Bitcoin has cleared the $67,000 level in the past day as on-chain data shows the population of whales on the network has continued to grow.

Bitcoin Has Surged Alongside Increase In Whale Count

As explained by analyst Ali in a new post on X, there has been a correlation between the cryptocurrency’s price and the total number of entities carrying at least 1,000 BTC.

“Entity” refers to a cluster of addresses owned by the same investor, as determined by advanced heuristics done by the on-chain analytics firm Glassnode.

Entities carrying more than 1,000 BTC are popularly called “whales.” At the current asset exchange rate, this lower cutoff for the cohort converts to about $66.5 million.

These investors are huge, so they can potentially move around large amounts quickly across the network, making them influential beings in the market.

As such, the behavior of the whales can be worth tracking since it may end up reflecting on the sector as a whole. One way to track the movements of these large entities is through their total count.

The chart below shows the trend in the total number of entities on the network that qualify as whales.

As displayed in the above graph, the total number of Bitcoin entities carrying a balance of at least 1,000 BTC has been shooting up recently, suggesting that some buying has been happening in the market.

From the chart, it appears that uptrends in the metric have recently coincided with surges in the asset’s price. This would suggest that these humongous entities have been helping drive these rallies.

So far, these whales haven’t taken to distribution yet, as their number has only gone higher. As such, the indicator may be one to follow in the coming days, as a turnaround in it could be a bearish sign for the price.

The higher the rally, the more likely it is that some of these giants will buckle and take their profits. However, if the number of these entities continues to rise regardless, like it has so far, then it could suggest that the demand is absorbing any profit-taking.

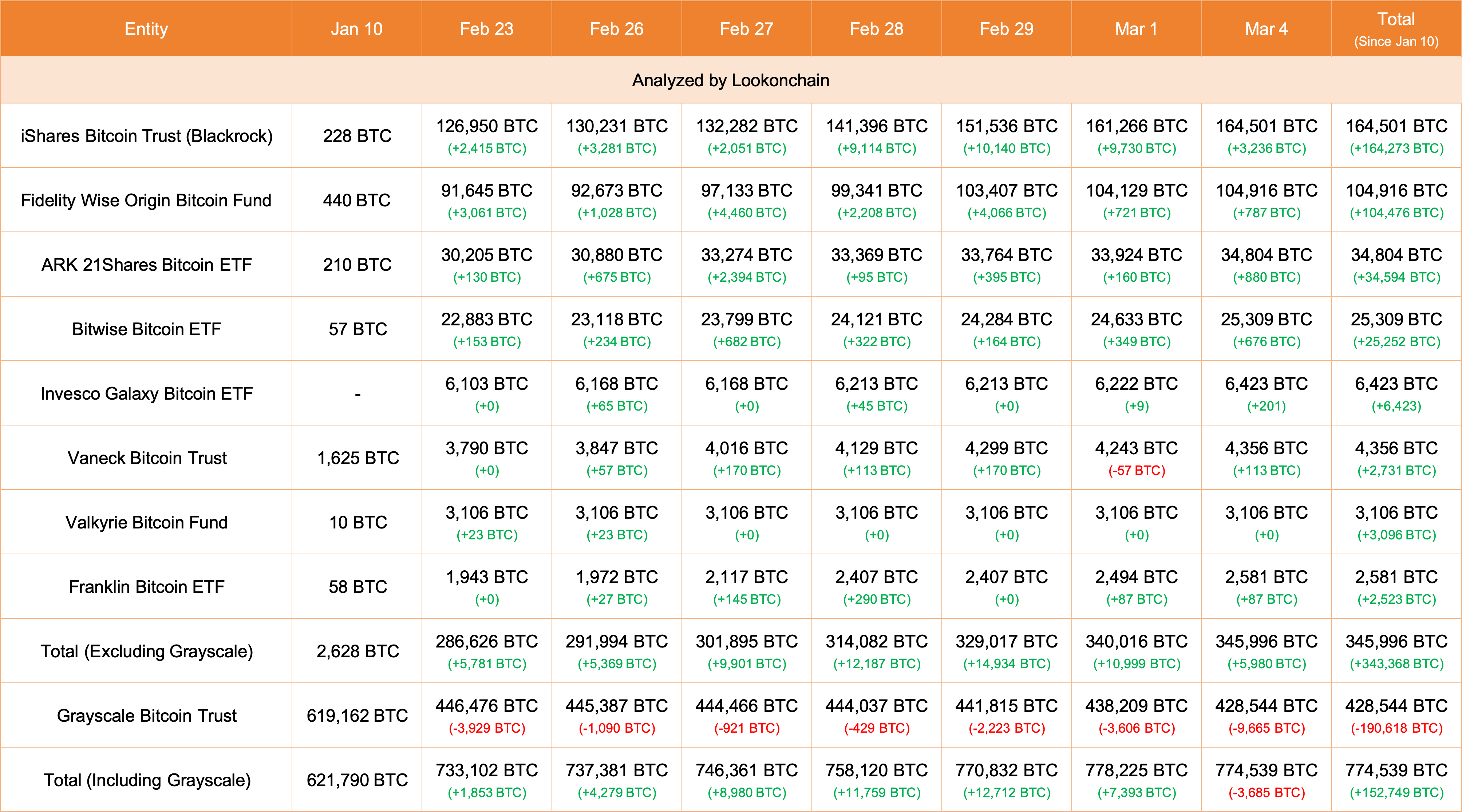

Speaking of whales, the exchange-traded funds (ETFs) also count as them, and it would appear that they have participated in net selling today, as smart-money tracker Lookonchain has pointed out in an X post.

From the table, it’s visible that the culprit is none other than Grayscale Bitcoin Trust (GBTC), which has been constantly hemorrhaging BTC since the ETFs first saw approval.

The other ETFs participated in net buying like usual, but due to Grayscale’s selling, the net change in the holdings of the ETFs has been negative at 3,686 BTC in the past day.

BTC Price

At the time of writing, Bitcoin is trading at around $67,000, up 25% over the past week.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments