The crypto and legacy markets are increasing their correlation levels. The new asset class has been trading like a big tech stock for a while as the global markets seem to brace for the beginning of a tightening cycle.

Related Reading | $240 Million In Crypto Futures Liquidates As Bitcoin Slips Below $39k

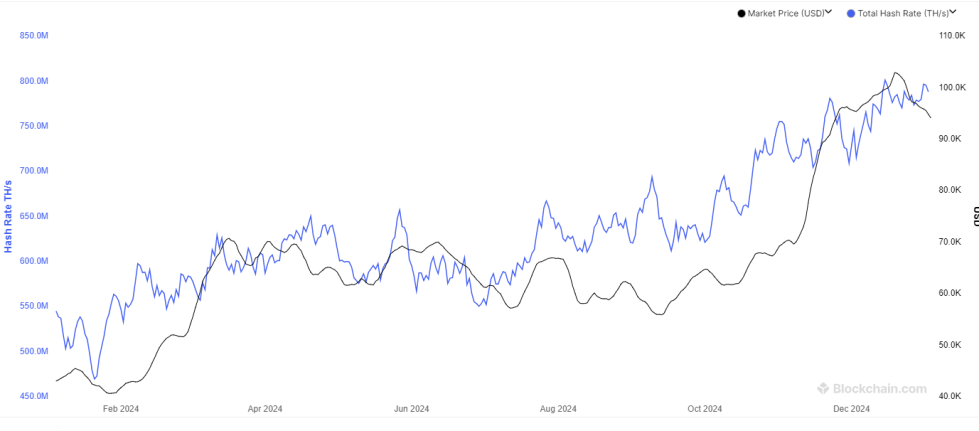

The U.S. Federal Reserve (FED) attempts to stop inflation, as measured by the Consumer Price Index (CPI), and will increase interest rates as well as begin to sell a portion of its balance sheet.

In an environment where investors expect a hawkish FED and a decline in economic growth, the correlation between assets class trends upwards. At least, this seems to be a general idea amongst investors.

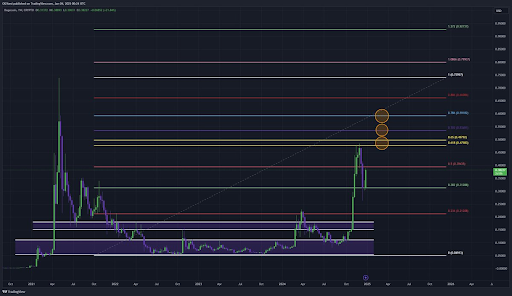

In the crypto market, this correlation is evident, as claimed by a report from Arcane Research. As seen in the chart below, larger digital assets by market cap, such as Bitcoin and Ethereum, have “followed each other over the past seven days” with a 90-day correlation entering all-time highs.

This pattern replicates across the top 50 cryptocurrencies by market cap, Arcane Research said, with ApeCoin becoming the best performer on this ranking. Arcane Research noted the following correlation across all financial sectors:

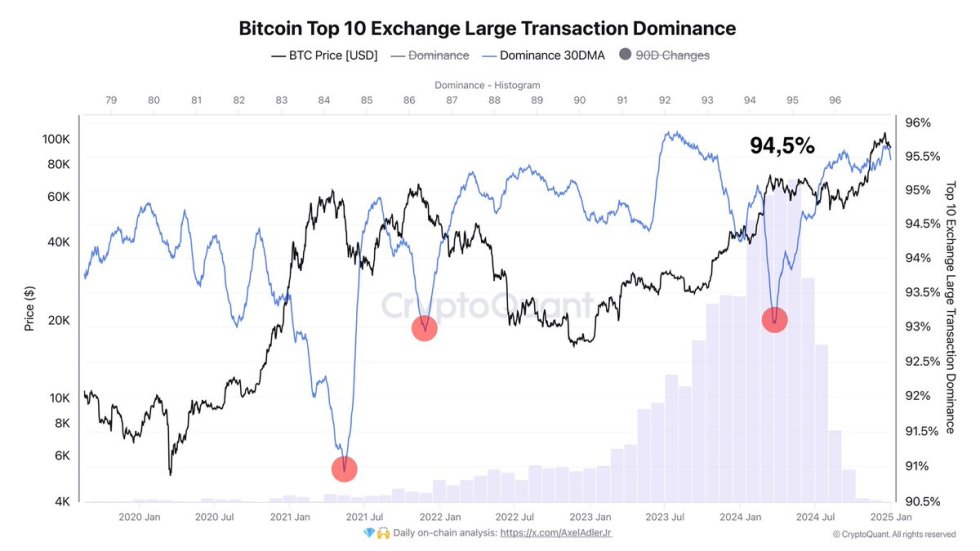

The increased correlations between the largest cryptocurrencies are part of a broader trend of increased correlations in the financial markets. Bitcoin’s 90-day correlation with the S&P 500 in currently sitting at an all-time high of 0.58 while its correlation with the tech-oriented Nasdaq index is even higher.

The last time Bitcoin and traditional equities were this correlated, the research firm added, was in July 2020. BTC’s 90-day volatility stands at equal levels as of November 2020.

At the time, these metrics reaching their currents levels predicted BTC and the crypto market’s entry into uncharted territory. The new asset class rallied into the $2 trillion total market cap.

What A Negative Correlation Could Spell For Crypto

However, the macro-economic outlook is different for today’s market. As BTC and other digital assets are more correlated with their legacy counterparts, they display a negative correlation with the U.S. dollar (DXY Index) and gold.

Arcane Research noted the following on the U.S. dollar’s strength and its impact on tech stocks, and therefore the crypto market:

Inflation expectations and FED policies impact tech. Costs of borrowing becomes more expensive, and the growth projections narrows. Bitcoin’s elevated correlation with tech stocks since March 2020 points a picture of institutional investors bundling bitcoin other risk assets.

BTC has entered the mainstream as a hedge against inflation, a way to protect wealth from the central bank’s monetary policies. However, BTC and other digital assets are trading in the opposite direction as Gold fills the role of inflation hedge.

When the correlation between crypto and the Nasdaq 100 turns negative, the nascent asset class could return to price discovery, according to former BitMEX CEO Arthur Hayes. This could send Bitcoin into the $1 million price point and Ethereum to over $10,000.

Related Reading | Here’s What Will Push Bitcoin To $1 Million, According to BitMex Founder

At the time of writing, Bitcoin trades at $41,200 with a 1% profit on the daily chart.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments