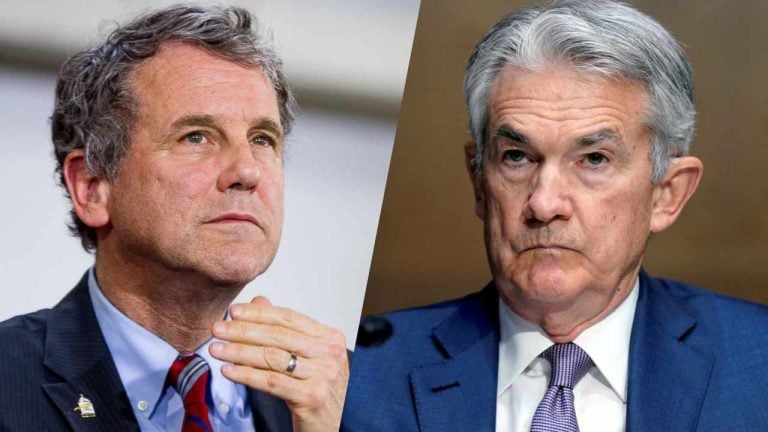

U.S. Senator Sherrod Brown has asked Fed Chair Jerome Powell not to forget the Federal Reserve’s “dual mandate” when making decisions about hiking interest rates at the next Federal Open Market Committee (FOMC) meeting. “It is your job to combat inflation, but at the same time, you must not lose sight of your responsibility to ensure that we have full employment,” the senator told the Fed chairman.

U.S. Senator Reminds Powell of Fed’s Dual Mandate

Federal Reserve Chairman Jerome Powell is facing political pressure over interest rate hike decisions. U.S. Senator Sherrod Brown (D-OH), chair of the Senate Committee on Banking, Housing, and Urban Affairs, sent a letter to Powell on Tuesday asking him to consider the Fed’s dual mandate before making any decision to raise interest rates in the next Federal Open Market Committee (FOMC) meeting.

Senator Brown wrote:

As you know, the Federal Reserve is charged with the dual mandate of promoting maximum employment, stable prices, and moderate long-term interest rates in the U.S. economy.

“It is your job to combat inflation, but at the same time, you must not lose sight of your responsibility to ensure that we have full employment,” the lawmaker stressed.

“For working Americans who already feel the crush of inflation, job losses will make it much worse. We can’t risk the livelihoods of millions of Americans who can’t afford it,” Brown continued, elaborating:

I ask that you don’t forget your responsibility to promote maximum employment and that the decisions you make at the next FOMC meeting reflect your commitment to the dual mandate.

A Fed spokesman reportedly confirmed that Powell received the letter Brown sent, noting that the normal policy is to respond to such communication directly.

Commenting on Brown’s letter to Powell, Mark Zandi, chief economist at Moody’s Analytics, was quoted by CNBC as saying: “Chair Powell has made it pretty clear that the necessary conditions for the Fed to achieve its full employment is low and stable inflation. Without low and stable inflation, there’s no way to achieve full employment.” He added:

He’ll stick to his guns on this. I don’t see this as having any material impact on decision-making at the Fed.

LPL Financial’s chief equity strategist, Quincy Krosby, opined: “The democratization of the Fed is the issue for the market, how much power the other members have vs. the chairman. It’s difficult to know.” Regarding Brown’s letter, the strategist said, “I don’t think it’s going to affect him,” noting:

He knows the pressure. He knows that the politicians are increasingly nervous about losing their seats. There’s very little he could do at this point, by the way, to help either party.

Bleakley Advisory Group’s chief investment officer, Peter Boockvar, commented: “I don’t necessarily think that Powell will buckle to the political pressure, but I’m wondering whether some of his colleagues start to, some of the doves who have become hawkish … Employment’s fine now, but as months go on and growth continues to slow and layoffs begin to increase at a more notable pace, I have to believe that the level of pressure is going to grow.”

Do you think the Federal Reserve is influenced by political pressure regarding interest rate hikes? Let us know in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments