Summary:

- Bitcoin has broken above the 50-day moving average with its push above $24k.

- BTC could rally another 18% before reaching the next level of significant resistance, around $28k.

- Capitulation by Bitcoin investors and miners could also be slowing down.

Bitcoin has had an eventful first few days of the week, having punched through the $22k resistance level early Monday and breaking the $24k resistance level today to post a local high of $24,276.

Bitcoin Could Gain Another 18% After Breaking $24k.

Bitcoin’s impressive price movement despite record-breaking inflation around the world has prompted popular BTC analyst, Magic Cannon, to forecast that the digital asset could gain another 18%.

According to Magic, Bitcoin has shown strength by breaking the 50-day moving average and could keep pushing past $24k to the $28k price level ‘before hitting the last major resistance zone.’

Magic’s analysis of Bitcoin’s current price action can be found in the tweet below.

#BTC has broken above the 50 day MA (in orange) and could rally another 18% before hitting the last major resistance zone. pic.twitter.com/Ss7y8w2UGM

— MAGIC (@MagicPoopCannon) July 20, 2022

$28k Is Around Bitcoin’s 100-day Moving Average.

Further double-checking the daily BTC/USDT chart below reveals that Bitcoin has reclaimed the important 200-week moving average (red) as support. This crucial moving average has a history of marking past Bitcoin bottoms and could be a significant indicator that BTC selling by investors and miners could have subsided.

However, the daily MFI, MACD, and RSI all point to an overbought scenario for Bitcoin that could result in a pullback to the same 200-week moving average around the $22.5 k price area. But, if Magic’s analysis is to be considered, a push higher to $28k is in line with Bitcoin tapping the 100-day (yellow) moving average around the same level.

Bitcoin Has Punched Through a Capitulation Structure – Willy Woo.

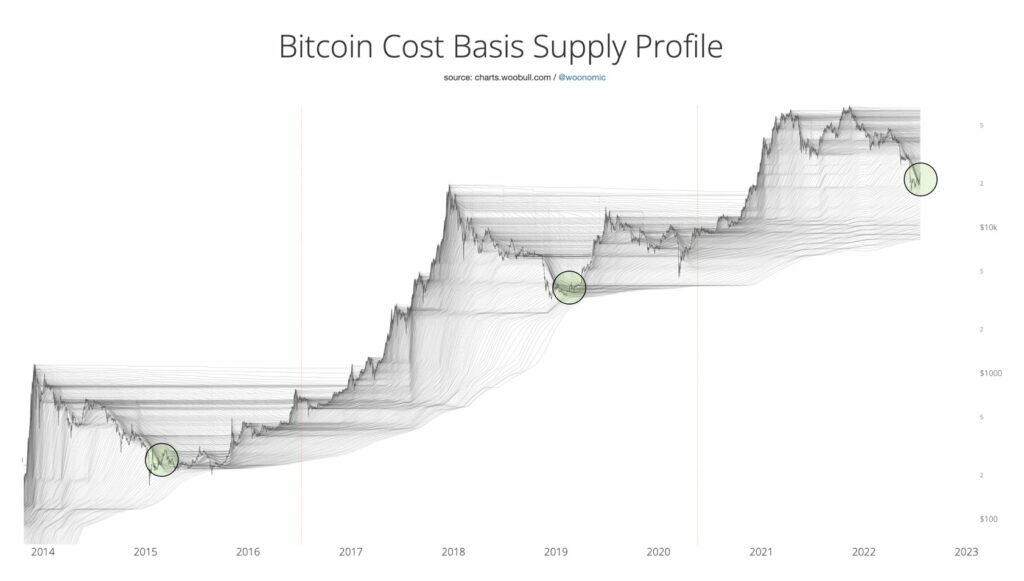

Similarly, veteran Bitcoin analyst, Willy Woo, has noted BTC’s price movements in the last few days and concluded that the digital asset could have ‘punched through a capitulation structure’ that could foreshadow the beginning of a proper bottom. He shared his analysis through the following statement and accompanying chart.

BTC punched through a capitulation structure. i.e. investors who bought higher sold out in droves while urgent buyers were there to rally the price against the selling. The next step in a proper bottom signature happens when the contours get dense under the price.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments