Following the new all-time high prices of Bitcoin and Ethereum on November 10, at $69,000 and $4,800 per coin respectively, the cryptocurrency market began a downtrend. The downtrend culminated in a market crash on December 4, when the total market cap for crypto dropped from $2.7 trillion to $1.9 trillion. During the crash, Bitcoin dropped to $42,000, while Ethereum hit a low of $3,500 per coin.

Although cryptocurrencies have taken an average price rebound of around 15% since then, a large number of investors in the market are fearful of whether a bear market is around the corner.

To understand whether these concerns have any objective grounds, we will discuss in the below article the outlook of Bitcoin and Ethereum, the two major market movers, in terms of their on-chain activity and technical analysis, which have historically acted as precursors for future cryptocurrency price action.

We will additionally discuss news in individual cryptocurrency product categories like layer-2 protocols, DeFi products, or blockchain games, along with any regulatory or funding developments to find out what has been trending in the cryptocurrency ecosystem over the last week.

BITCOIN ANALYSIS

On-Chain Activity:

Bitcoin underwent a deleveraging event starting December 3 that drove the price down nearly 24% at one point but found some stability around 10% below the daily (December 3) open. Although price cratered, holders remained strong as coins only briefly entered exchanges throughout the week.

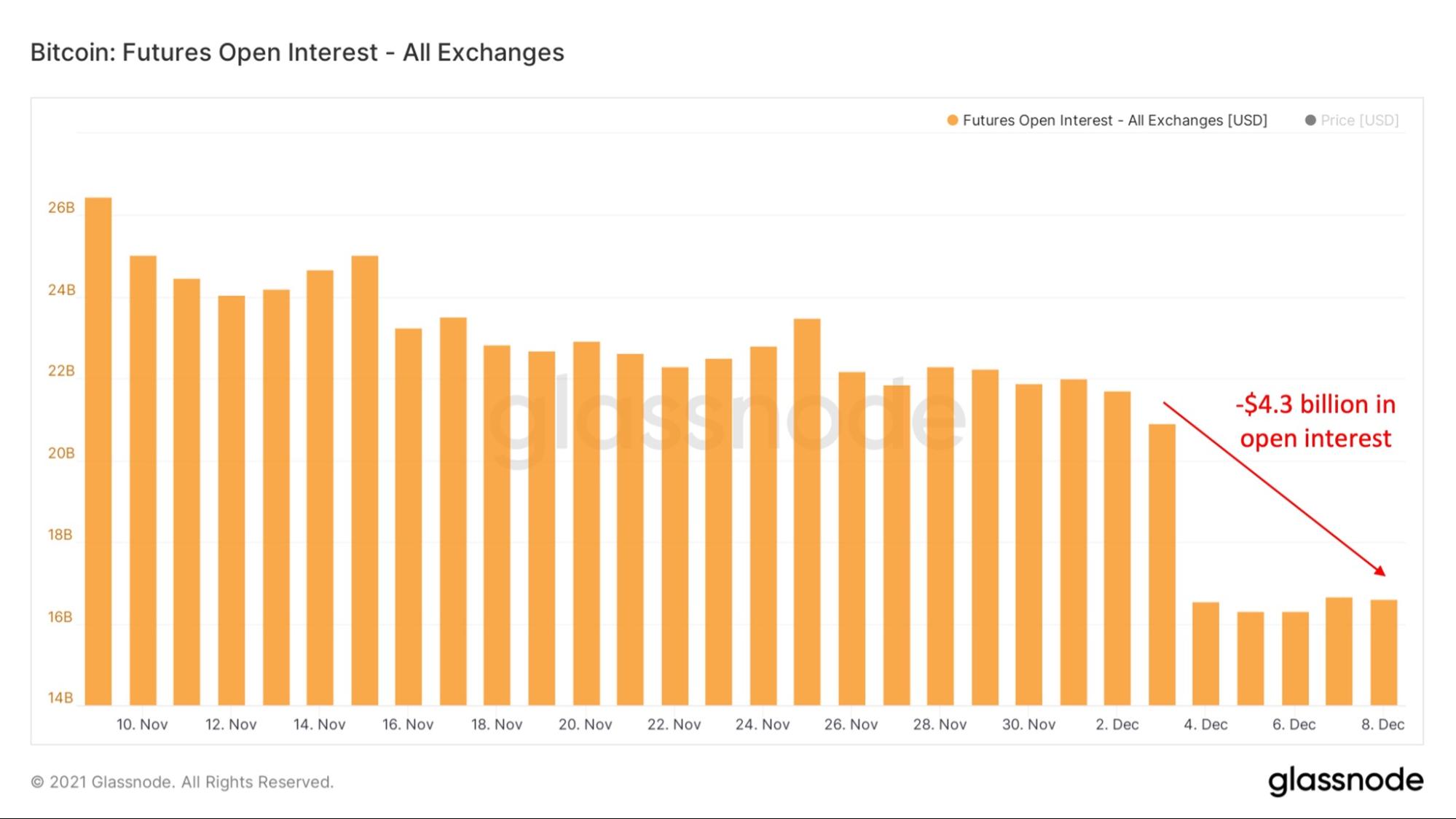

1. Open Interest

~20.6% of Bitcoin’s open interest (OI) was closed as a result of the marketwide deleveraging event that has been taking place since December 3; at the time of writing there is $16.6 billion in open futures contracts, down from $21.7 billion just a week ago. This decline in OI is seemingly a result of investors across several market types turning risk-off in response to Omicron uncertainties and announcements around tightening fiscal policy, which lead to cascading liquidations in BTC. Nearly $470 million in longs were liquidated over December 3 and 4 and long liquidation dominance hit 98.3%.

2. Holder Behavior – Exchange Flows

Despite the outsized drawdown in the market value of BTC, exchange flows remained at historically low levels for a sell-off of this magnitude. This suggests the decline in Bitcoin’s price isn’t the result of investor capitulation. Only 5,800 BTC entered exchanges the day of the initial deleveraging shock; since then net flows have flipped negative as coins continue to flee exchanges. Since December 3, approximately 22,463 BTC have left the exchanges.

&

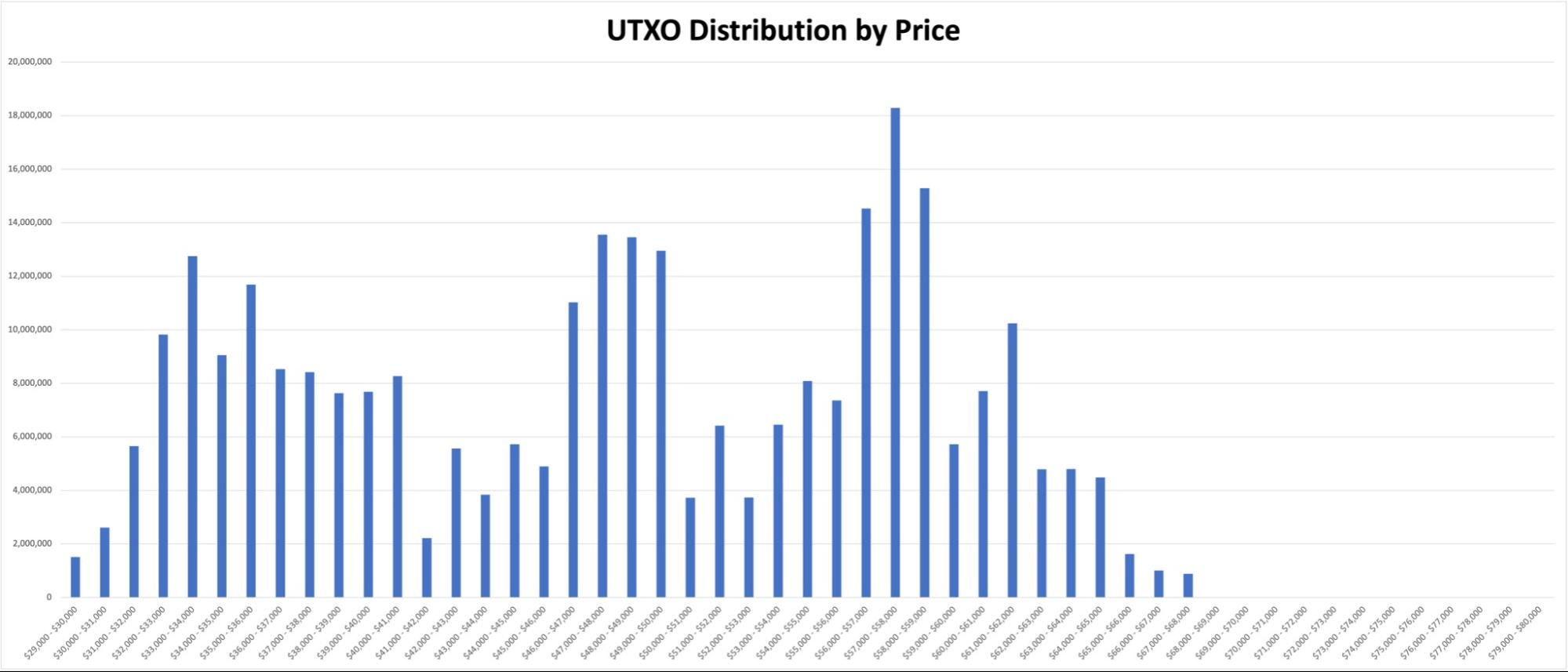

3. Key Levels – UTXO Creation Distribution

Finding direction during volatile market conditions can be difficult. Observing points at which BTC has historically changed hands frequently can provide clarity on points of support and resistance. Following the distribution of UTXOs created by price offers such insight, and shows the current price level has historically seen increased user activity. Other price levels to watch as potential targets to the upside include $56,000 to $59,000 and to the downside include $40,000 to $43,000.

&

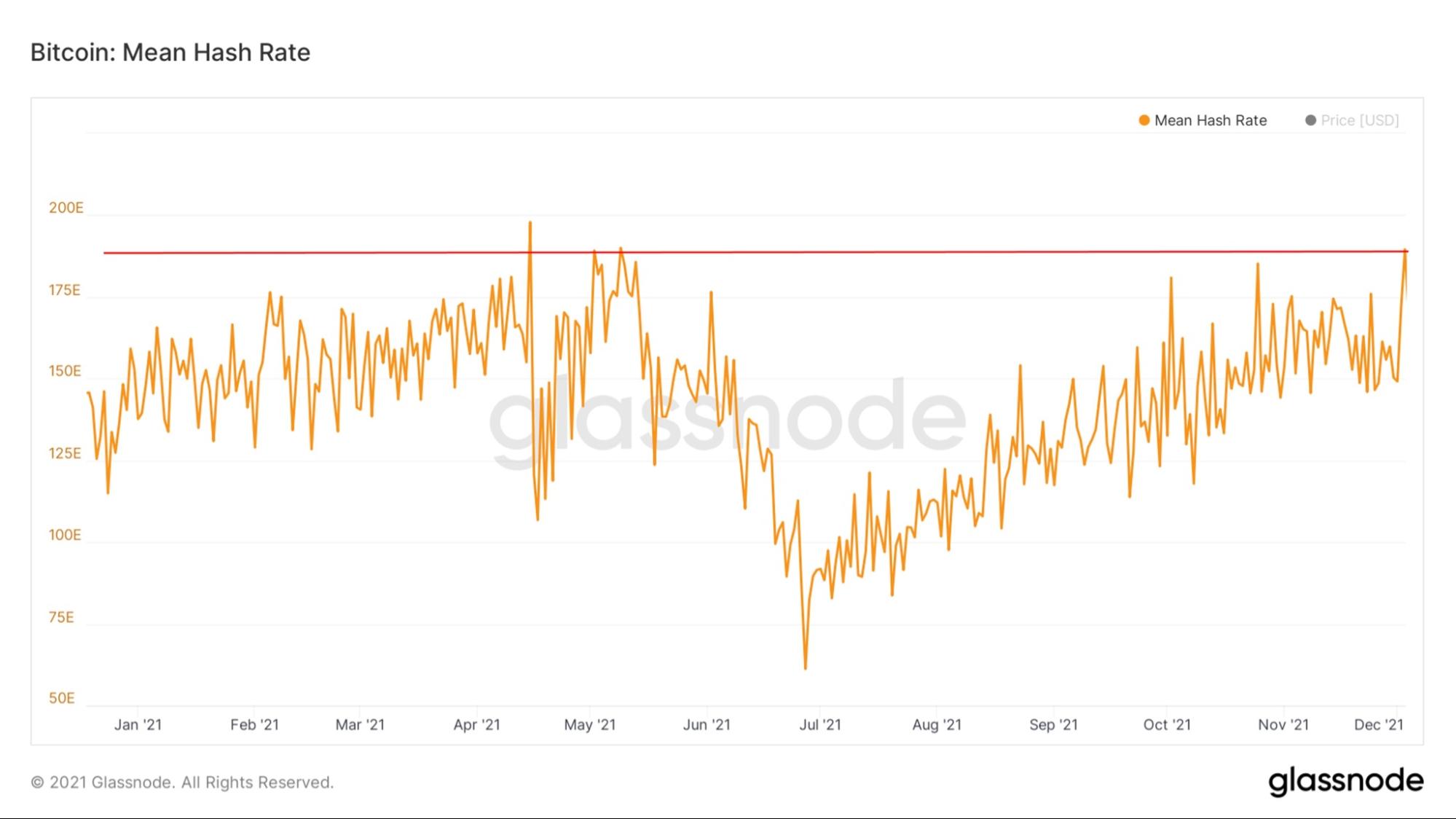

4. Network Hash

Amidst the chaos of price volatility, hash climbed to 189.5 million Th/s. Up over three times from the bottom seen in June, hash now sits within 5% of the all-time high of 197.9 million Th/s This is a healthy sign for the network and indicates that miners are not capitulating as price volatility to the downside ramps up.

Bitcoin Technical Analysis:

1. Weekly 50 SMA

During the violent early-weekend crash on Friday night (December 4), Bitcoin dropped to its 50-week simple moving average (SMA) at $47,000, after making a wick as low as $42,000.

The 50-week SMA has always defined Bitcoin bull markets to date. Bitcoin always stayed above its weekly 50 SMA during its long-term uptrends and hardly ever touched it. And those touches on the moving average have generally been soft-landings, not abrupt crashes like the one on December 4, which has kept Bitcoin investors worried since then. Historically, when Bitcoin fell below its SMA-50 on a weekly close, its downtrend continued for at least a few more months.

2. Weekly Momentum Indicators

Let’s take a look at Bitcoin’s weekly momentum indicators to have an idea about the likelihood of Bitcoin staying above its weekly 50 SMA.

The week of Bitcoin’s new all-time high at $69,000 (November 8) closed with bearish momentum indicators, following which Bitcoin started its recent downtrend and hit as low as $42,000 on December 4.

In the below chart, you will see that the weekly RSI got rejected at the 70 level (the upper end of the purple horizontal band) on the week of November 8. If the RSI could close above 70 that week, it would have carried itself to the overbought territory, which would have increased the likelihood of further price action to the upside. However, rejection at the 70 level changed the momentum and suggested that the trend could be shifting in the following weeks, which it did.

Currently, the weekly RSI is trying to cross above the 50 resistance level but if the week closes below 50, this could indicate a further loss in buying power and a continued downtrend.

The Stochastic RSI (Stoch RSI) on the other hand, had a bearish cross of its faster line (the blue line) with the slower line (the orange line) on the week of November 8, which likewise indicated a shift in price momentum to the downside. As of this week, the Stochastic RSI has already dropped close to oversold levels. We need to have a positive stochastic cross (the blue line crossing up the orange line) for the momentum to shift back to positive.

The MACD is generally a more lagging indicator compared to RSI and Stoch RSI, which had its bearish cross only last week. The desired positive cross in Stoch RSI needs to be supplemented with a positive cross of the MACD line in the coming weeks, so that Bitcoin will have more buying power to remain above its 50-week simple moving average price, or climb back above it in case it breaks down.

3. Broken Ascending Channel Support

Bitcoin was following an ascending channel since making its 2021-low at $30,000 per coin on July 20 as you can observe in the chart below. With the most recent crash on December 4, Bitcoin broke down from this rising channel. Now, it needs to crawl back to that channel if it is to start a new uptrend.

4. SMA 400 on the 4-hour

The SMA 400 line on the 4-hour Bitcoin price chart has also been a critical threshold in terms of identifying Bitcoin bull markets. Historically, whenever Bitcoin has managed to throw itself above the SMA 400 on the 4-hour chart, it was usually followed with strong rallies to the upside. As you can observe in the below chart, the same thing happened last October when Bitcoin managed to get above the SMA 400 (the blue line) at $45,000, and then it was promptly followed by a hike to its new all-time high price of $69,000.

However, with the December 4 crash, Bitcoin dropped back below its SMA 400 on the 4-hour, which indicates a downtrend. Bitcoin needs to climb back above the SMA 400 and back to its ascending channel from July 2021, both of which are pretty much at the same price level now at $58,000. In that shell, we have confluence that $58,000 will act as strong resistance if and when Bitcoin starts climbing back up.

5. Net Value to Transaction Volume (NVT) on the weekly

At least, the Network Value to Transaction Volume ratio (the NVT) is still giving a positive signal. The NVT is an indicator that has worked exceptionally well for Bitcoin on the weekly timeframe, which is defined as the ratio of closing total market capitalization against the total transaction volume during the specified period. The NVT is often regarded as the price-to-earnings (PE) ratio of cryptocurrencies.

In the weekly Bitcoin chart below, the NVT value climbs up with the rising Bitcoin price and the color of the NVT indicator line remains green as long as the Bitcoin network is not calculated to be too expensive by the indicator, given the total volume of transactions by the closing of every week. Drops in the NVT indicator value may eventually cause the color of the line to turn red, which then suggests that Bitcoin is overvalued.

Every time in Bitcoin’s history, whenever the NVT indicator line turned to red on the weekly chart, it was followed by at least a 40% drop in the price of Bitcoin. The last time that the NVT turned red was the week of May 10, 2021, which was followed by Bitcoin crashing from $58,000 to $30,000 in only a matter of two weeks.

In that sense, even if Bitcoin falls below its 50-week SMA, the general uptrend may still be intact as long as the weekly NVT indicator line remains green.

ETHEREUM ANALYSIS

On-Chain Activity:

On-chain data suggests that Ethereum holders have remained unnerved by last weekend’s sell-off. Holders who spent their ETH made a profit as coins continued to be removed from exchanges in the days that followed the market-wide crash.

1. aSOPR

Ethereum’s Adjusted Spent Output Profit Ratio remained above 1 throughout the dip, meaning holders didn’t spend their coins at a loss in aggregate. This is a sign of strength and suggests the near 22% decline in ETH’s market value isn’t a sign of a greater trend reversal; price has since stabilized ~7% below the December 3 open and holders continue to spend their ETH in profit.

&

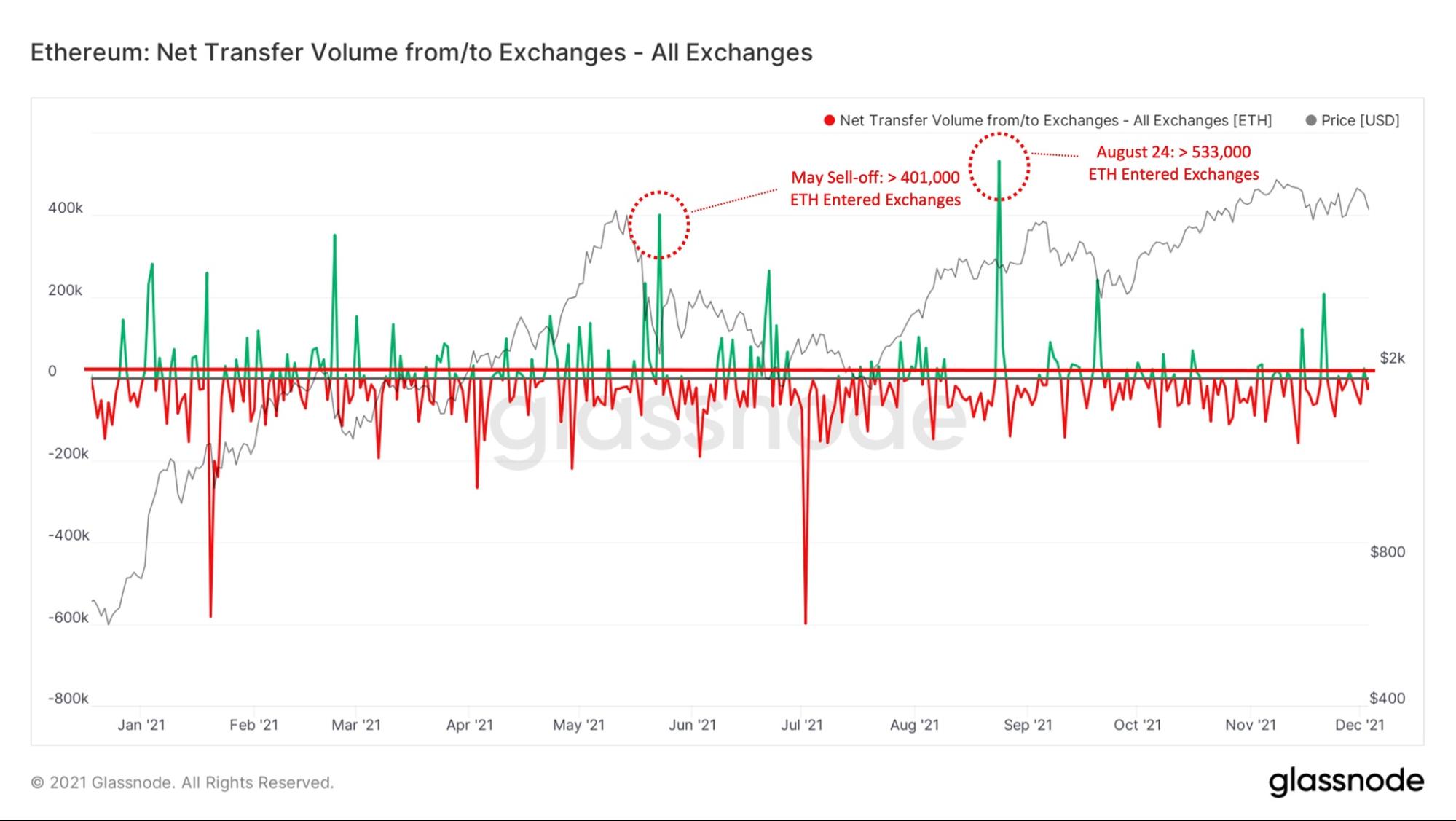

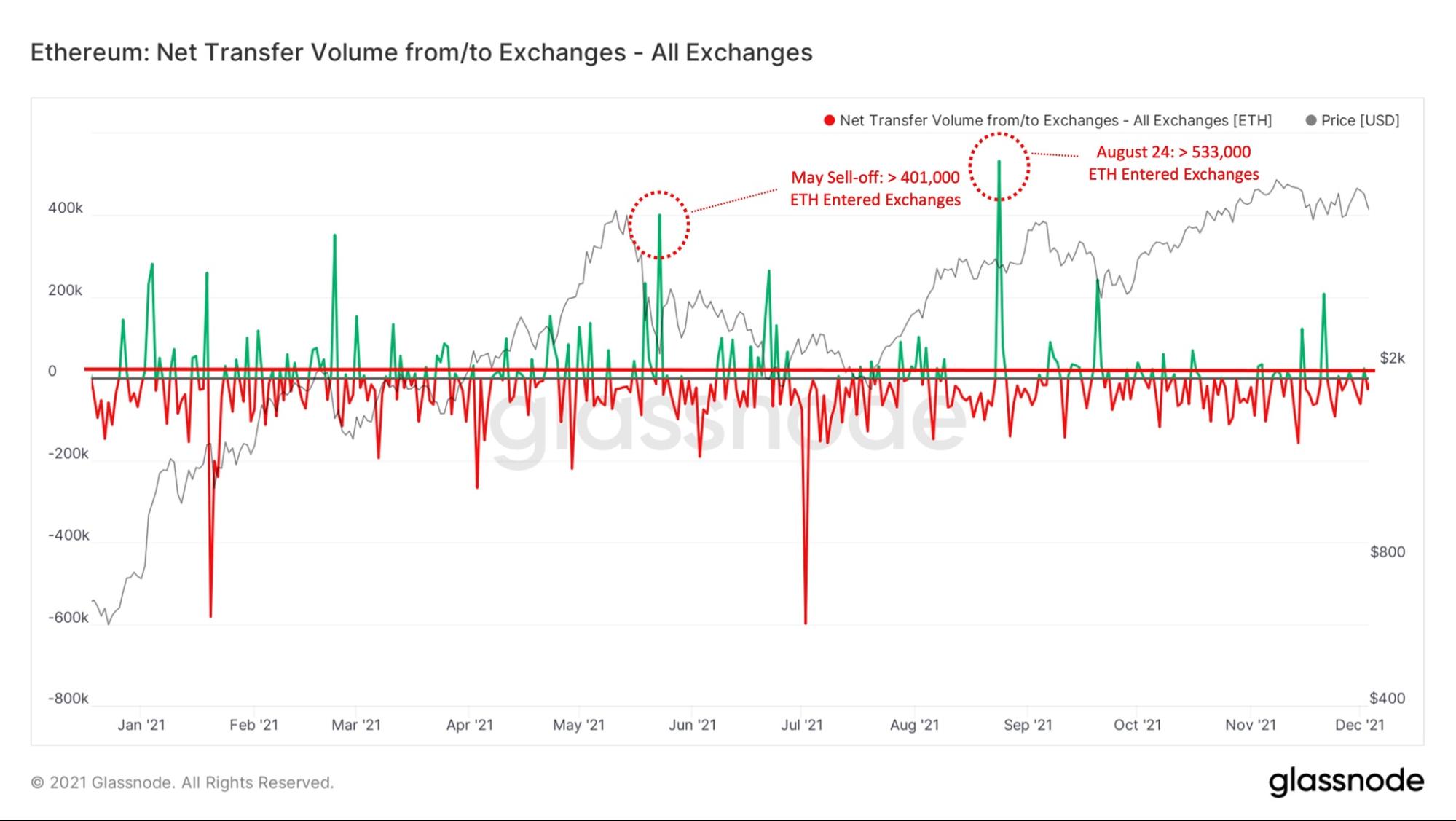

2. Exchange Balance

The net flows in ETH’s exchange balance highlights the conviction of holders through the December 3 sell-off. Only 24,870 ETH entered exchanges leading into last weekend’s dip, which equates to only $112.3 million at the close price on December 2; this suggests very few holders moved their coins from storage to exchanges as price declined. More than 25,000 ETH left exchanges in the following days which shows holders aren’t exhibiting any signs of capitulation, and the trend in coins exiting exchanges continues.

Ethereum Technical Analysis:

Ethereum’s price action has historically been very strongly correlated to that of Bitcoin. Throughout the history of the cryptocurrency market, Bitcoin managed to drag Ethereum and other cryptocurrencies along with itself, either to the upside or to the downside. The primary reason for this synchronized price action was that funds entering and exiting the cryptocurrency market initially flowed into Bitcoin, which then moved in and out of Ethereum and other cryptocurrencies, i.e. the altcoins. In that sense, Bitcoin should not be on a downtrend for the Ethereum price to climb higher.

1. Rising Channel Support

Interestingly, even though Ethereum followed the Bitcoin price during the December 4 crash, where it fell by a whopping 24% (from $4,600 down to $3,500 per coin), it managed to recover very quickly and bounce very hard, compared to Bitcoin. During this comeback, Ethereum also managed to preserve its ascending channel support coming from the July 2021 lows, while Bitcoin has broken down from one.

2. Ethereum-to-Bitcoin Price Outlook

Ethereum’s outperforming Bitcoin is also evident in the below Ethereum/Bitcoin price parity chart. As you can see in the below chart, Ethereum started a strong uptrend against Bitcoin at the end of March 2021 where it managed to triple the ETH/BTC parity price up to 0.09 BTC per ETH.

Historically, the 0.115 parity is a very important price level because it constitutes the all-time high ETH/BTC monthly-close price (see the below chart). If Ethereum continues its climb upwards against Bitcoin, this historical level is likely to act as strong resistance.

Even though Ethereum stands strong against Bitcoin, further drops in Bitcoin price can still take Ethereum’s USD price down along with itself. However, if Ethereum can sustain the uptrend against Bitcoin, that would translate to Ethereum dropping less in USD value in case of a continued Bitcoin downtrend, just like how it bounced following the December 4 crash.

3. Weekly Momentum Indicators

Similar to Bitcoin’s weekly momentum indicators against USD, Ethereum’s weekly indicators also look weak for the USD pair.

Just like Bitcoin, Ethereum/USD’s weekly RSI got rejected at the 70 level after making its new all-time high at $4,800 per coin (see the below chart). Stoch RSI also made a bearish cross and it is still on a downtrend. What is coming is that the MACD is about to make a bearish cross. If the MACD line does make that bearish cross while the Stoch RSI fails to make a positive cross and starts rising back, the downtrend in USD price may continue. Of course, Ethereum’s USD price action is strongly correlated to that of Bitcoin so Bitcoin’s next moves will likely dominate Ethereum’s trend.

The good news is the ETH/BTC parity looks like it still has more room to go considering its weekly momentum indicators. The MACD just turned green last week and the line made a positive cross. Moreover, if the weekly RSI does not get rejected at 70 and closes above it this week, this may suggest further upside for the ETH/BTC parity. The weekly Stoch RSI’s cruising in the overbought territory (above 80) adds further confluence for the upside potential of ETH/BTC.

In that shell, even if Bitcoin continues its downtrend against USD, Ethereum may preserve its USD value better during the coming days.

CRYPTO INDUSTRY UPDATES

Regulatory Developments

Crypto Company Executives Take to Capitol Hill

Crypto executives and other industry figures testified before Congress on December 8 to discuss the state of the crypto ecosystem, where the U.S. stands on a relative regulatory basis, among other topics. This kind of discourse between those building in the space and lawmakers has been lacking up to this point, which is why the testimony was so important; lawmakers were able to learn more about the industry and those representing the industry were able to hear about concerns of lawmakers. Cooperation between regulators and industry leaders is an important component of advancing the technology and its adoption in the United States. This event marked an important milestone in this relationship, which can have positive externalities moving forward.

Funding Developments

1. Microstrategy and El Salvador Buy the Dip

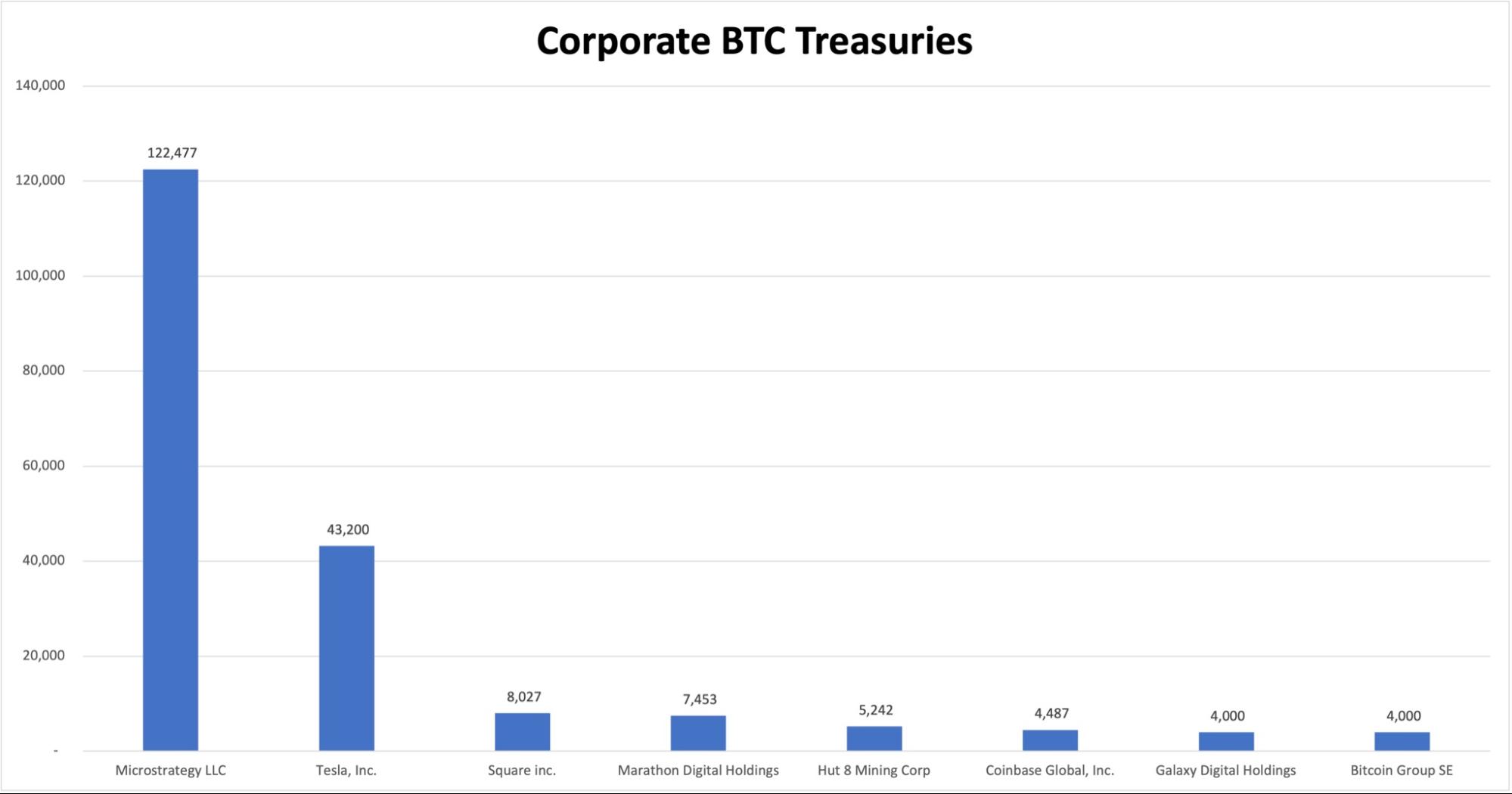

Microstrategy and El Salvador capitalized on the dip-buying opportunity by adding more Bitcoin to their reserves. On November 29, Microstrategy added 7,000 BTC to its reserve at an average purchase price of $59,000 per BTC. The company spent a total of $415 million on the transaction. Additionally, the company’s CEO, Michael Saylor, announced another purchase of 1,434 BTC on December 9. With these purchases, the amount of BTC on Microstrategy’s balance sheet has risen to ~122,478 BTC with an average purchase price of $29,861 per BTC. The below chart compares the corporate BTC treasuries of public companies in the United States

El Salvador added more BTC to its treasury on two separate occasions over the last couple of weeks. On November 26 the country added 100 BTC when the price was trading around $54,000, and picked up an additional 150 BTC on December 4 at an average price of ~$48,670.

2. $500 Million Fund for Algorand

Borderless Capital is launching a new $500 million fund for Algorand, which is called the ALGO Fund II. Algorand is one of the top 20 cryptocurrency projects in the market in terms of its total capitalization. With the proceeds of ALGO Fund II, the Algorand team aims to develop projects built on the Algorand blockchain including NFT and DeFi applications.

Borderless Capital, a firm based in Miami, is the leading investor in the Algorand ecosystem. In June 2019, it launched its first fund, the ALGO Fund I with a capital of $200 million. The ALGO Fund I had invested in over 100 companies over the past 2.5 years, which include Tinyman, Yieldly.Finance, Reach, Opulous, and Flare Network.

CRYPTOCURRENCY PRODUCT UPDATES

Layer 2 Developments:

1. EIP- 4488

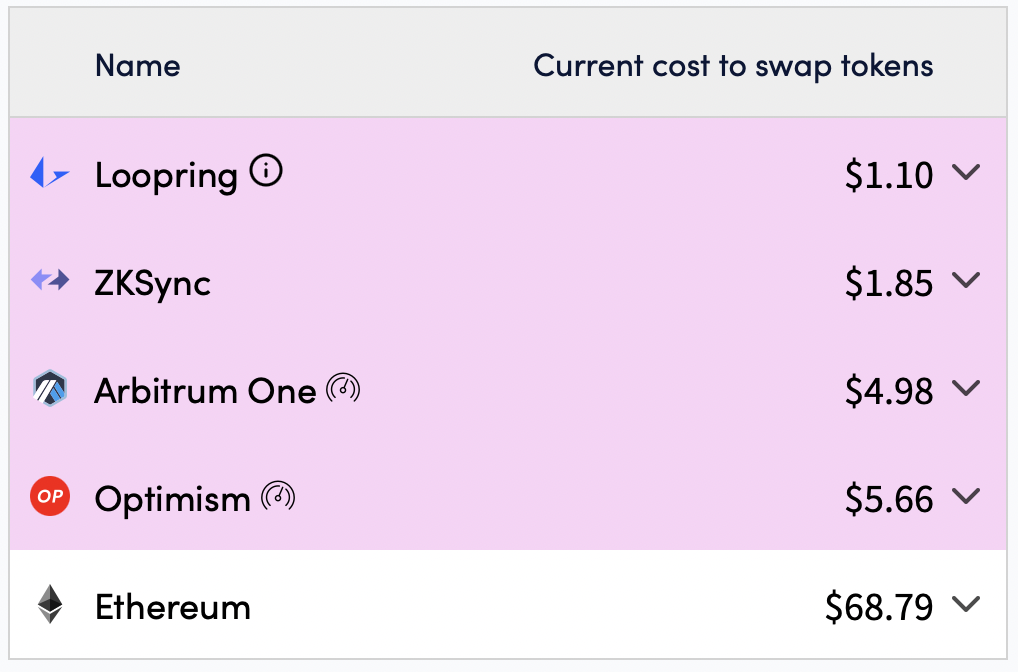

Ethereum gas fees have been running hot in the second half of 2021 as a consequence of the rapidly increasing adoption. This has prompted Ethereum users to leverage layer 2 en masse. While swapping or transferring Ethereum on the Ethereum mainnet is still the most expensive option by far, the costs of layer 2 solutions are also rising. The costs you see in the below chart all used to be less than a dollar at the beginning of 2021, excluding that of Ethereum.

Rising costs on layer 2 solutions lead up to the launch of EIP – 4488. This proposal aims to put a limit on the amount of gas required for the Ethereum mainnet to communicate with layer 2 solutions, like rollups. The call data cost is 16 (gas) per byte of data in its current state. If the EIP-4488 proposal passes, it will be reduced to 3 per byte. The proposal also includes a limit on the call-data per block to mitigate security issues associated with lowering the cost.

However, there is also a tradeoff with the EIP-4499. Lowering the call data fees by more than 5x may grow block sizes to unsustainable levels. Vitalik commented, “It’s literally data we add to each transaction. If we lower the gas cost, and keep the gas limit per transaction as is, we then have bigger blocks, which can be problematic in the short and long term. Short term, it increases the worst case block size.”

DeFi

1. Uniswap V3 Goes to Voting to Launch on Polygon

The Uniswap community is going to vote for or against the launch of Uniswap V3 on the Polygon layer-2 sidechain. Launching on Polygon will allow Uniswap users to benefit from the very low transaction fees that are common with Layer 2 solutions while preserving the functionalities of Uniswap.

The first stage of voting in Uniswap’s governance platform, which is called the Temperature Check, passed with almost a 100% vote. The second stage in the process, the Consensus Check, was completed on December 2 and passed with a 98.62% vote in favor of the launch of Polygon. The final stage, called the Governance Proposal, contains a seven-day voting period, the result of which will dictate Uniswap’s future with Polygon.

2. Terra Approves Proposal for DeFi Tax Reporting

In the wake of regulatory pressures, DeFi developers are working hard to accommodate the future regulatory needs of their users. The Terra community voted in favor of a proposal that will fund the development of a tax reporting application. The application will simplify the tax process for users by using the blockchain to calculate their expenses, receivables, and earnings, which then compiles a report that is shared interactively with the leading tax reporting platforms.

The proposal on the Terra blockchain was submitted on November 22, one week after the Infrastructure Bill was signed into law in the U.S.

3. Defi Llama Begins Tracking TON Swap (Everscale)

DeFi Llama is a dashboard offering cross-chain data solutions around the DeFi ecosystem. Their product allows for greater transparency around DeFi applications by giving users a free and accessible data outlet.

The DeFi Llama platform recently integrated TON Swap to its platform. Now users of Everscale can track the total value locked in the protocol, view its most recent audit documentation and code, and download protocol data for analysis. This is a strong step in maturity for Everscale and its users, who now have a solution that increases the transparency around their holdings.

TON is available to buy and stake on CEX.IO.

&

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments