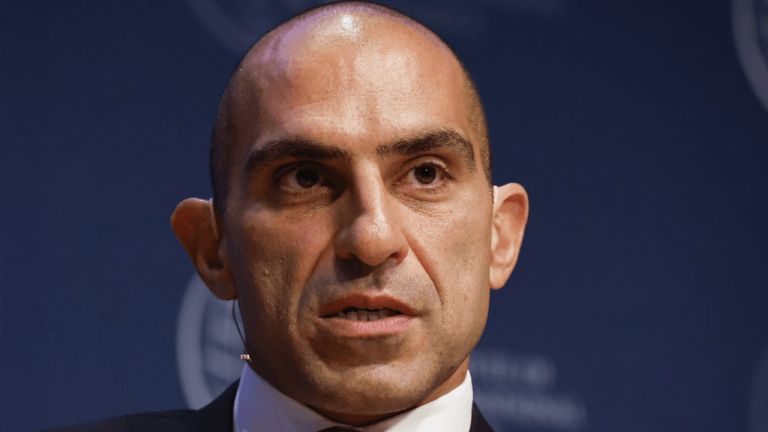

PayPal CEO Dan Schulman has doubled down on his bullish stand on Bitcoin, crypto, and its underlying technology. In a recent interview with CTech, the executive talked about the future of finance, digital assets, and how the two will merge in the next era of the digital economy.

Related Reading | Paypal Wants Its Own Stablecoin. But Are They Crypto-Worthy?

Schulman will participate in an upcoming event called Axis Tel Avin on March 29th. During this event over 50 investors, CTech reported, running venture capital funds and representatives from companies based around the world will discuss financial innovations.

Speaking to CTech Schulman said to feel “very excited” about how the potential for crypto and digital ledger technology can improve the financial system. The executive believes price action and short-term speculation regarding the price of BTC of other cryptocurrencies should be dismissed.

In opposition, he said:

think the initial things that everyone thinks about Crypto, buying and selling it, and what the price of bitcoin is going to be tomorrow, that’s the least interesting part about digital currencies to me. That is thinking about digital currencies as an asset class. To me, the real exciting thing about digital currencies is what kind of utility can they provide in payments.

Schulman identified central bank digital currencies (CBDCs) as a current financial world trend. These financial entities, from economic giants such as China and the European Union, are close to or are in the current development of these digital assets.

In that sense, the PayPal CEO believes a merge between traditional and crypto assets will transform finances. He said:

The intersection between CBDC, stable coins, digital wallets, and enhanced utility of payments through cryptocurrencies is not just fascinating but I think will redefine a lot of the financial world going forward.

The PayPal Approach To Crypto

As CTech added, the conference will be attended by major companies, such as Amazon, P&G, GM Ventures, Garmin Konnect-Volkswagen. It’s possible that many of the participants are interested in learning the best to integrate crypto into their business model.

The industry has reached a $2 trillion market cap in less than a decade and has seen an explosion in demand from retail and institutional investors. The surge is often attributed to a financial bubble, but some executives, developers, and investors see potential.

Since 2020, PayPal has been making a hard push to integrate Bitcoin and altcoins into their platform. The payment services recently enable a cash-out feature with digital assets. Although it’s currently only available in certain regions, the company has stated its intention of expanding to their millions of users.

At that time, PayPal (PYPL) stock price saw a rally as the demand for digital assets increased during the start of the COVID-19 pandemic. However, the stock has backtracked on most of its gains and currently trades near pre-pandemic levels. Their crypto strategy could be a way to attract new users.

Related Reading | PayPal, Venmo Will Charge Flat Fee For Crypto Transactions Below $200

At the time of writing, PayPal trades at $96 with sideways movement over the past few days.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments