Bitcoin’s hash rate has endured a series of significant price drawdowns only to emerge stronger than ever. We look at potential implications for bitcoin miners.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

New Hash Rate All-Time High

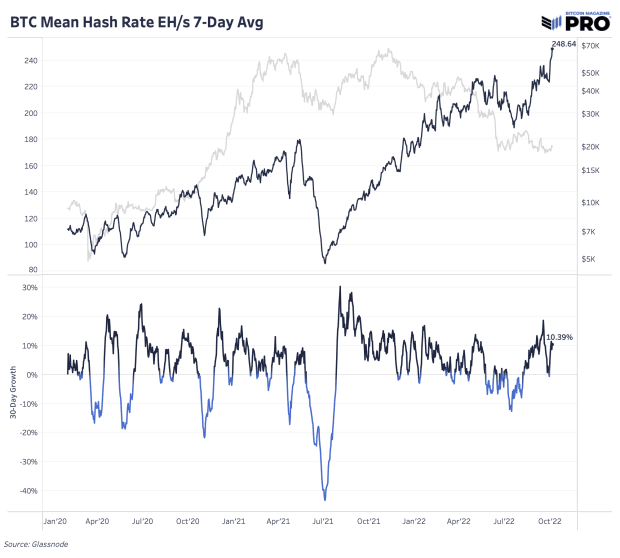

Just two months ago, the 2022 expansion in Bitcoin hash rate was looking bleak. The bitcoin price had plummeted, miner margins were getting compressed, large public miners were shedding bitcoin holdings and it was a ripe time to revisit the state of miner capitulation in the market. Fast forward to today: price has come down from a massive bear market rally to $25,000 while hash rate coming online has exploded to a new all-time of nearly 250 EH/s. The chop and range and rallies in bitcoin price haven’t impacted the hash rate from ripping higher this year. Hash rate hasn’t really declined on a 30-day growth basis since July.

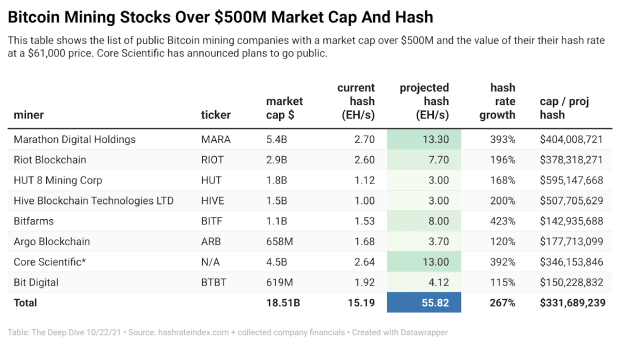

That’s some of the best public data available to chalk up why bitcoin hash rate has exploded so much. It’s public miners executing on expansion plans. But that doesn’t mean large scale mining companies haven’t faced additional pressures. Compute North, one of the largest data center operators and bitcoin mining hosting services, filed for Chapter 11 bankruptcy just weeks ago. They housed miners for companies like Marathon Digital, Compass Mining and Bit Digital across 84 different mining entities. A major auction on the bulk of Compute North existing assets will take place on November 1, 2022 including mining containers, machines and entire data centers.

In the Celsius collapse, Celsius Mining also filed for bankruptcy back in July. That said, it’s clear from the recent Compute North’s bankruptcy that the pressure is still on large-scale miners. They aren’t out of the woods yet and we’ve been hesitant to call for an end of miner capitulation this cycle as price has stagnated and hash price (miner revenue divided by hash rate) continues to face some strong headwinds with this level of hash rate expansion playing out.

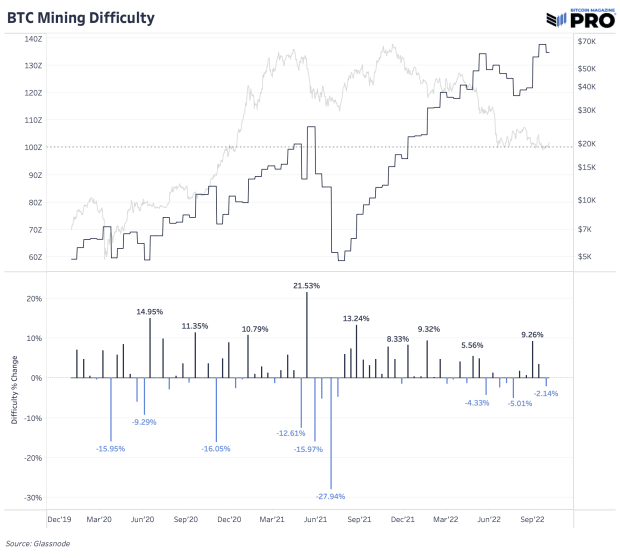

After making a new all-time high, mining difficulty saw a decent sized negative adjustment of 2.14% right before this explosion in hash rate over the last week. But that looks to be all short-term relief because as of now, the next projected difficulty adjustment is looking like a vicious 13.5% positive adjustment at the time of writing. We haven’t seen that level of adjustment since right after the Chinese mining ban. That type of adjustment would be bad news for existing miner profitability as hash price would come under further pressure.

It takes incredible operational excellence to continue to excel in the bitcoin mining industry over multiple cycles.

This is why bitcoin mining-related equity investing can be either extremely lucrative (if you choose one of the winners) or downright disastrous.

In our December 21 piece last winter, we said the following,

“​​What you should gather from evaluating the performance of publicly-traded miners against bitcoin itself is that due to the capital structure of their business and the valuations present in equity markets, miners can and likely will outperform bitcoin over periods when hash price rises significantly.

"However, over the long term the revenue in bitcoin terms for every mining company is guaranteed to decrease in bitcoin terms, and due to the excessively large earnings multiples that companies currently trade with in equities markets in a zero interest rate world, even bitcoin mining equities trend to zero over time in bitcoin terms (once again, due to the equity multiples assigned in a zero interest rate fiat-denominated world).”

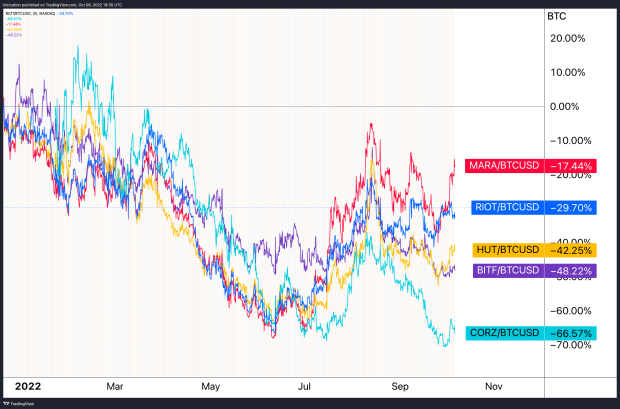

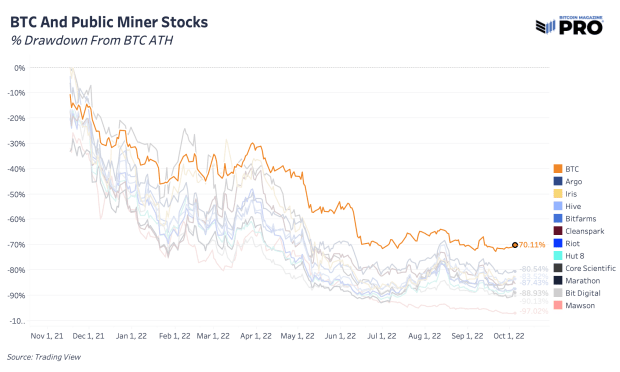

Since that point, the share prices of publicly traded mining companies are all down significantly when measured against bitcoin itself.

This should come as no surprise. Miner margins are getting relentlessly squeezed as earnings decrease, in both bitcoin and dollar terms.

Since the all-time high in the bitcoin price, every publicly traded mining company has underperformed the asset itself, bar none.

While mining-related equities can certainly appreciate from their current beaten down valuations, the advancement of mining machines and the economic incentives of mining all but ensure that hash rate continues to increase further from here.

To quote a prior issue of ours,

“However, the dynamics involved with evaluating publicly traded bitcoin miners is a bit different. Unlike other “commodity” producers, bitcoin miners often attempt to retain as much bitcoin on their balance sheet as possible. Relatedly, the future supply issuance of bitcoin is known into the future with near 100% certainty.

"With this information, if an investor values these equities in bitcoin terms, significant outperformance against bitcoin itself is achievable if investors allocate during the correct time during the market cycle using a data-driven approach.”

In the future, mining-related equities as well as ASICs will once again be primed for large outperformance against bitcoin itself. We don’t think that time has arrived just yet.

Relevant Past Articles

- 12/21/21 - On-Chain Mining And Public Miner Performance

- 6/29/22 - Mining Hash Price Bear Market

- 7/5/22 - Public Miners Start Selling Bitcoin Treasuries

- 7/11/22 - When WIll The Bear Market End?

- 7/26/22 - Bitcoin Hash Rate Plummets 17% From All-Time High

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments