Bitcoin (BTC) prepared for a rare bear feature to return on May 8 after an overnight sell-off took the market ever closer to January lows.

BTC circles $34,400 lows

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to $34,200 on Bitstamp, recovering to trade around $500 higher at the time of writing.

The pair had seen brief support around the $36,000 mark, but this gave way as thin weekend liquidity added to the volatility.

Bitcoin liquidations themselves were limited, however, as market sentiment had long expected a deeper pullback after a tumultuous week on stock markets.

Data from on-chain monitoring resource Coinglass countered 24-hour liquidations for both Bitcoin and Ether (ETH), running at around $80 million.

Updating his short-term price outlook, popular Twitter commentator Credible Crypto envisaged a “flush” taking BTC/USD to as low as $29,000, marking a new 2022 low.

Bids near $30,000, among them those of a whale trader on exchange Bitfinex, may prove too enticing to leave unfilled.

The downside momentum into May 8 accompanied news of trouble at Blockchain protocol Terra. The firm, which pledged to buy unlimited amounts of BTC to back its United States dollar stablecoin TerraUSD (UST), saw its first major test as a market participant mass sold UST worth almost $300 million.

While disruption was minimal, UST briefly saw its dollar peg eroded by up to 0.8%.

“Today’s attack on Terra-Luna-UST was deliberate and coordinated,” Caetano Manfrini, legal officer at Brazilian crypto business forum GEMMA, responded to the events.

“Massive 285m UST dump on Curve and Binance by a single player followed by massive shorts on Luna and hundreds of twitter posts. Pure staging. The project is bothering someone. on the right path!”

Do Kwon, the Terra co-founder now well known for both his Bitcoin buys and social media engagement, remained conspicuously cool.

Despite Kwon’s words, however, UST traded around 0.5% below its $1 target at the time of writing, according to data from CoinMarketCap.

In further comments, Cointelegraph contributor Michaël van de Poppe admitted that the event “was not fueling the markets” but categorized it as “FUD.”

“Let’s see how price is reacting here on Bitcoin as we’re sweeping all those lows currently, little overextended to the downside,” he told Twitter followers in a part of his latest update.

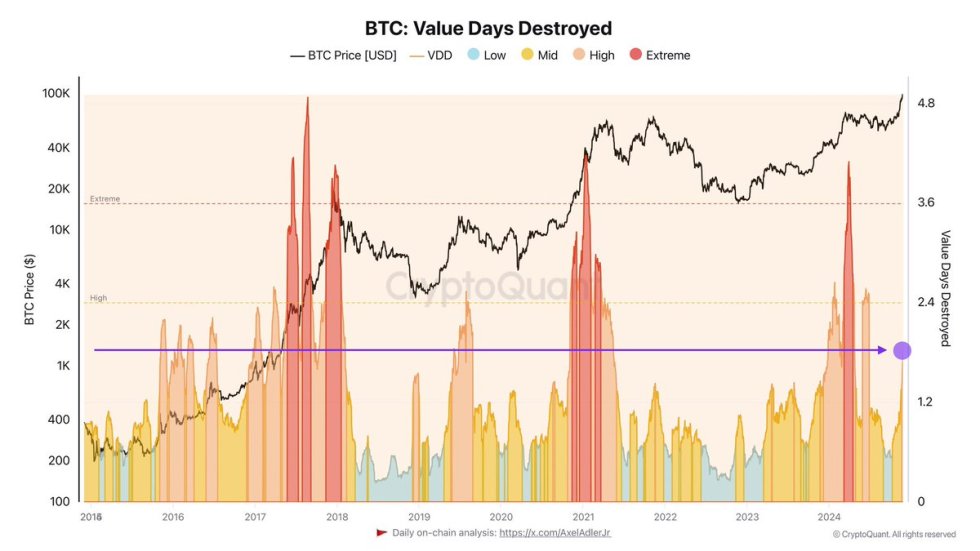

Weekly chart threatens bear pattern absent for eight years

Zooming out, meanwhile, the Bitcoin chart still looked decidedly unappetizing.

Related: Any dip buyers left? Bulls are largely absent as the total crypto market cap drops to $1.65T

On weekly timeframes, BTC/USD was near to completing its sixth consecutive red weekly candle — something which had only occurred once before in its history back in 2014.

That year followed the blow-off top of Bitcoin’s first halving cycle and subsequent comedown, exacerbated by the hacking of then major exchange Mt. Gox.

Previously, Bitcoin’s four straight red weekly closes had already put it in a situation last occurring after the March 2020 COVID-19 crash.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments