Bitcoin remains rangebound as most of the crypto market continues to trade in the red. The number one crypto has seen some profits on lower timeframes, but the general sentiment in the market still points to uncertainty.

Related Reading | Bitcoin Miners Contributing To BTC Crash? New Report Sheds Light

At the time of writing, BTC’s price trades at $20,800 with a 4% profit in the last 24 hours and an 8% loss in the past week.

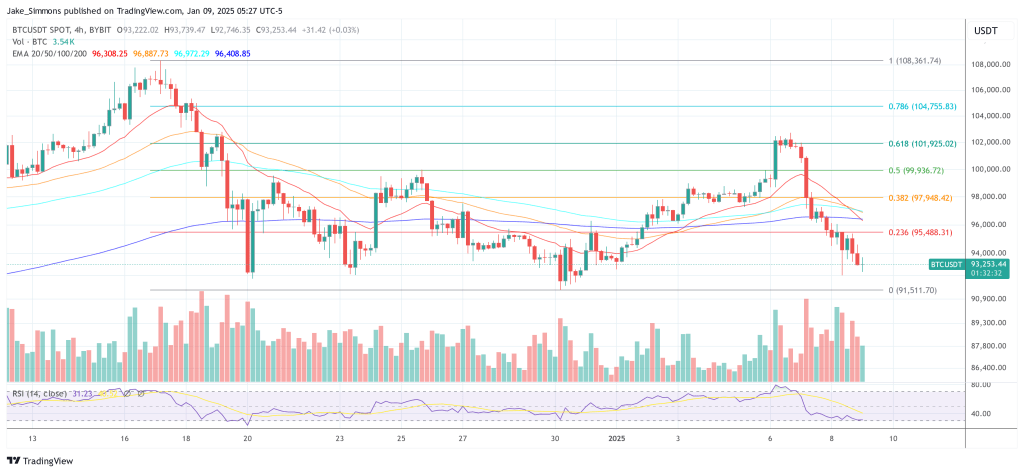

On lower timeframes, data from Material Indicators records an increase in bid orders for BTC’s price of around $18,000. There are over $49 million in bid orders. This stands as the most critical area of support for the cryptocurrency, at least in the short term, along with $20,000 due to its psychological importance in the market.

Between $18,000 and current levels, Bitcoin has some bids orders which could prevent a fresh attack from the bears. Material Indicators, as seen below, show over $15 million in bids orders around those levels.

If the price trends to the upside, there is some liquidity around $22,000 with around $8 million in asks orders for this level alone. There are more asked orders below which could suggest BTC’s price will remain rangebound and in a consolidation phase for the time being.

A break above $22,000 or $24,000 could signal bullish continuation as those levels have important asks orders on lower timeframes.

Despite BTC’s price consolidation of around $20,000 and its reaction to the downside pressure experienced during the past week, most inventors are bearish. Analyst Michaël van de Poppe believes BTC could target $23,000 in the coming weeks if the cryptocurrency is able to hold around its current levels.

In that sense, the analyst added:

The overall consensus is that we’ll be going way lower and people continue spreading that idea, as they’ve heard from strangers on the interwebs. Just like they have been heard from strangers on the interwebs that they should buy crypto, when it was peak 2021. Standard.

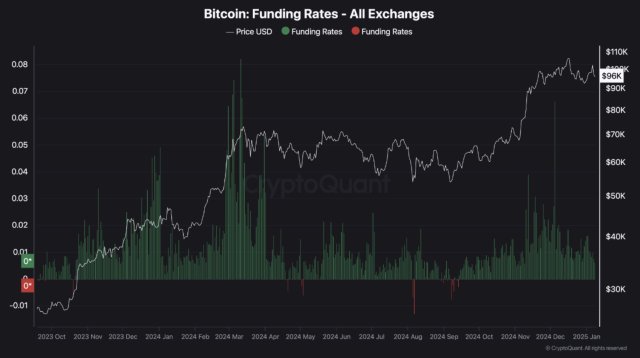

From another perspective, CryptoQuant CEO Ki-Young Ju claims “most cycle indicators are saying the bottom” could be in for BTC’s price. After months of trending to the downside, the cryptocurrency has entered oversold territory and might see some relief from the macro-economic factors contributing to the selling pressure.

Young Ju said:

Not sure how long it would take for consolidation in this range though. Opening a big short position here sounds not a good idea unless you think that $BTC is going to zero.

Related Reading | Low Bitcoin Prices Trigger Inflows, But Investor Sentiment Remains Weak

Additional data provided by CryptoQuant’s CEO records an increase in the number of BTC outflows from centralized exchanges. While inflows remain high, this suggests new BTC whales could be buying the dip and accumulating around these levels.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments