Summary:

- Gary Gensler’s SEC rejected Grayscale’s Bitcoin exchange-traded fund application citing fraud and market manipulation concerns.

- The digital asset manager sought regulatory permission to switch its BTC spot trust index to an ETF, changing the product’s structure and reducing a huge discount on the asset.

- CEO Michael Sonnenshein promised his company would the SEC for its “capricious and discriminatory decision”.

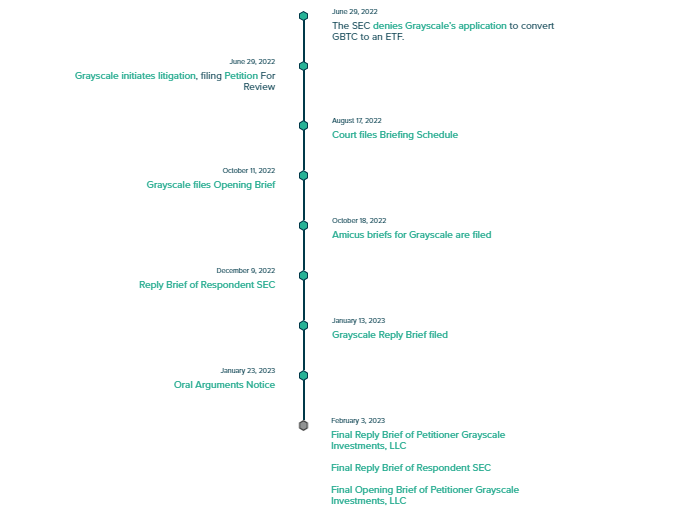

Crypto’s largest digital asset manager Grayscale recently filed final briefs in its lawsuit against the U.S. Securities and Exchange Commission for rejecting its Bitcoin spot ETF application. The company which is a subsidiary of Barry Silbert’s Digital Currency Group (DCG) launched its legal battle against Gary Gensler’s agency back in October 2022.&

Grayscale Bitcoin Trust (GBTC) was launched in 2013 as an index fund offering BTC spot exposure to customers. The company filed to convert GBTC into an exchange-traded fund (ETF), changing the structure of the product and possibly stemming a huge discount on the asset.&

Indeed, the discount on GBTC shares rose to almost 40% in late 2022, a record high for the popular Bitcoin product worth over $12 billion at the time.&

SEC Rejects Grayscale Bitcoin ETF Application&

Gary Gensler’s SEC rejected Grayscale’s application claiming concerns of industry fraud and crypto market manipulation. The decision garnered heavy backlash from the crypto asset manager who argued that the SEC had approved similar spot-based ETFs and futures products.&

Grayscale responded to the SEC’s verdict with a lawsuit on October 12, 2022, in line with previous promises of legal actions from CEO Michael Sonnenshein. Sonnenshein said the company would sue the SEC if its BTC ETF application was rejected again.

DCG Sells Grayscale Shares At Discount

Grayscale’s parent company Digital Currency Group (DCG) started selling discounted shares from products issued by its crypto asset manager. DCG decided to offload assets from the $10 billion-strong portfolio to raise cash. The group’s lending and trading arm Genesis declared bankruptcy last year and owes over $3 billion to creditors, Gemini included.

Filing with the SEC showed that DCG has mainly focused on selling assets from the company’s Ethereum-based product under the ticker ETHE. However, DCG might decide to offload GBTC shares before the Genesis bankruptcy proceedings are over.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments