On-chain data shows the Bitcoin whales now own over 40% of the entire BTC supply, as they have continued to accumulate more recently.

Bitcoin Whales Have Been In Buying Mode Since Mid-March

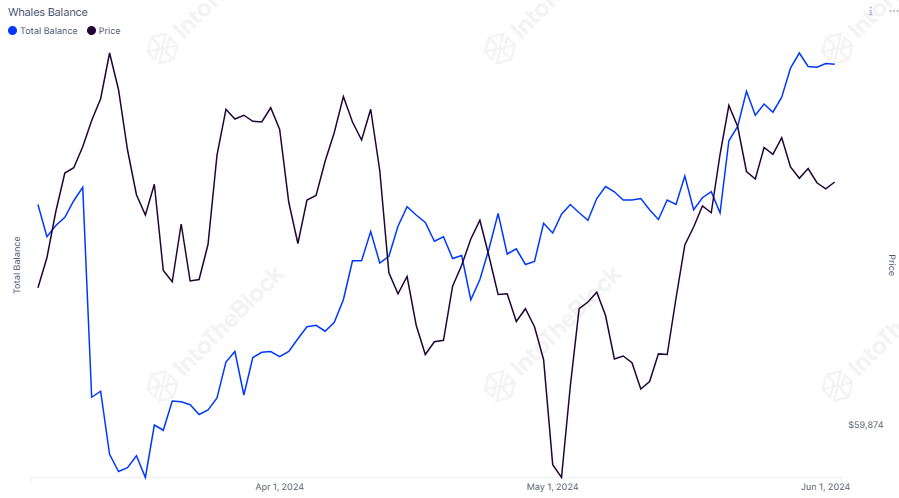

According to data from the market intelligence platform IntoTheBlock, the BTC whales have been increasing their supply since the middle of March. The “whales” here refer to the Bitcoin addresses carrying more than 1,000 BTC in their balance.

At the current exchange rate of the cryptocurrency, this amount converts to around $71.4 million, which is quite quite massive. Because of these large holdings, the whales are considered influential entities on the network.

As such, their collective behavior can be something to watch, given that their movements may affect the cryptocurrency’s price. There are many ways to track this behavior, one of which is through the trend in their total supply.

Below is the chart shared by IntoTheBlock, which reveals the trajectory of the collective balance of these large holders over the past few months.

As the above graph shows, the balance of the Bitcoin whales has been constantly increasing during the past few months. This rise started as the consolidation following the price’s all-time high (ATH) began.

It would appear that while the rest of the market was panicking about the struggle BTC’s price was facing, these colossal entities were seeing it as an opportunity to accumulate more of the asset.

Following the latest buying spree, the holdings owned by these large investors have risen to a figure equivalent to more than 40% of the cryptocurrency’s entire supply in circulation.

If the whales keep up buying, they may soon cross the 50% supply mark. While buying from these holders is a positive sign for the coin’s price, the fact that these holders aren’t far from controlling most of the supply may not be optimal.

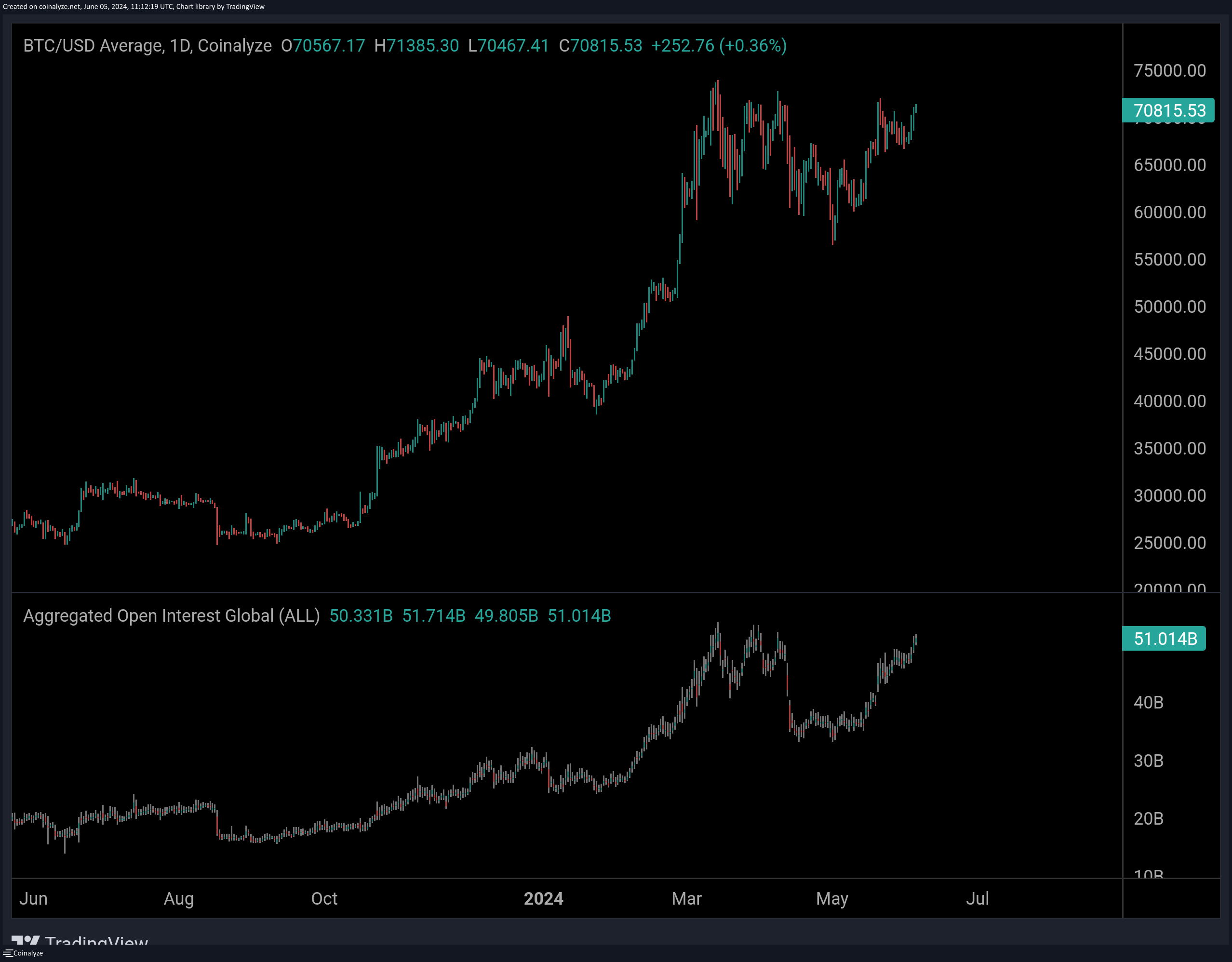

In some other news, as CryptoQuant Netherlands community manager Maartunn has shared in an X post, the total Open Interest across the cryptocurrency sector currently stands at $51.01 billion, which is quite close to the ATH.

The Open Interest here measures the total amount of derivatives positions (in USD) related to cryptocurrencies currently open on all exchanges. Generally, the total leverage in the market goes up when the metric increases, so the market could become more unstable.

As Open Interest in the digital asset sector approaches its ATH, it’s possible that some sharp volatility could soon be coming for coins across the market.

BTC Price

At the time of writing, Bitcoin is trading at around $71,400, up 6% over the past week.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments