The Bitcoin hash rate has come a long way from the China crackdown that saw it fall by 50% in a matter of weeks. Its recovery has not only been swift but has been strong in the same regard. It continues to do well in terms of growth. However, with the growth has come expectations of where this metric might finish in the year 2022. Analysts have put this number at 300 EH/s by the end of the year but can bitcoin achieve this in the next 8 months?

Hash Rate Needs To Rise

The bitcoin hash rate is not doing badly compared to where it was last year. With its fast growth at the beginning of the year, it has been able to push past 200 EH/s. However, with momentum slowing down over the past two months, this number has not risen by much. This now raises the question of how much the hash rate must grow on a monthly basis for it to be able to hit the 300 EH/s figure by the end of 2022.

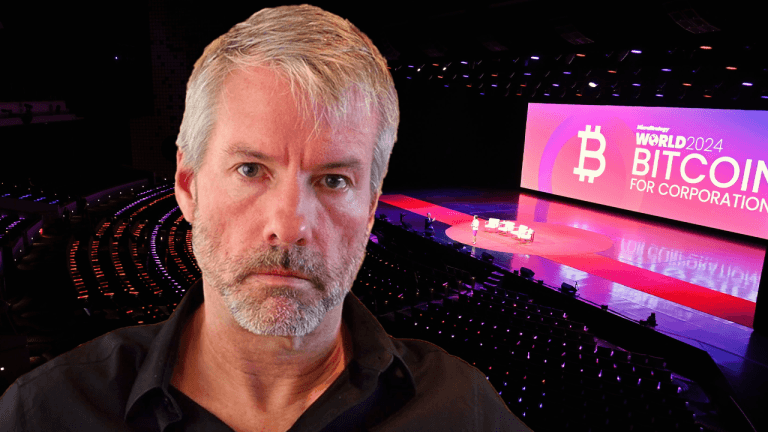

Related Reading | MicroStrategy Deepens Its Bitcoin Bet With 4,167 BTC Purchase

With its current figure at 200 EH/s, the bitcoin hash rate would need to continuously rise at a rate of 5% per month to be able to touch the 300 EH/s mark by the end of 2022. While this might seem like a huge feat, it remains an entirely plausible situation for the digital asset going forward. That is if the hash rate can recover to its normal growth rate before it started stagnating in the last two months.

A reason behind this stagnation though could be supply chain issues. These issues had risen during the 2020 pandemic and two years later, supply chain issues continue to plague the tech industry, mining inclusive. This is because it is now harder for miners to receive the equipment that they would need to set up and expand their operations, thus causing the growth to slow to a crawl. This has led to mining facilities missing their hash rate targets.

BTC hashrate at 200 EH/s | Source: Arcane Research

Nevertheless, once these supply chain issues are out of the way as expected in 2022 and the hash rate begins to rise once more, bitcoin could very well hit this 300 EH/s target by the time the year runs out.

How Bitcoin Miners Are Doing

On the miner side, the past week has proven to not be as good as those preceding it. After seeing the daily miner revenues rise consecutively for at least two weeks, it seems the trend is starting to reverse. Daily bitcoin miner revenues had fallen 0.13% for the past week to put revenues at $41,938,620.

BTC begins another recovery trend | Source: BTCUSD on TradingView.com

Fees per day were up 34.31% however, seeing daily fees rise to $617,437. Average transactions per day were also up 2.80% from the previous week’s 260,713 to last week’s 268,006. Block production per hour declined significantly in the same time period, falling from 6.21 to 5.93, representing a -4.60% decline.

Related Reading | Bitcoin Hashrate Controlled By Publicly-Listed Companies Spikes To 19%

Mining difficulty had risen to a new all-time high over the past week too. A 4% difficulty adjustment being behind the block production rate decreased to only 5.93 blocks per hour. Average transaction value also grew by 7%, while there was a 10% growth in the daily transaction volume.

Featured image from NMK, charts from Arcane Research and TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments