Bitcoin is now in a consolidation phase after weeks of significant selling pressure and fear throughout the market. The price has dropped over 19% from local highs in late August and is currently testing resistance around $58,000. Despite this recent downturn, the broader outlook remains optimistic.

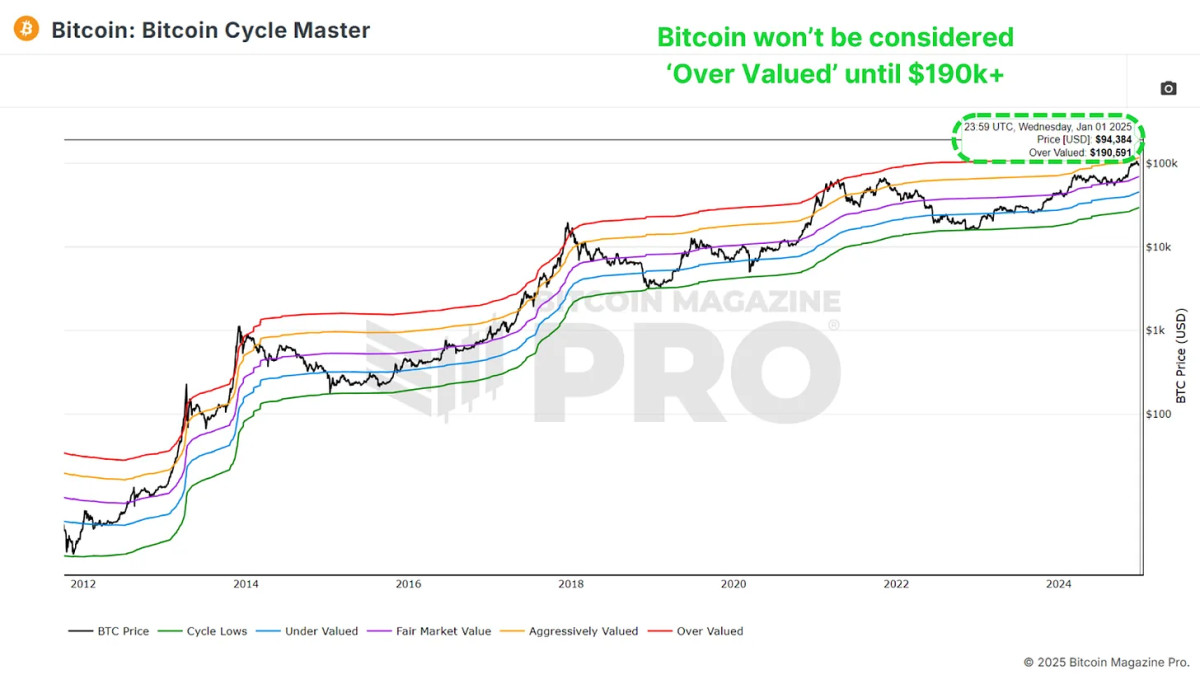

Top analysts and investors are projecting a price surge, with predictions of Bitcoin reaching $100,000 by the end of the year. One prominent analyst recently shared a chart with a technical prediction that points to a potential breakout in the coming weeks.

This consolidation period could be setting the stage for the next major rally as Bitcoin continues to test key resistance levels. Investors are keeping a close eye on these technical indicators to determine the future price direction of the leading cryptocurrency. With volatility still present, the next few weeks will be critical for Bitcoin’s trajectory.

Is Bitcoin Reaching $100,000 This Year?

Bitcoin is currently at a crucial level, aiming to reclaim higher prices and initiate a bullish trend. After weeks of fear and uncertainty dominating the market, optimism is slowly returning as top investors share more confident outlooks.

One of the leading voices in this shift is Kaleo, a respected investor and trader, who recently posted a technical analysis on X. His analysis draws a comparison between the current BTC chart and the one from January, a pivotal month when spot Bitcoin ETFs were approved and the price surged aggressively.

Kaleo’s bold prediction places Bitcoin at $100,000 by December, a figure that has been a key target for crypto investors since the last bull run. While the market has been recovering from a series of corrections since March, the idea of Bitcoin reaching this milestone by year-end is not far-fetched. Bitcoin rallies are historically fast and explosive, which makes this prediction feasible if the market momentum picks up soon.

The market is still navigating through a recovery phase, but many investors are eyeing this $100,000 target as a realistic possibility. Should Bitcoin break through key resistance levels, the coming months could see an accelerated push towards this milestone, setting the stage for another historic bull run.

BTC Price Action

BTC is currently trading at $56,443, following a 10% surge from $52,540. The price is now testing local resistance at $58,070. Despite this positive movement, BTC remains below the 4-hour 200 exponential moving average (EMA), currently at $58,820. This EMA has acted as a key resistance level since early August, influencing short-term momentum.

For bulls to regain control and initiate a stronger upward trend, BTC must break through the 4-hour 200 EMA and surpass the critical $60,000 level—a significant psychological barrier for crypto investors. Successfully overcoming these resistance points could position BTC to target mid-range prices around $65,000.

Conversely, if BTC fails to breach the 4-hour 200 EMA, we may see a period of ranging consolidation or even a deeper correction. The inability to clear this resistance could lead to a test of lower support levels, potentially impacting market sentiment and short-term price action. Investors should closely monitor these key levels to gauge Bitcoin’s next moves and adjust strategies accordingly.

Featured image from Dall-E, chart from TradingView

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments