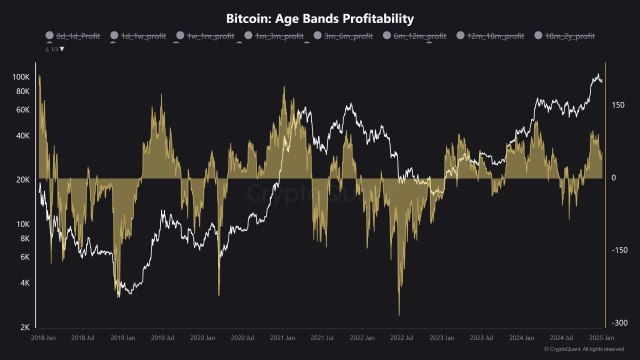

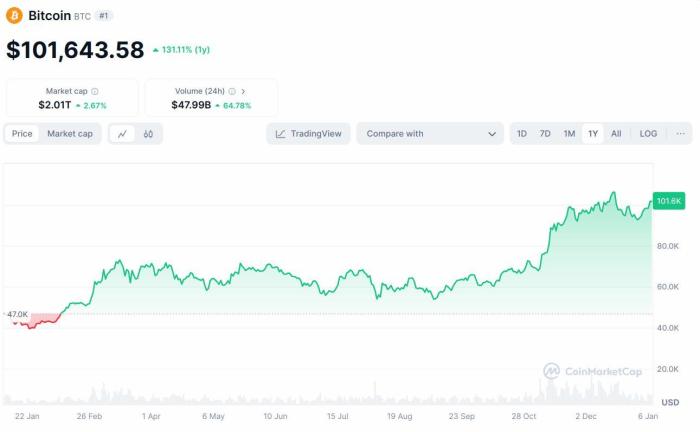

![DCA strategy & crypto [SERIOUS2] [NO MOONS] DCA strategy & crypto [SERIOUS2] [NO MOONS]](https://a.thumbs.redditmedia.com/LmvuzPnKunusffgy2qCGYX72GNDsbw5BFlQiyGGhlN8.jpg) | Disclaimer for the feds: I never owned any crypto, never traded any crypto, never made any profit and this post is purely for entertaining purpose only. This is not a financial advice. Feel free to convince me or counter argument my points in the comments. Been trying to discuss this topic for years now in the sub because everyone seem to love & blindly follow the strategy. Unfortunately it shows that many don't really understand it nor realize how bad it truly is compared to other strategies. Here's a critical perspective about the most popular investing strategy that I truly don't believe in anymore since 2020. What is DCA?By definition, Dollar-cost averaging (DCA) is the automatic investment of a set monetary amount on a periodic basis. The goal of DCA is to lower the average cost related to the current price of an asset. Long term goals are to buy regulary in the up & down markets where investors target the goal to buy at lower prices and fewer at higher prices. Another goal is to reduce the impact of volatility which doesn't make sense when it comes to Cryptocurrencies but I'll get to that point later. An example : DCA in the stock marketThe stock market or blue chip stocks are a great example of an asset where DCA works perfectly fine. Let's take a look at a chart: This is the SPX ( S&P500 ) chart. I used as entry value the week right before the COVID crash. It was the ATH price level of that time so the entry is the worst possible. ( literally buying ATH a few weeks before the crash ) To calculate the average cost to DCA since that day I've used the moving average indicator that will show us the average price since that date. So on average, that should be where most investors average would be. After 1231 Days since the covid crash ( damn it's been that long already ...? ) the investor would be up +12.27% now. They bought at ATH before crash, through the entire bullmarket and are still up. If we take a different approach which is more risky the investor has now applied the strategy to a bluechip stock. In this example I use Apple ( AAPL ) the biggest market cap stock. They exclusively bought the bluechip stock, took a bigger risk of it falling behind the market valuation and are now up 40.1% since that entry. Now let's take a look at CryptoIf you accumulated since that day back from below 10k level you are now up +4.67%. So you basically entered the Crypto market before the big hype at a cheap level and accumulated for almost a year below 20k before the big bullrun started and the results are a +4.67% profit of your investment. Why?Because DCA is a strategy same as any other investment strategy out there. When the strategy was created it was not meant for Cryptocurrency. It wasn't meant for incredible volatile assets that jump +200% within a year and then drop -73% the next year. The point of "lowering your exposure to volatility" doesn't apply to crypto because the entire asset is volatile 24/7. The point of DCA and the meaning behind "lowering the exposure to volatility" is preventing feelings or FOMO to buy during a rally or heavy green day ( such as after earnings report when sentiment switches very bullish sometimes ) but also to prevent buying too much right before a major decline ( catching a falling knive ) because the FOMO kicked in to buy the dip. Averaging up & down in this particular case makes sense because long term the entries won't be too high compared to the average price the asset will move and works because stocks & stock markets have proven in the past to always recover. Crypto is the stock market on crack. Many rules & strategies don't apply to the crypto market that potentially crashes -20% and jump +50% next day. "It's just hindsight because of the bull market" Oh is it? Alright so let's see how a DCA since $3900 before the 2017 run would look like. A whopping +52%. You just barely made more profit over a span of 2149 Days ( 307 weeks ) than a boomer investor with his bluechip stock in almost half the time. And if I show you the profits of that investor sticking to AAPL it gets depressing. Up +120% more than twice than you for being an early adopter in BTC, an early investor, far before any bullrun and taking massive risks compared to the AAPL investor. I seriously don't know how many examples I need to give to proof the invalidation of DCA into crypto. It is simply not worth it UNLESS you come from the old days. When DCA was truly worth itSo why is this such a misconception and wide spread idea of "DCA & HODL" and where does it come from? Well, it worked in the past. In the far away past from the very early ages of Crypto. And it's true those that have beeen believing in crypto since the early days have become very wealthy for applying the strategy. A few friends of mine have become incredible rich thanks to stacking BTC in the early days and sticking to their believes that BTC will eventually one day replace the fiat system. Those that truly made it have accumulated since early days and still sit on a larger bag from those days while slowly cashing out whenever they want some fiat. ( Everyone else btw burned themself selling too early or jumping back in too high ) But the invalidation starts right here. Those early investors were buying into BTC far before it reached mainstream media, the average investor and any big money. The downside risk nowadays is almost identical to back in the days in terms of volatility. Yet the ROI is incredible lower. Buying at 30k now will most likely not get you a 10x or even a 5x within a few years like back then. DCA since peak 2011I would like to bring up this example because it's very interesting to look at. If you've been consistently applying the strategy since $20 BTC you would be up +210% now. If you stopped DCA end of year 2021 ( pretty much last high ) they would still be up +400%. So... is DCA just straight up useless?Nope it's not. But it's important to understand that DCA is a very easy & beginner friendly strategy that can be executed very poorly. And making money was never easy. Markets are PvP so whoever puts the most effort into it will most likely be the winner at the end. However, there are plenty of ways to improve your DCA plan. This might be worth another post if people are interested but would be too much to explain here. But a simplified way is to ask yourself "is it truly worth to buy here?" "Is the current price considering potential future prices really worth the risk?" ""Will it really continue to rally although it had plenty of new All time highs last days?" And what will truly help is improving, learn & adapt in the market. We are in the for the long run and it's a marathon - not a race, correct? So spending a couple days / month is most likely already enough to greatly improve your knowledge & entries in the future.Starting today might be your personal start of building a great fundamental for decade long investment decisions. Macro economics, market psychology, how money moves & looking at charts will guaranteed help. I made a simplified explanation about this in this post You can also start DCA out after significant rallies. If you DCA'd through november 15-20k range there is nothing wrong with selling small portions at 30k. If prices go back down, you have more buying power to DCA at lower levels. If not, YOU STILL MADE PROFIT. Sure, it could've been more by holding. But your leftover bag still went up, right? It's a common lowering risk strategy to sell the way up just in case things turn around ConclusionDCA is an easy beginner strategy but even a strategy can be executed poorly. Although we had an incredible run in 2023 so far ( 2x in less than 5 months greatly outperfoming stock markets & major stocks ) there are plenty of investors still in heavy losses using this strategy. Entering the market with such a strategy itself is totally fine but that doesn't stop you from improving it nor improving yourself and gather more knowledge about investing & strategies in general. DCA worked in the past and works greatly with the stock market but has become a tough strategy for the Crypto markets due the incredible Bullrun we had in 2021. The volatility and price range of Crypto has increased heavily. If you truly believe BTC will hit an equal run as from 2011 ( 1000x ) you would expect BTC to be at 30,000,000 USD by the end of 2031. So unless you truly believe in that target applying DCA at current prices because of "it worked in the past" has tons of invalidation on chart. And honestly, I just try to help people stop believing in the echo chamber. Smart money doesn't DCA into BTC. Markets have matured, BTC is being treated as a high risk asset hedge against inflation. It isn't being treated equally as AAPL or other Bluechip stocks and smart money doesn't DCA into it. It buys based on macro economic indicators & outlooks which is a different topic but I've made a simplified post about it in the past that you can find here. At the end of the day BTC will always win against the monetary system. Chances are very high it will hit a new All-time-high one day and everyone who uses the strategy the last years and now will be in profit and I genuinly hope everyone who read this post will make it. However, I stick to my view that blindly DCA into crypto is a bad strategy and there are way better ways to accumulate. [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments