Bitcoin (BTC) will cost $1 million by 2030, one of the industry’s best-known pundits insists, as countries worldwide shun the euro and United States dollar.

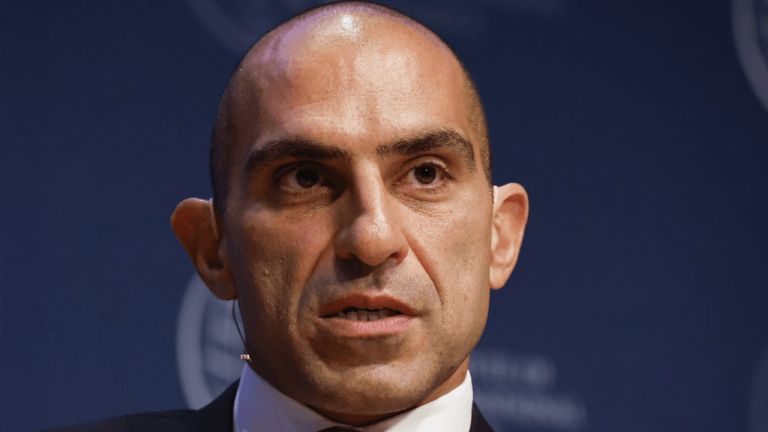

In his latest blog post published o April 27, Arthur Hayes, former CEO of crypto derivatives giant BitMEX, doubled down on his sky-high price prediction for Bitcoin and gold.

Bitcoin, gold, commodities... just not fiat

In light of sanctions on Russia over its invasion of Ukraine, a giant pivot in both geopolitical and economic policy is coming, Hayes said.

As the U.S. and European Union battle to reduce dependency on Russian energy and food, the long-term repercussions are all but certain to hurt them — and send Bitcoin to the moon.

The situation is complex. Inflation, already at 40-year highs before the Ukraine conflict, is being exacerbated by Western sanctions, while Russia is reeling from the West freezing hundred of billions of dollars worth of its offshore assets.

China, meanwhile, is eyeing the situation with a view to protecting itself from a copycat move targeting its assets.

Since the end of the 1990s, a virtuous circle has seen China sell cheap goods to the West in return for its fiat currency, which is then sent back to importers in return for government debt. This keeps interest rates low, and China’s goods become even cheaper as a result.

Disruption to supply chains, inflation and now the risk of asset confiscation is now changing the status quo. Rather than switch its production model, however, Hayes believes that China will need to find a way to reduce its exposure to worst-case scenarios.

“It is impossible for China to sell trillions of USD and EUR worth of assets without destroying the global financial system. That hurts both the West and China equally and bigly,” he wrote.

“Therefore, the path of least destruction for those assets is to cease reinvesting maturing bonds back into the Western financial system. To the extent that China or its proxy State-Owned Banks can lighten up on Western equities and real estate without impacting the market, they will do so.”

Hayes identified “storable commodities, gold and Bitcoin” as the potential exit outlets for Beijing. While such a situation would be at extremes of the spectrum, there should nonetheless be a non-zero chance of China reversing its stance on issues such as Bitcoin mining.

“Doom loop” will spark $1-million Bitcoin, $20,000 gold

More striking, however, is the post’s outlook for the future of the Western democracies, and in particular, the European Union.

Related: ‘Something sure feels like it’s about to break’ — 5 things to know in Bitcoin this week

Unable to be self-sustaining, Hayes argues, shutting out Russia will fuel an unstoppable fire that will result in the disintegration of the European project.

Exporters such as Germany will be unable to compete with China, while rampant inflation will create internal anger within the EU between the north and south.

“The ECB is trapped, the EU is finished, and within the decade we will be trading Lira, Drachmas, and Deutschmarks once more,” his prediction reads.

“As the union disintegrates, money shall be printed in glorious quantities in a pantheon of different local currencies. Hyperinflation is not off the table. And again, as European savers smell what the rock is cookin’, they will flee into hard assets like gold and Bitcoin. The breakup of the EU = $1 million Bitcoin.”

$1 million per single Bitcoin will also come as a result of the “doom loop” in Western financial policy, notably yield curve control (YCC), as a tool to prevent bankruptcy.

Gold — still the darling of the store-of-value narrative — will have seen up to $20,000 per ounce by the end of the decade.

Concluding, Hayes issued a call to arms to Bitcoiners, warning that the Bitcoin network needs participation in order to endure.

“The Doom Loop will usher in $1 million Bitcoin and $10,000 — $20,000 gold by the end of the decade. We must agitate for self-interested flags to save part of their current account surplus in Bitcoin so that Bitcoin farm-to-table economies sprout around the globe. Again, unlike gold, Bitcoin must move — otherwise the network will collapse,” the blog post concludes.

“Bear no malice towards those recalcitrant flags that refuse to learn even after hearing the good word. As Lord Satoshi said, ‘Forgive them, for they do not know what they do.’”

As Cointelegraph reported, Hayes is no stranger to sky-high price predictions, eyeing a BTC price “in the millions” in his previous post in March.

Reacting, macro analyst Alex Krüger nonetheless called for a rethink of some of his points.

“He will leave many a reader scarred with the mentality of a goldbug who believes the world is forever doomed,“ he tweeted, saying that Hayes “fabricates facts and exaggerates things to make his fat tail narratives come across as highly certain.”

“The Fed going dovish again starts a new bull run. YCC is one way that could happen,” he acknowledged in comments.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments