Kosamtu/E+ via Getty Images

A Quick Take On Greenidge Generation

Greenidge Generation (NASDAQ:GREE) reported its Q1 financial results on May 16, 2022, after having gone public in a merger with Support.com in September 2021.

The company operates a power plant and has related data center operations in New York and South Carolina.

Until we see Bitcoin's price rise materially, we likely won't see much improvement in operating income, so I'm on Hold for GREE until Bitcoin's price action turns bullish.

Greenidge Overview

Connecticut-based Greenidge was founded to develop a vertically integrated Bitcoin mining and power generation company.

The firm is headed by Chief Executive Officer, Jeff Kirt, who joined the firm in March 2021 and previously was Managing Partner of Fifth Lake Management and a Partner at Pamplona Capital Management, both private investment firms.

The company seeks to use low-carbon or zero-carbon energy sources to power its Bitcoin mining facilities.

GREE owns and operates a 106-megawatt power generating facility in Dresden, New York, which originally was a coal-fired plant and has since been converted to a natural gas-burning energy plant.

The plant provides energy to neighboring communities as well as to the company's data center hosting Bitcoin mining operations.

Greenidge's Market & Competition

The global market for Bitcoin mining is currently in significant flux, with the recent bans on mining in China having caused a large amount of that country's hashpower to exit the network while those operators look for more suitable locations.

Many mining concerns have relocated to the United States, due to its more predictable regulatory and legal environment and pro-business approaches in a number of states, although certain states have been less-than-welcoming to the industry.

The market value for mining depends on the price of Bitcoin, since the majority of value going to the miner is a function of the current Bitcoin reward rate of 6.25 Bitcoin per successfully mined block.

At a price of $25,000 per Bitcoin, the annual mining rewards for the entire industry would be approximately $8.21 billion.

Major industry participants include:

Bitfarms

Argo Blockchain

DMG Blockchain

Hive Blockchain

Hut 8 Mining

HashChain Technology

DPW Holdings

Layer1 Technologies

Riot Blockchain

Marathon Patent Group

Others

Greenidge's Recent Financial Performance

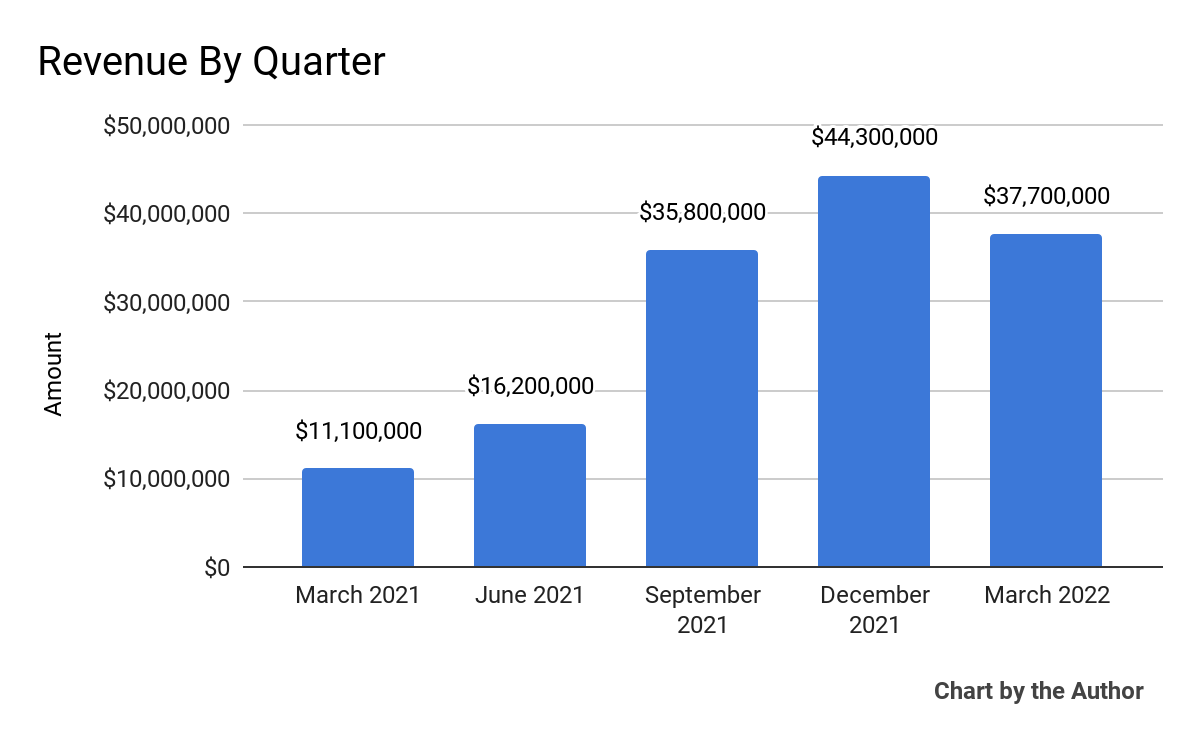

Total revenue by quarter (includes Support.com data through September 2021) has grown markedly:

5 Quarter Total Revenue (Seeking Alpha)

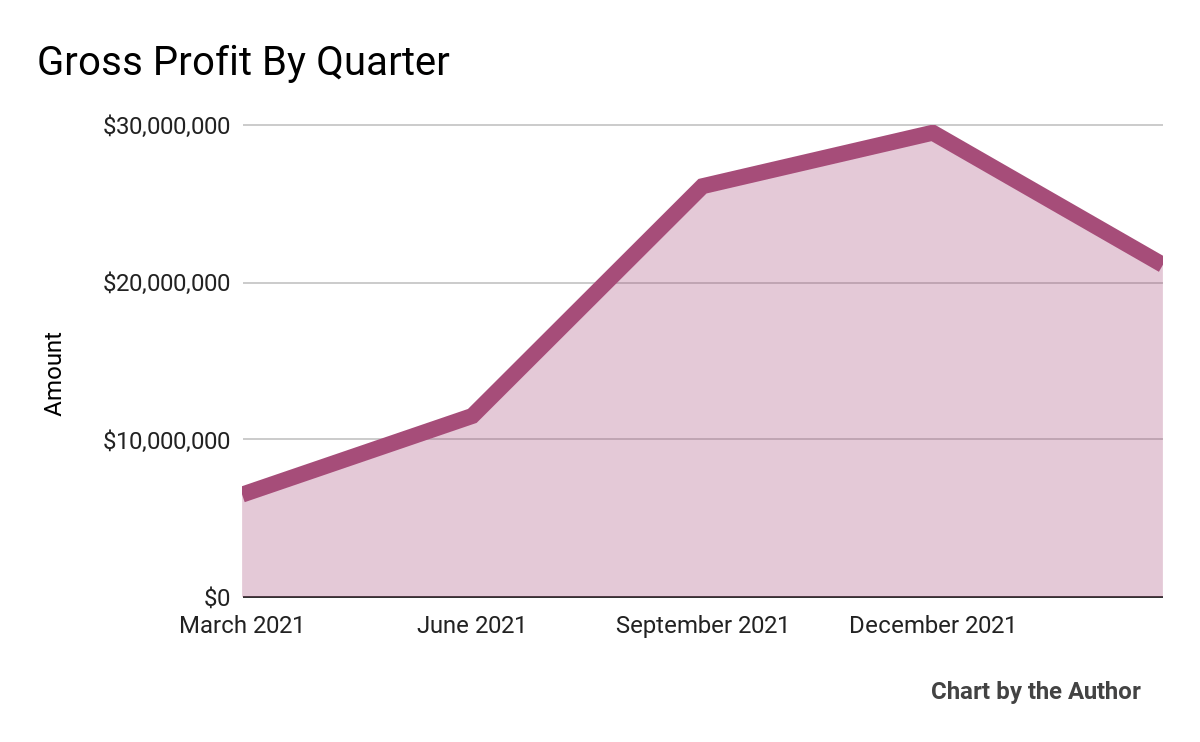

Gross profit by quarter (includes Support.com data through September 2021) has also grown at a similar trajectory to that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

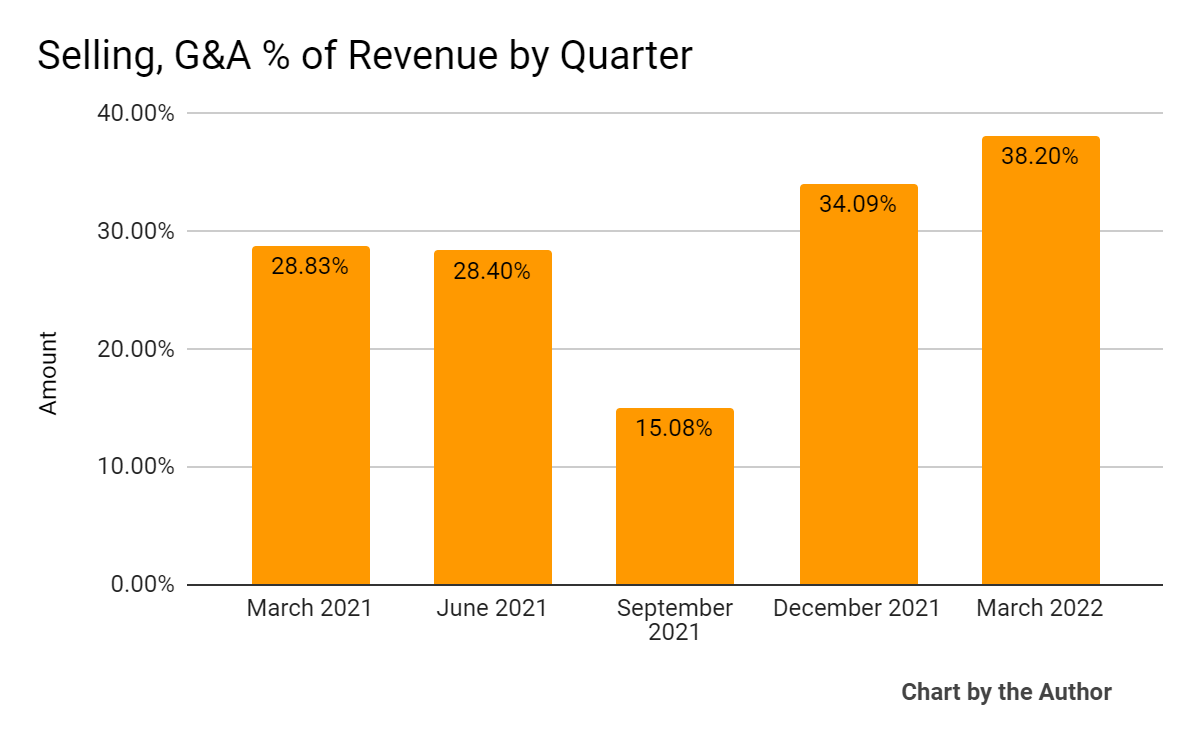

Selling, G&A expenses as a percentage of total revenue by quarter (includes Support.com data through September 2021) have varied considerably in recent quarters:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

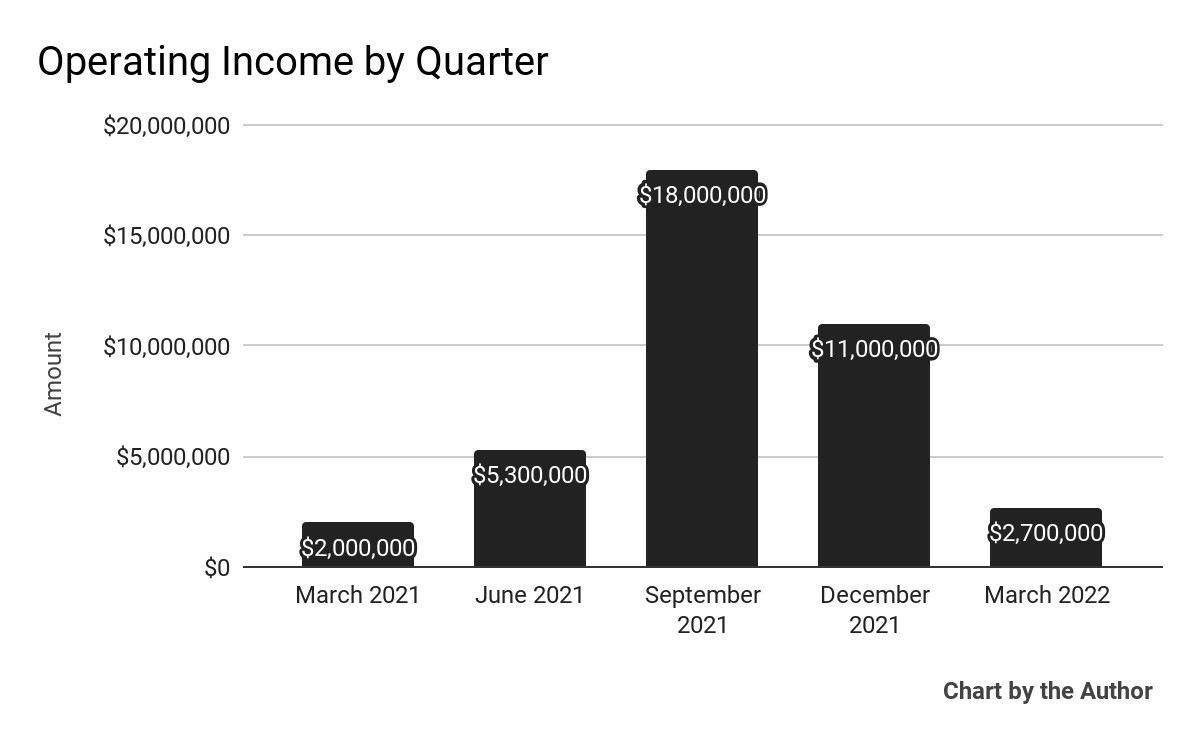

Operating income by quarter (includes Support.com data through September 2021) has fluctuated materially in recent reporting periods:

5 Quarter Operating Income (Seeking Alpha)

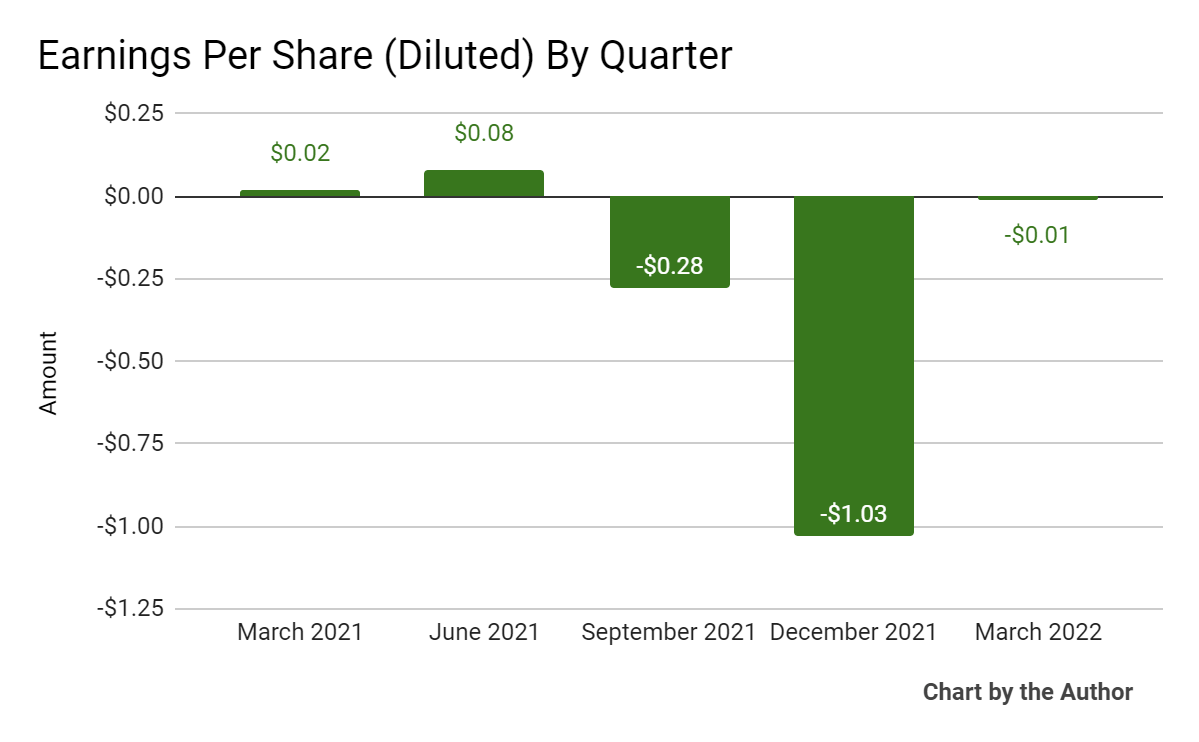

Earnings per share (Diluted - includes Support.com data through September 2021) have varied, although the highly negative figure in Q4 2021 was due to a non-cash goodwill write-off of the Support.com business:

5 Quarter Earnings Per Share (Seeking Alpha)

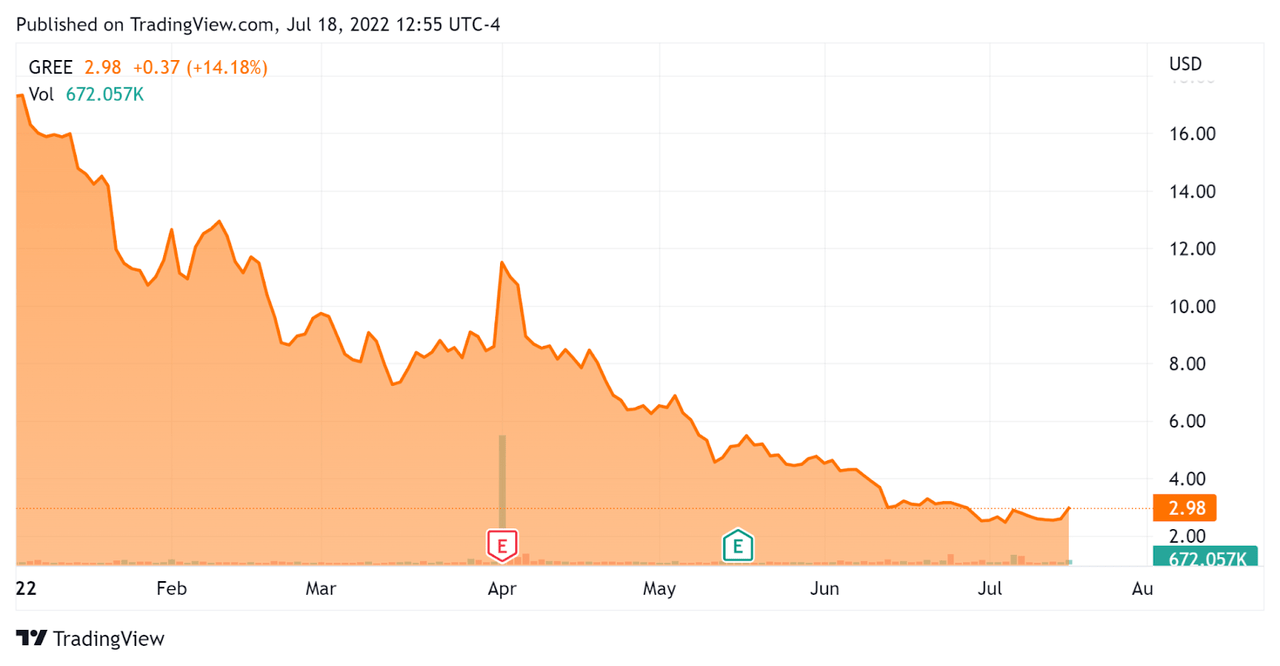

Since the beginning of 2022, GREE's stock price has fallen 83 percent vs. the U.S. S&P 500 Index's fall of around 18.9 percent, as the chart below indicates:

Year-to-date Stock Price (Seeking Alpha)

Valuation Metrics For Greenidge

Below is a table of relevant capitalization and valuation figures for the company:

Measure | Amount |

Enterprise Value | $182,130,000 |

Market Capitalization | $107,960,000 |

Enterprise Value/Sales (TTM) | 1.36 |

Price/Sales (TTM) | 0.69 |

Revenue Growth Rate (TTM) | 377.51% |

Operating Cash Flow (TTM) | $43,920,000 |

Earnings Per Share (Fully Diluted) | -$1.24 |

(Source - Seeking Alpha)

Commentary On Greenidge

In its last quarterly report (Source - Seeking Alpha), covering Q1 2022's results, management highlighted growth in capacity expansion at its South Carolina data center facility, which contributed 22% of the firm's hashpower.

Also, the company closed the quarter with approximately 19,600 miners in operation and orders for another $135 million worth of equipment at Bitcoin miner supplier Bitmain.

As of the June 30, 2022 operational update, the firm had 27,500 miners in operation, with 24% of hash rate coming from its South Carolina facility.

As to its financial results, total revenue continued its strong growth as the company brought additional miners online.

However, GAAP operating profit has been highly variable due to volatile Bitcoin pricing conditions.

For the balance sheet, the firm finished the quarter with $98 million of cash and crypto holdings, $28 million in undrawn financing. The company completed two debt financings during the quarter for a total of $108 million in funding, of which the company had received $81 million.

Additionally, Greenidge completed secured equipment financing of $81 million with an April 2024 maturity, $54 million of which was funded by quarter end.

Looking ahead, the stock price for the company will be heavily influenced by the price of Bitcoin, which has recently dropped substantially from its all-time highs reached in 2021.

Some analysts presume the price of Bitcoin has dropped due to a rising interest rate environment combined with trader views of Bitcoin as a 'risk asset' similar to technology stocks.

Whatever the reasons, GREE's future potential financial results are tied to its ability to cheaply produce power, acquire mining machines at a reasonable price and operate its facilities efficiently.

The primary risk to the company's outlook is a continued depressed price for Bitcoin, lowering revenue growth and potentially delaying expansion plans.

Regulatory concerns are also a potential issue, as the firm's recent application for a Title V Air Permit renewal was denied for its New York power plant.

Management said the denial 'does not have any impact on our current operations in Dresden' and appears to be preparing to challenge the permit denial in court.

New York State has made headlines in the Bitcoin industry by its apparent hostility to mining data center facilities and other industry participants, so I don't envy GREE's potential battle in an unfavorable regulatory environment.

Until we see Bitcoin's price rise materially, we likely won't see much improvement in operating income, so I'm on Hold for GREE until Bitcoin's price action turns bullish.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments