Bitcoin has faced significant selling pressure and underwhelming price action since late December, leading many investors to question its short-term trajectory. Despite these challenges, BTC continues to hold above key demand levels, maintaining a long-term bullish outlook. This resilience underscores the broader market’s confidence in BTC as a robust store of value and a leading asset in the crypto space.

Top analyst Axel Adler shared insightful data on X, highlighting an important trend among short-term holders. According to Adler, these investors are, on average, selling their Bitcoin holdings at a loss. This behavior is often indicative of panic selling or capitulation, as newer market participants exit positions during periods of heightened volatility and uncertainty. While such trends can temporarily weigh on price performance, they also suggest a potential bottom as weaker hands exit the market, paving the way for stronger, more confident buyers to step in.

Bitcoin’s ability to hold key demand amid these conditions signals underlying strength, and many analysts believe this phase could set the stage for a major rally. As the market continues to evolve, the coming weeks will be critical in determining whether BTC can reclaim its bullish momentum and push toward new highs.

Short-Term Holders Selling at a Loss

Bitcoin is currently navigating a pivotal consolidation phase, marked by heightened fear and uncertainty among market participants. This phase has primarily targeted short-term holders, whose behavior often amplifies market volatility. Top analyst Axel Adler recently shared compelling data on X, shedding light on this dynamic. He revealed that the 7-day average Short-Term Holders SOPR (Spent Output Profit Ratio, SMA7D) has fallen below 1, a critical threshold.

When the SOPR metric dips below 1, it signals that short-term holders are selling their Bitcoin holdings at a loss. Such behavior typically occurs during periods of market stress, as these holders exit positions to minimize further losses. While this adds short-term selling pressure, it can also limit the available supply on the spot market, creating a potential buffer for demand to catch up. This dynamic often paves the way for a more balanced market and eventual recovery.

However, the current consolidation remains precarious. If BTC continues to decline, short-term holders may intensify their selling, further testing market resilience. The silver lining, as Adler notes, is that the coins held by this cohort are finite. Once this supply is exhausted, the market could stabilize, setting the stage for stronger hands to accumulate and support a more sustainable uptrend.

As BTC hovers at key levels, the behavior of short-term holders and broader market demand will play a crucial role in determining the next major move. The coming weeks will be instrumental in shaping Bitcoin’s trajectory for the year, with many analysts still optimistic about a long-term bullish outlook.

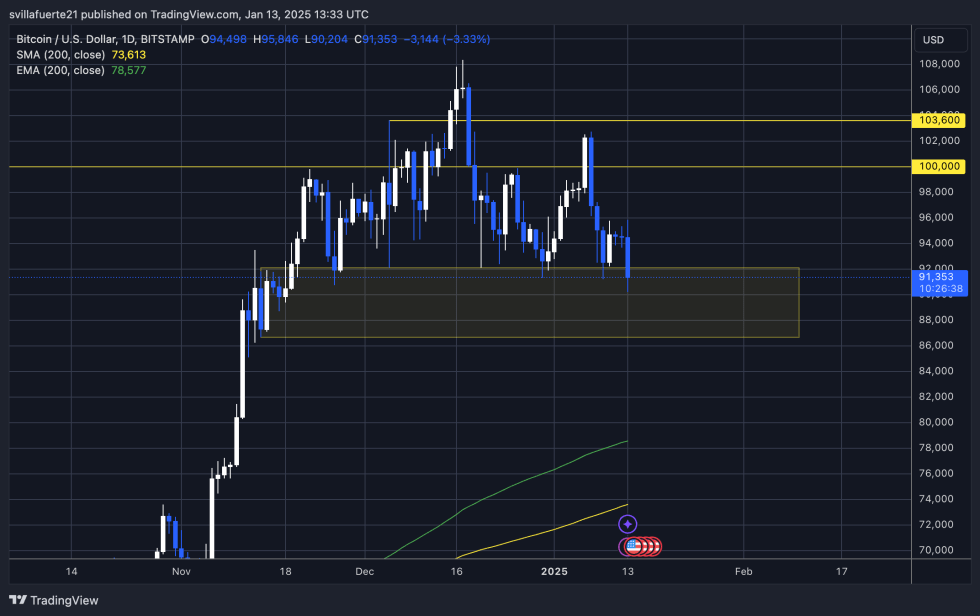

Bitcoin Price Update: Testing Key Levels Amid Volatility

Bitcoin is currently trading at $91,300, following a sharp decline from the $95,700 level earlier this week. The recent drop has intensified market uncertainty, with bulls under pressure to reclaim critical levels. To reestablish momentum, BTC must close above the $92K mark in the coming days, signaling renewed strength and a potential path toward recovery. A subsequent push to reclaim $95,000 would be essential to confirm a bullish reversal.

However, the market is not without its risks. If BTC fails to hold the $90K support level, a further breakdown could trigger a deeper correction. Analysts are eyeing the $87K mark as the next significant support level, which could serve as a potential base for buyers to step in. This level will be crucial to monitor, as a failure to hold it could lead to even more bearish sentiment in the short term.

The coming days will be pivotal for Bitcoin’s short-term trajectory. Traders and investors alike are closely watching whether bulls can regain control and stabilize the price above $92K. Meanwhile, downside risks highlight the importance of maintaining key support levels to avoid a more significant pullback in this volatile market.

Featured image from Dall-E, chart from TradingView

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments