binance USD (BUSD), USD Coin (USDC), Cardano (ADA), Polygon (MATIC), Solana (SOL), and Ripple's XRP (XRP) taking up spots 5 to 10, respectively.

This is almost exactly in line with the market cap rankings of the top10 cryptocurrencies, with slight differences in the order, and with Polygon getting in the top10 instead of Dogecoin.

As we can see, crypto investors that use exchanges prefer holding layer 1 and layer 2 blockchain projects, as well as stablecoins.

The reason for this is simple - people that hold their money on exchanges are either beginners and are just learning about Bitcoin or crypto (so they stick with the large cryptos), traders who require high liquidity (and trade mainly Bitcoin), or users that want to quickly go in and out of assets, and are sticking with stablecoins to avoid downturns caused by the crypto winter.

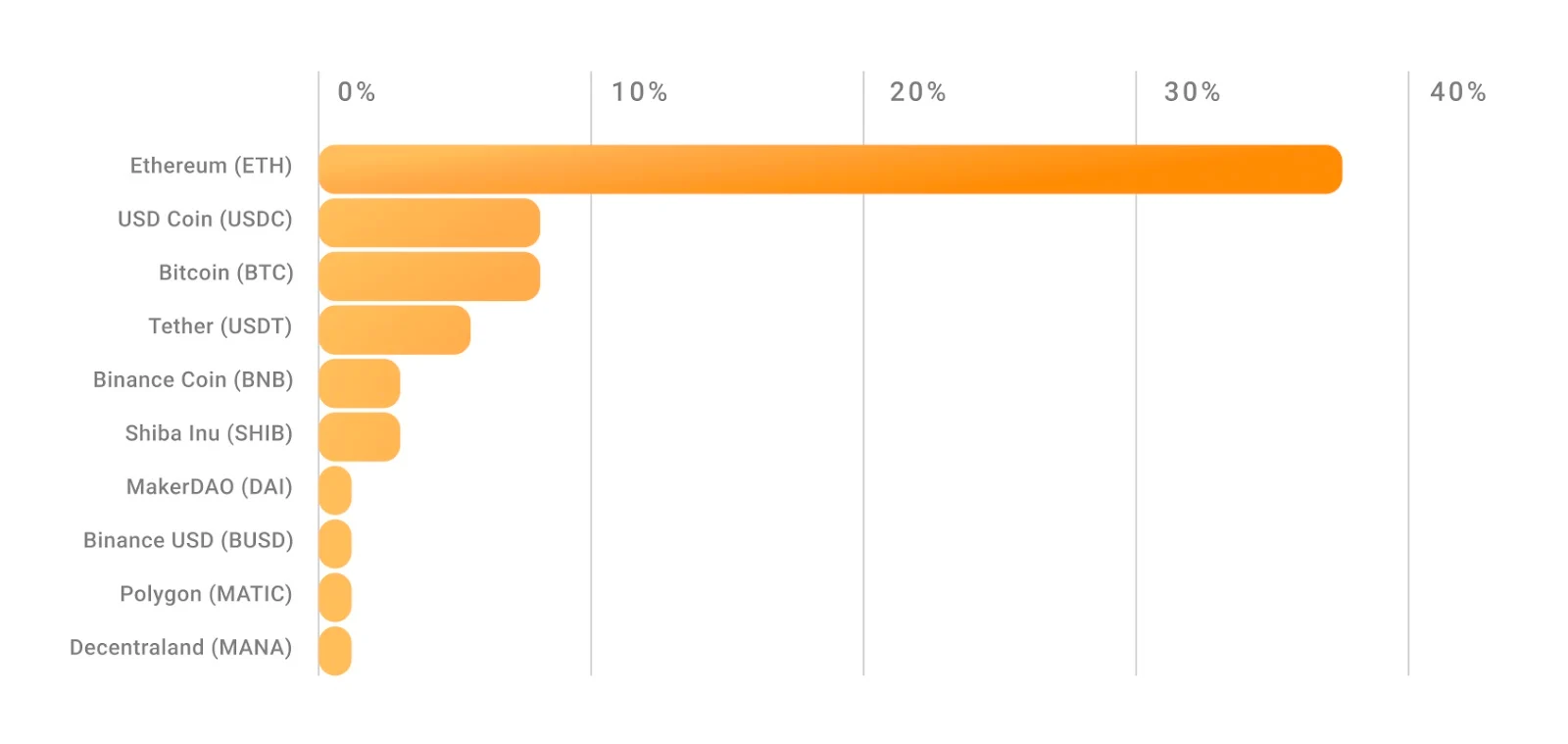

Crypto Wallet User Portfolios

When it comes to investors that have their crypto holdings in a DeFi wallet, things are a bit different. In fact, due to decentralized wallets being the main way of accessing the functionalities of decentralized finance (DeFi), wallet users choose Ethereum as their main cryptocurrency.

On the other hand, Bitcoin fell to rank3, as it got flippened by the USD Coin due to the recent shaky markets. With the top3 being known, the rest of the spots are taken up by USDT, BNB, SHIB, DAI, BUSD, MATIC, and MANA.

As you may have noticed, the situation is quite different for the crypto wallet users, as they focus more on Ethereum and other DeFi protocols. So, based on the portfolios of crypto investors that use wallets and exchanges, we can see that there is a big difference in the way they invest. This difference is mainly due to decentralized finance being accessible only on Ethereum, as well as the fact that most of the wallet users are long-term investors.

Best Crypto Assets to Buy Now

Now that we've seen the difference in portfolios between the average exchange and wallet users, let's take a look at the best cryptos to buy now.

Bitcoin (BTC)

Bitcoin is the world's largest and most well-known cryptocurrency, with a market capitalization just shy of $400 billion. BTC is also the crypto with the highest level of adoption, both in terms of usage and acceptance by businesses.

Exchange users prefer holding Bitcoin, while wallet users have the largest cryptocurrency by market cap as the third-most-held asset. This is because Bitcoin is the primary trading crypto asset, as well as the cryptocurrency most of us start with. The majority of Bitcoin held in wallets is held by long-term investors, rather than traders. This is because, as mentioned above, Bitcoin is seen as a store of value that will appreciate over time.

Investing in Bitcoin is the safest way of getting into crypto, as most of the moves the crypto sector makes (up or down) are caused by Bitcoin. Out of all cryptocurrencies, Bitcoin is considered the most risk-off, especially because of its institutional adoption. While the potential returns may not be as tempting as those of some smaller cryptocurrencies, the potential downside is also much more limited.

Therefore, the undisputed champion and the best crypto to buy now based on what the top retail and institutional holders are doing is Bitcoin.

Ethereum (ETH)

Ethereum is the world's second-largest cryptocurrency, with a market capitalization of over $180 billion. ETH is a popular choice for investors and traders alike, due to its wide range of use cases.

Ethereum is used for participating in DeFi protocols, as a means of exchange, and for paying transaction fees on the Ethereum network. It's also worth mentioning that a large portion of the total supply of ETH is locked up in DeFi protocols, which further adds to its scarcity.

The wallet crypto community prefers holding Ethereum, while exchange users have it as their second most popular choice. This is because Ethereum is used mostly for trading and participating in DeFi protocols. The fact that Ethereum is used mostly for accessing DeFi also means that it's more likely to be influenced by the day-to-day volatility of the crypto markets.

However, given its wide range of use cases and institutional adoption, Ethereum is still a very safe investment. It has much more upside potential than downside risk, which is why it's one of the best cryptos to buy now.

Also Check: How to Stake Ethereum

Tether (USDT)

Tether is a stablecoin that's pegged to the US dollar, with a market capitalization of over $65 billion. USDT is the most popular stablecoin in the world, and it's used mostly for trading on cryptocurrency exchanges.

The majority of Tether is held on exchanges, as it's used mostly for trading purposes. This is because Tether allows traders to avoid the volatility of the crypto markets when needed, while still being able to get into cryptocurrencies quickly.

Tether is a decently safe investment (despite its controversies), as it's backed by the US dollar and other cash equivalents. However, given its close relationship with the US dollar, it doesn't have much upside potential.

Therefore, Tether is a good choice for investors who want to avoid the volatility of the crypto markets while waiting to put their money in some, in their eyes, promising crypto.

Binance Coin (BNB)

Binance Coin is the native token of the Binance Smart Chain blockchain as well as the Binance cryptocurrency exchange, with a market capitalization of over $40 billion. BNB is used mostly for paying transaction fees on the Binance exchange, participating in protocols situated on the Binance Smart Chain, as well as for participating in ICOs that are hosted on the Binance Launchpad.

The majority of Binance Coin is held in exchanges, rather than on exchanges (though both exchange and wallet users hold it in high regard). The fact that Binance Coin is used mostly for trading also means that it's more likely to be influenced by the day-to-day volatility of the crypto markets.

However, given its wide range of use cases and institutional adoption, Binance Coin is still a very safe investment. It has much more upside potential than downside risk, which is why it's one of the best cryptos to buy now.

Binance USD (BUSD)

Binance USD is a stablecoin that's pegged to the US dollar, with a market capitalization of over $17 billion. BUSD is the official stablecoin of the Binance ecosystem.

Wallet and exchange users alike are holding this token. This is because Binance USD allows traders to avoid the volatility of the crypto markets, while still being able to trade cryptocurrencies.

Binance USD is a very safe investment, as it's backed by US dollars, and it's used mostly for trading purposes. However, given its close relationship with the US dollar, it doesn't have much upside potential.

Therefore, Binance USD is a good choice for investors who want to avoid the volatility of the crypto markets, but it's not the best choice for those who are looking for upside potential.

USD Coin (USDC)

USD Coin is yet another stablecoin that made it into the top cryptocurrencies that wallet and exchange users hold, and for a good reason. USDC is a US dollar-pegged cryptocurrency, with a market capitalization of over $54 billion. USDC has skyrocketed in popularity in recent months due to people trusting its reserve holding audits more than USDT's holding attests.

While exchange users do hold USDC, the fourth-largest cryptocurrency by market cap is mostly held by wallet users, with it taking the second spot after surpassing BTC.

There's not much to say about USDC except that it currently seems that it is the safest stablecoin, and therefore a good place to put your money in if you want to avoid short-term volatility without leaving the crypto space completely.

Cardano (ADA)

Cardano is the 8th cryptocurrency by market cap, with a market capitalization of over $15 billion. While ADA doesn't have many use cases at the moment, Cardano is one of the most promising blockchain platforms with an incredible community of developers and investors.

Exchange users seem to hold ADA more often, as it made it into the top10 most-held assets. However, this digital asset doesn't seem to be too interesting to wallet users.

Investing in Cardano would be betting on its future success rather than current functionality. Therefore, it is certainly a riskier option than its competitor Ethereum, but also one with a much larger upside.

Polygon (MATIC)

Polygon is a layer 2 scaling solution for the Ethereum blockchain, with a current market capitalization of $7.2 billion. MATIC, the native coin of the Polygon ecosystem, is mostly used to pay gas fees on the Polygon blockchain, as well as a long-term investment for those that support this project.

MATIC made it into the top10 most held cryptos for exchange users, but not the wallet users. This is because, as much as people use it for gas fees, it is still a short-term or mid-term trade for most.

However, given its wide range of use cases and institutional adoption, Polygon is still a very safe investment. It has much more upside potential than downside risk, which is why it's considered one of the best cryptos to buy now.

Also Check: How to Stake MATIC

Solana (SOL)

Solana is a popular blockchain network and one of the so-called "Ethereum Killers." SOL, its native token, is currently either used for gas fees, or as a short or mid-term trade - as such, it falls in the same space as the aforementioned MATIC.

Exchange users love holding SOL, as it ended up in their top10 most held crypto assets. However, wallet users are a bit less interested in Solana, simply because its long-term outlook is somewhat shaky due to network instability.

However, given its immense potential for future gains and current low price, Solana is certainly a contender for the best-buy category for many investors.

Ripple (XRP)

Ripple's XRP is a cryptocurrency that's used mostly for payments and money transfers, with a market capitalization of over $17 billion. XRP is used mostly for cross-border payments and money transfers, as it's much faster and cheaper than traditional methods like SWIFT (which it aims to replace).

The majority of XRP is held by exchange users, rather than wallet users. This is because Ripple is used mostly for payments and money transfers, or as a short or mid-term trade, rather than as a long-term investment.

While it goes without saying that Ripple had its controversies, we can't deny that XRP is a digital asset with a huge market cap, and an even larger market. Therefore, many people consider it a great investment, or at least a great trade.

Shiba Inu (SHIB)

Shiba Inu is an Ethereum-based cryptocurrency that is named after a Japanese hunting dog breed. Shiba Inu is widely considered to be an alternative to Dogecoin - in fact, SHIB founders were inspired by Dogecoin when creating their cryptocurrency.

Shiba Inu and Dogecoin are both meme coins - projects that launched as a parody or inside joke that have their communities as their only utility.

While Dogecoin was launched in December 2013, Shiba Inu was created 7 years later by an anonymous individual or group called Ryoshi.

While the price growth of SHIB (alongside other meme coins) is largely attributed to hype and not fundamentals, numerous investors hold it on their accounts - after all, SHIB made it into the top10 most popular wallet cryptos, taking up none other than rank 6.

Also Check: How to Stake Shiba Inu

MakerDAO (DAI)

DAI is an Ethereum-based stablecoin managed by the Maker Protocol and the MakerDAO decentralized autonomous organization (DAO). The price of DAI is soft-pegged to the US dollar and is collateralized by a mix of other cryptocurrencies that get deposited into smart-contract vaults each time new DAI is minted.

MakerDAO managed to make it into the top10 most popular cryptocurrencies for wallet holders due to its transparent ecosystem.

However, as DAI is a stablecoin after all, it doesn't have any upside potential - and given what we've seen with the Terra ecosystem, it may have some downside potential.

Decentraland (MANA)

Last but not least, we have Decentraland, the leading Metaverse ecosystem. Metaverse is certainly one of the emerging crypto technologies that rocked the world in 2021, and MANA has benefited greatly from that.

Therefore, it ended up on the top10 most popular wallet user list. When taking a look at its potential utility and the potential growth of the Metaverse sector, it goes without saying that Decentraland is nothing to scoff at.

Is Now a Good Time to Invest in Crypto

There's an old saying by Confucius that goes something like:

- “When is the best time to plant a tree?”

- “Ten years ago.”

- “And when is the next best time?”

- “Today.”

In this fashion, the best time to invest in the crypto market would undoubtedly be when Bitcoin was worth only a couple of cents. However, the second-best time is to start now, and learn along the way - and now that you have the list of most popular cryptocurrencies for exchange and wallet users, you are one step closer to making your investment move.

Timing Matters

If you're looking for short-term gains, then it may be a good choice to wait for the market to correct before buying any crypto. However, if you're looking for long-term gains, then any time is a good time to invest in the cryptocurrency market. This is because the majority of the top cryptos by market cap are still in the early stages of adoption and have a lot of upside potential.

Of course, you should always do your own research before investing in any crypto.

Final Word

So, we've come to the end of the article! We've gone through all the most popular cryptocurrencies, both from the perspective of the wallet and exchange users. They are all popular for a reason, as they have strong fundamentals and are backed by institutional investors. So, if you're looking to invest in cryptos, these might be your safest options.

There you have it – the 13 most popular cryptocurrencies at the moment. Each of these cryptos has a wide range of use cases and strong upside potential. So, if you're looking to invest in the crypto market, these are the crypto projects that you should keep an eye on. Thanks for reading!

Check out our blog for more exciting crypto content, or head over to the CoinStats main page and start tracking your portfolio like a pro!

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments