The crypto market traded higher at press time, helped at least in part by traders scaling back expectations for a 100 basis point (1 percentage point) hike in borrowing costs by the U.S. Federal Reserve later this week.

In the lead were major decentralized finance (DeFi) coins, boasting double-digit percentage growth in 24 hours and outperforming market leaders bitcoin (BTC) and ether (ETH).

Cryptocurrency lending platform Aave's native coin, AAVE, was up 15% at $91. Last week, AAVE proposed a decentralized yield-generating dollar-pegged stablecoin GHO to expand services offered on the platform. GHO is likely to generate additional revenue for the Aave decentralized autonomous organization (DAO) by sending 100% of interest payments on GHO borrowing to the DAO, the proposal said.

Decentralized exchange (DEX) Uniswap's UNI traded at $7, representing a 13% gain. Bitcoin, the biggest cryptocurrency by market value, changed hands at $20,660, up 3.5%, while Ethereum's ether token was priced at $1,200, up 8%. Other notable gainers were programmable blockchain Solana's SOL cryptocurrency, privacy-focused coin monero, Polygon's MATIC, cosmos and algorand.

Rates traders saw a 49% chance that the Fed would deliver a full percentage point interest rate hike on July 27, a significant decline from 80% seen after the release of Wednesday's consumer price index (CPI), an indication of inflation or deflation, according to data tracked by the Chicago Mercantile Exchange's FedWatch tool.

The repricing of the probability lower began later Thursday after Federal Reserve Governor Christopher Waller said the "markets may have gotten ahead of themselves" in pricing in a 100 basis point rate hike for July.

However, Waller said he supports a 75 basis point rate hike later this month and may consider a bigger rate hike if the retail sales and housing data paint a positive picture of the economy.

Due Friday at 12:30 UTC, or 8:30 a.m. ET, the retail sales data is likely to show that consumer spending increased by 0.9% in June. The housing data due on July 19 could show housing starts tumbled 14.4% in May, while building permits dropped 7%.

DeFi outperformance a flash in the pan

Observers were unsure if the rally in the DeFi majors would be long-lasting, given the fundamentals remained weak.

"Sure, we see some rally in the DeFi coins for now, but fundamentally nothing has changed. The total value locked has been destroyed," crypto financial services firm Amber Group said, while noting the absence of large buying.

"We have seen some institutional mandates scooping up majors and DeFi blue chips, but it's not like massive amounts," Amber's trading desk told CoinDesk.

The total value locked (TVL) in DeFi protocols has crashed to $38 billion from $95 billion this year. And there was hardly an uptick as of writing, according to data source Defi Pulse. The total value locked is the amount of user funds deposited in the DeFi protocols and is one of the most commonly used metrics to assess the sector's growth.

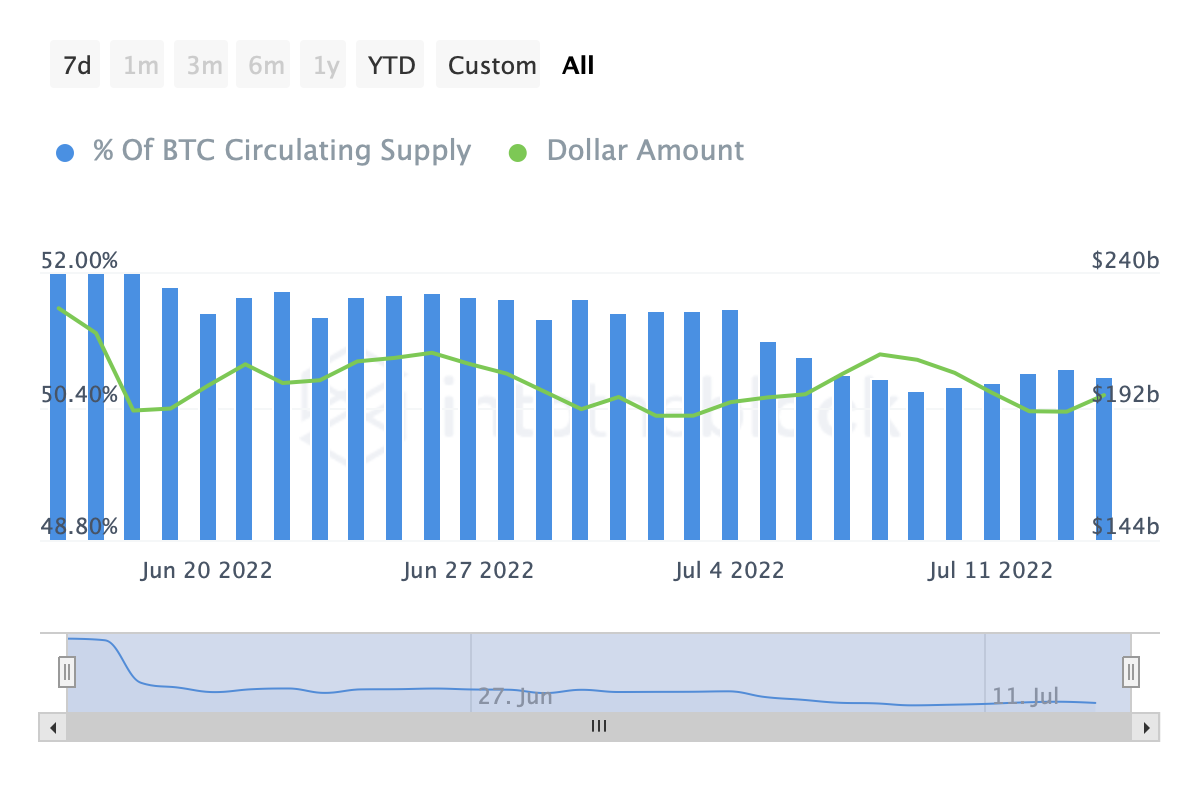

Other indicators, such as the volume of bitcoin locked in DeFi and the number of addresses lending and borrowing in DeFi protocols, pointed to a continued slowdown in the activity.

"The volume of wrapped bitcoin participating in DeFi protocols is a clear indicator of the DeFi momentum among more traditional crypto investors," Jesus Rodriguez, CEO of the analytics firm IntoTheBlock, wrote in an DeFi analysis piece published Tuesday. "Recently, that indicator has dropped to a near all-time low, signalling a slowdown in the DeFi activity among Bitcoin holders."

Bitcoin supply locked in DeFi (IntoTheBlock)

The percentage of bitcoin's circulating supply tokenized on Ethereum and locked in DeFi fell to a near record low of 50.6% on July 8 and was last seen at 50.8%, data tracked by IntoTheBlock shows.

Rodriguez cited the decline in the number of addresses borrowing and lending to a 12-month low as another indicator of "DeFi winter," along with a drop in the number of loans above $100,000 and transaction costs on Ethereum.

Explaining broader market resilience

The crypto market's remarkable show of strength since Wednesday's CPI release has analysts scrambling for an explanation.

Amber said traditional and crypto markets were short while heading into the CPI release. Bitcoin, for one, fell to $19,200 from $21,600 in the three days leading up to the inflation data published on Wednesday. Wall Street's tech-heavy Nasdaq index dropped more than 250 points early this week on fears an elevated inflation would compel the Fed to suck off liquidity at a faster pace.

Perhaps, a potential ugly inflation figure was priced in advance, allowing for some stability since the data release.

"What's helping now is perhaps the absence of further massive liquidations," Amber's trading desk said. "The crypto market was slammed from the previous CPI [released on June 13] till now and massively underperformed traditional markets during that period."

And while several indicators say the bottom is in, the probability of the market witnessing a quick bull revival appears low, thanks to the worsening outlook for global economic growth, persistently high inflation and continued Fed tightening.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments