The Bitcoin price took a major hit at the end of the past week, falling below the psychological $70,000 level yet again. According to CoinGecko data, the price of BTC currently stands around $69,204, reflecting a 0.1% decline in the past day.

However, on-chain data suggests that the premier cryptocurrency is currently retesting a significant support level and might soon resume its upward trajectory.

Nearly 2 Million Addresses Purchased At This Bitcoin Price

In a recent post on the X platform, prominent crypto pundit Ali Martinez revealed that Bitcoin has established a major support area around its current price point. This evaluation revolves around the number of coins purchased around the current price level, according to IntoTheBlock’s data.

Above is a chart showing the distribution of the Bitcoin supply across various price ranges. The size of the dots in the chart depicts the strength of the resistance and support zones and the volume of coins acquired around each corresponding price range.

Data from the market intelligence firm shows that a massive 1.97 million addresses bought roughly 965,000 BTC between the $67,353 and $69,383 levels. According to Martinez, the significant buying activity within this price zone has led to the establishment of a key support area.

In the post on X, the crypto analyst highlighted the strength and importance of the range BTC’s price is currently wedged in between. Martinez noted that the $67,353 – $69,383 support zone needs to hold strong for the Bitcoin price to “sustain its upward momentum.”

The nearly 2 million investors who have their cost basis around this support area could double down on their position and accumulate more BTC, and this buying activity – if sufficient – can ensure that the support stands strong. However, if this vital support area fails to hold, investors could see the price of BTC fall to as low as $65,000.

$1.57 Billion In BTC Withdrawn From Centralized Exchanges

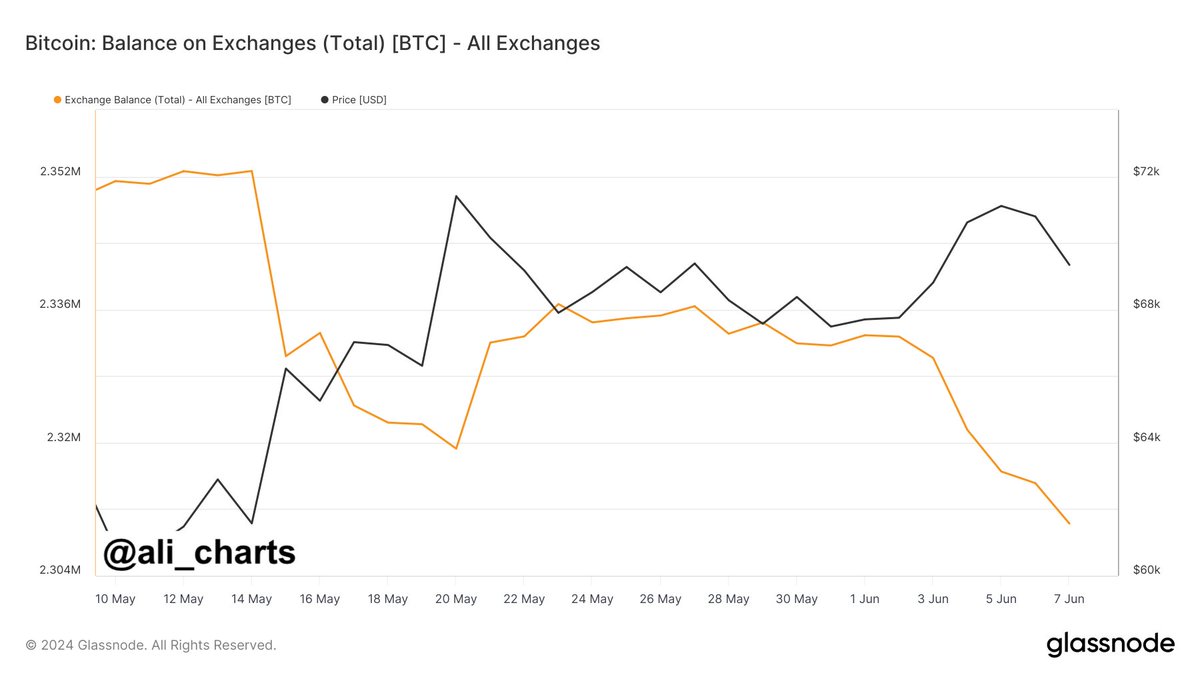

An on-chain development that could potentially impact the Bitcoin price and help keep it above the aforementioned support level has come to light. In another post on X, Ali Martinez shared that investor confidence seems to be on the rise at the moment.

The crypto analyst revealed that significant amounts of BTC made their way out of centralized exchanges in the past week. According to data from Glassnode, roughly 22,647 BTC (equivalent to more than $1.57 billion) were transferred from crypto exchanges in the last seven days.

This massive outflow of crypto funds from trading platforms suggests a shift in investor sentiment and strategy. What’s more, it might be indicative of fresh accumulation, with investors not willing to leave their newly acquired assets in the custody of centralized exchanges.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments