Central banks are trying to keep yields from exploding higher while they hike rates to fight inflation. Who will step in to buy bonds in current conditions?

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Looking For The Marginal Bond Buyer

Where are the bond buyers? As central banks around the world continue their attempts to wind down balance sheets, there is declining demand for sovereign debt everywhere you look. In fact, the Bank of England (BoE) was forced to buy more bonds this week, a continued expansion that is a clear sign that right now central banks have been (have to be) the only marginal buyer in the room.

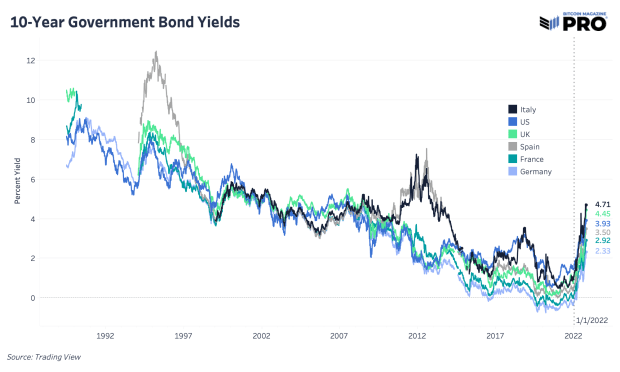

Every day we check sovereign debt yields; every day they are going higher. The only dynamics that have taken yields lower or kept them flat in the short term is the announcement of interventions from the BoE, BoJ and the ECB. So far, these efforts have shown to provide only temporary relief. We’re likely to see all “temporary” liquidity injections become more long-staying policies as larger-scale issues (like the insolvency risk to United Kingdom pension funds) come to the surface. Central banks still seem adamant on using rate hikes until inflation is much closer to their 2% targets, so we could easily see restrictive rates continue while at the same time see central banks abruptly purchase bonds as various liquidity crises arise.

Realized volatility in U.K. government bonds is now even higher than for bitcoin. That said, bitcoin volatility is at one of its lowest historical levels (suggesting a big move coming) while bond volatility everywhere continues to rise.

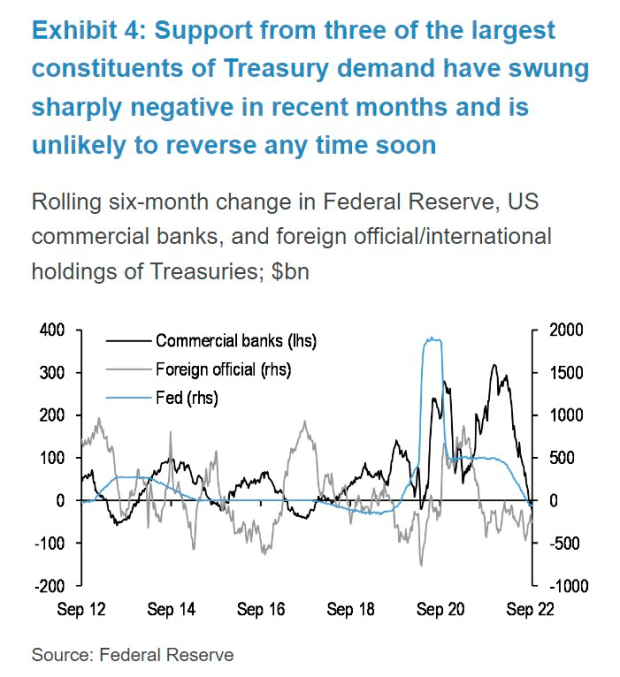

What is most concerning is the decline in buying for U.S. Treasuries across major groups: commercial banks, foreign institutions and the Fed. Many don’t want to step in and buy until we see the Fed’s next policy move in fears that rates haven’t reached their peak. Many can’t buy as a strong dollar and subsequent decline in other major currencies have also forced foreign buyers out of the market. Countries have been running down their foreign exchange reserves to defend their own currency’s purchasing power instead.

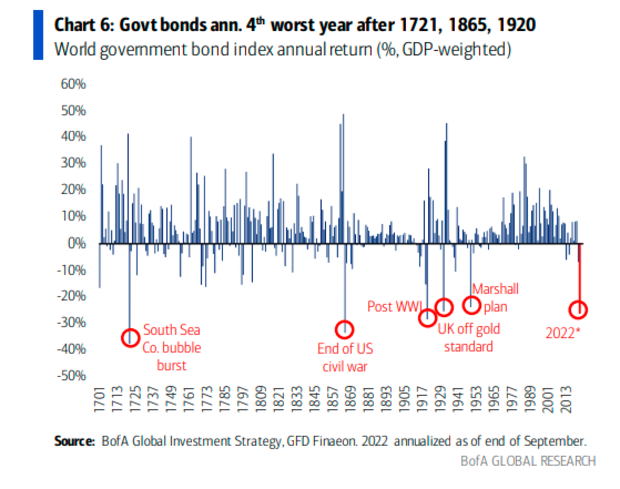

Ultimately what we need to see to reverse this explosion and unprecedented rise in yields globally is a wave of marginal buying in sovereign debt outside of domestic governments. Otherwise, the market is telling us that bond prices need to be lower (and interest rates higher) for bonds to be seen as an attractive investment and allocation right now. As shown by the chart below, we’re coming off one of the worst performance years for returns in history — a once-in-a-century regime shift.

The other argument against the lack of bond buying right now is that very soon, there will be. Either via a deflationary bust that makes inflation much lower, a shortage of U.S. Treasury collateral in the market during a margin call or new regulations that force new buyers — like commercial banks or pension funds — to hold more U.S. debt against their will.

But right now, many are asking what to do with these “safe” or “risk-free” assets when they no longer seem to be safe, seem to carry more risk and are imploding with volatility.

Relevant Past Articles

- 9/23/22 - The Unfolding Sovereign Debt & Currency Crisis

- 9/7/22 - Europe: The Sovereign Debt Bubble Dominio

- 7/12/22 - Brewing Emerging Market Debt Crisis

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments