- Bitcoin briefly tests $49k before rebounding to $51k amid a $270 billion crypto market selloff.

- Concerns over the US recession and Japan’s rate hike trigger market turmoil.

- FBI warns of rising crypto scams during increased market volatility.

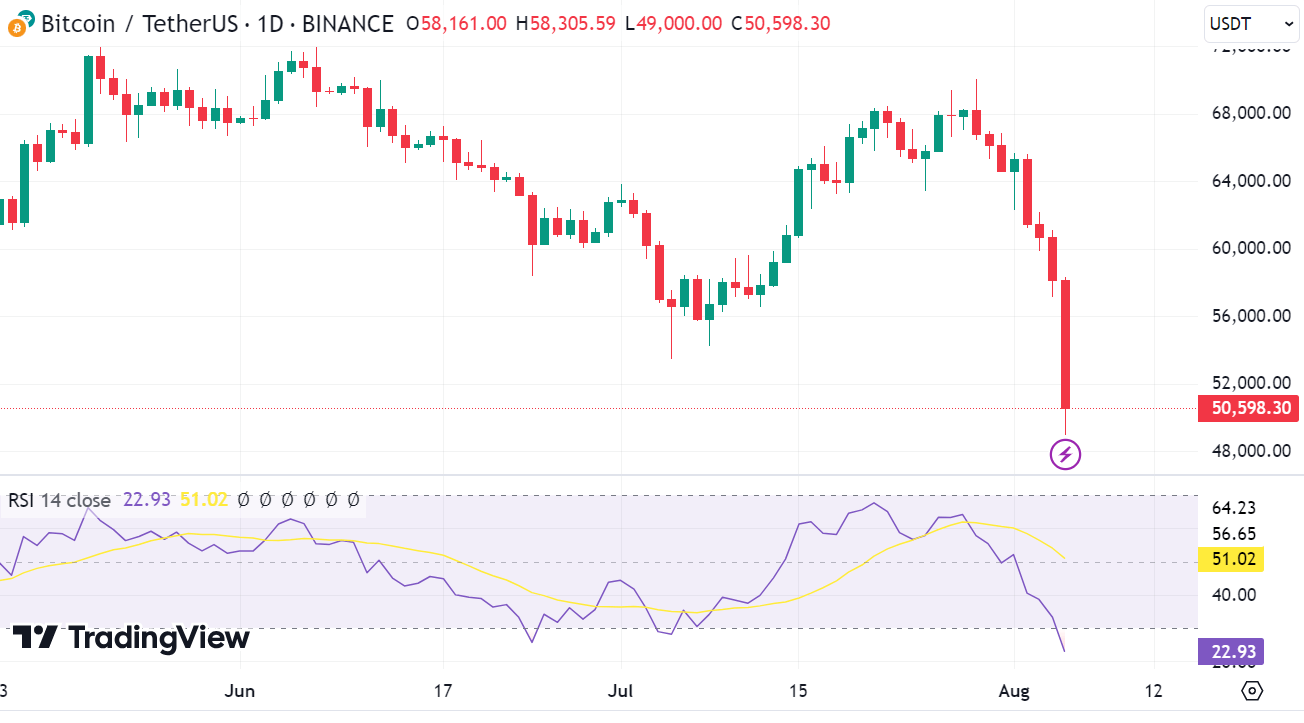

The cryptocurrency market has experienced a significant downturn today, shedding approximately $270 billion in value over 24 hours according to CoinGecko data. Leading this decline, Bitcoin plummeted by almost 20%, reaching $49,121, its lowest level since February at $53,091.

Ether also suffered a substantial drop of 21%, falling to $2,300, erasing its gains for the year. Other cryptocurrencies like Binance’s BNB and Solana have also suffered significant losses.

Bank of Japa hikes its benchmark interest rate

This dramatic downturn in the crypto market coincided with a broader selloff in equities, particularly in Asia-Pacific markets, exacerbated by Japan’s Nikkei 225 falling by as much as 7%.

The Bank of Japan’s decision to hike its benchmark interest rate to the highest level in 16 years triggered this selloff, sending shockwaves through financial markets.

The sharp rise in the JPY/USD is causing a massive unwind of Yen carry trade positions and contributing to the sharp decline in US stocks. For those who do not understand how this works, a brief explanation

1) Many traders were borrowing Jap Yen (JPY) at low interest rates,… pic.twitter.com/sfi0Hva56M

— Adam Khoo (@adamkhootrader) August 5, 2024

The US Nasdaq also slid into correction territory, marking its worst three-week stretch since September 2022, further contributing to the decline in risky assets, including cryptocurrencies.

The market’s reaction was influenced by Japan’s monetary tightening and the US Federal Reserve’s recent actions.

Although the Fed opted to hold its benchmark rate steady, it did not indicate a rate cut in September, which many market experts had anticipated.

This uncertainty added to the market’s anxiety, causing traders to price in a 100% chance of lower US base rates in September.

Concerns of a potential US recession

The selloff reflects growing concerns about a potential US recession, triggered by softer economic data and rising geopolitical tensions.

Tony Sycamore, a market analyst at IG, highlighted that Bitcoin and other cryptocurrencies are risk assets and are highly susceptible to market volatility. He noted that Bitcoin is currently testing crucial support levels and must hold the $53,000 mark to prevent further declines.

However, at press time Bitcoin was trading at $51,657, well below this support level, despite making a comeback from around $49k.

FBI issues warning

The cryptocurrency market’s volatility has also heightened security concerns. The FBI has issued a warning about scammers exploiting the market crash to steal users’ funds.

The FBI advised users to be cautious of unsolicited messages or calls indicating account problems and urged them to verify any issues through official channels. The agency’s warning comes amid a significant increase in crypto-related fraud and hacking incidents.

In the first half of 2024, hackers stole nearly $1.4 billion worth of crypto, more than double the amount stolen in the same period in 2023.

This increase is attributed to the rising value of various tokens, including Bitcoin, Ethereum, and Solana. Ari Redbord, global head of policy at TRM Labs, noted that while the security of the cryptocurrency ecosystem has not fundamentally changed, the higher value of tokens has made them more attractive targets for criminals.

As Bitcoin and other cryptocurrencies navigate these turbulent times, investors and users should remain vigilant about market conditions and potential security threats.

The post Bitcoin tumbles, tests $49,000, amid major crypto selloff appeared first on CoinJournal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments