Summary:

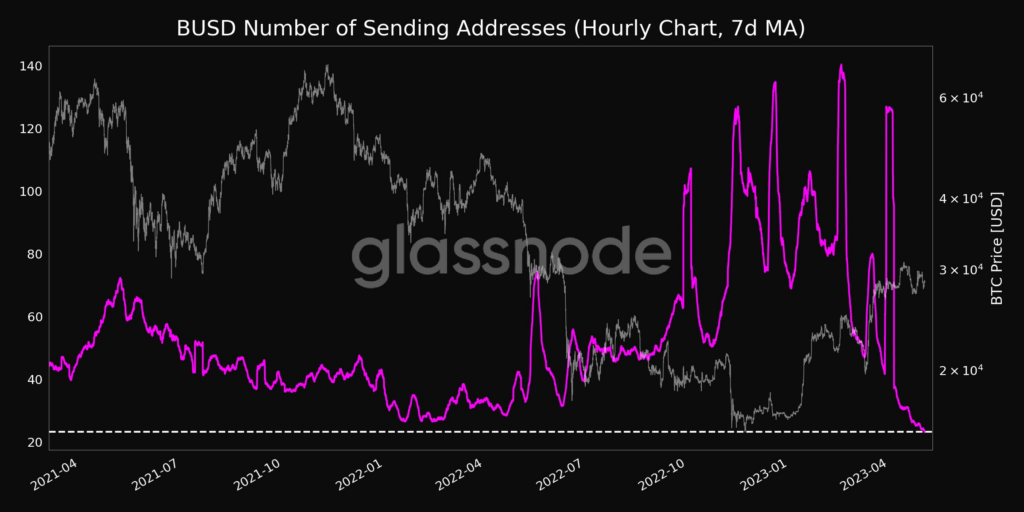

- The number of wallets sending and receiving BUSD transfers slumped to a new two-year low on May 2, data from Glassnode showed.

- Declining trading activity comes after U.S. regulators cracked down on stablecoin issuer and crypto trust company Paxos.

- The Binance-branded token slumped further as protocols, investors, and platforms lost faith in the stablecoin.

- Meanwhile, Tether’s USDT dominance over the stablecoin market strengthens while rival issuers navigate regulatory scrutiny and banking debacles.

Binance USD (BUSD) transactions dipped to a fresh two-year low on May 2, 2023 months after regulatory scrutiny and widespread loss of faith punctured the stablecoin’s market cap.

Glassnode data showed that Binance USD transactions have not declined to this level since mid-2021. The on-chain analytics firm used a seven-day moving average to track wallets sending and receiving BUSD. Both metrics indicated record-low levels.

BUSD’s Fall

BUSD’s dwindling activity comes after its issuer Paxos was the subject of enforcement actions from two U.S. regulators. The crypto trust company received a Wells notice from the U.S. Securities and Exchange Commission accusing Paxos of issuing unregistered securities. Paxos promised to litigate if necessary and “categorically” opposed the SEC’s allegations.

New York’s Department of Financial Services (NYDFS) ordered Paxos to cease issuing new BUSD tokens. Paxos is regulated by the NYDFS and can operate in New York’s jurisdiction. The company said redemptions would continue until February 2024 at the very least.

DeFi protocols like Aave lost faith in BUSD following the news. Community members proposed removing the stablecoin from lending pools and decentralized services. Platforms like Coinbase also moved to delist the token.

Tether Solidifies Stablecoin Lead

Tether’s USDT, crypto’s largest stablecoin, continues to command the lion’s market share of the stablecoin ecosystem amid troubling times for rivals. At its peak, BUSD boasted over $23 billion in supply. This figure has dipped sharply to around $5 billion.

USDT’s market cap alone is north of $82 billion. Tether’s closest competitor Circle (USDC) has a market cap of just above $30 billion. Tether is also reportedly minting significant amounts of new USDT tokens.

Typically, Tether creates new USDT in response to increased demand, signaling the influx of fresh cash into the ecosystem often deployed to purchase Bitcoin, Ethereum, and other cryptocurrencies.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments