In this week’s crypto highlights, we explore the price movements of BTC, FIL, BNT, and SNX. Additionally, this recap includes other notable industry news items that occurred over the last seven days. Without further ado, let’s dive into the latest market developments.

Noteworthy market events

Crypto exchange Hotbit terminated its operations

Crypto exchange Hotbit announced that it would be halting operations as of May 22. The exchange asked its users to withdraw funds before June 21. In a formal statement, Hotbit clarified that it was shutting down due to operating conditions deteriorating. The company highlighted declining cash flow, and blamed a shift in crypto sentiment.

In addition, the platform described the numerous difficulties it was facing. They include cyber attacks, and losses brought on by project flaws. Furthermore, in August 2022, one of the crypto exchange’s employees faced a criminal probe, which forced the platform to suspend its operations for weeks due to an investigation.

MetaMask denied withholding customers’ crypto for taxes

On May 21, certain members of the crypto community noticed a section of MetaMask’s terms of service that stated the company “reserved the right to withhold taxes where required.” Some believed this related to users’ income taxes, or that the platform collects taxes from users.&

This situation caused a backlash in the MetaMask community, questioning the wallet’s decentralization. However, some users hurried to refute the spread of false information.

The next day, ConsenSys, the company behind MetaMask, hosed these rumors. The parent company clarified that it only applies to sales tax that ConsenSys has to pay on other products and plans, like subscriptions to Infura (Ethereum API).

Tornado Cash was hit by an attack

On May 20, an unknown attacker created a malicious proposal that gave them fake voting power, giving full control over governance aspects of Tornado Cash. They include TORN tokens held in the main governance contract, as well as the ability to withdraw locked tokens.&

PeckShield specialists noted that hackers exchanged most of the withdrawn tokens for Ethereum, and sent digital assets to the Tornado Cash address. Some part of the withdrawn tokens was transferred to the Bitrue platform.

Soon after that, an unknown attacker published a proposal that could potentially return control over the project to the Tornado Cash decentralized autonomous organization (DAO). According to the attacker, they plan to revert the obtained tokens back to zero, and remove the malicious code that allowed them to seize control of the mixer.&

The proposal is expected to pass when the voting period concludes on May 26. Some Tornado Cash community members believe that this could be just an attempt to manipulate the TORN price.

Lighting Labs updated Taproot Assets to offer a “better” version of token minting on Bitcoin

Lightning network (LN) infrastructure firm Lightning Labs has rebranded its Taro project to Taproot Assets, and released a software update that introduced a new way to create and use tokens on top of Bitcoin. The solution is available on the LN testnet along with a basic set of features for application developers. According to LN developers, mainnet support is “coming soon”.

Taproot Assets allows users to issue and transfer tokens on the Lightning Network in a more cost-efficient manner. Notably, Domo, the creator of the BRC-20 standard, has referred to Taproot Assets as an “unequivocally” better solution. This is because Taproot Assets creates multiple assets off-chain before settling them as a single on-chain transaction. Also, witness data – the type used by Ordinals – is transacted and stored off-chain.

One sentence news

- Ripple announced the launch of its CBDC platform, a solution for central banks, governments, and financial institutions to issue national digital currency and stablecoins.

- Gemini informed about a delay in payment by Digital Currency Group (DCG) of $630 million as part of the compensation to Gemini Earn users. The platform clarified that it’s considering whether to provide a forbearance to DCG to avoid its default.

- Ledger postponed the release of its Recover service after a community backlash, stating the firm won’t introduce the new feature before releasing the code for it.

- At the Bloomberg Odd Lots podcast, U.S. Commodity Future Trading Commission (CFTC) Chairman Rostin Behnam affirmed that decentralized finance (DeFi) platforms offering derivatives services would be regulated by the agency.

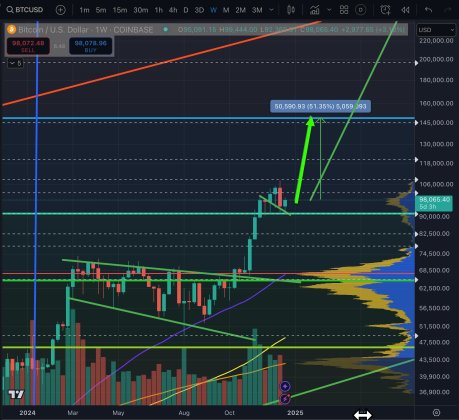

Bitcoin was consolidating in a narrow range

The Bitcoin price decided to suit up as a stablecoin, showing predominantly sideways movement within the $26,500-$27,500 range over the last seven days. According to Glassnode, Bitcoin’s recent consolidation is one of the tightest the asset has experienced in the last three years.&

Essentially, horizontal channels are considered to be neutral, and indicate the period of indecision. This means that the market could be waiting for a trigger to help determine its next price direction.

Generally, such events are followed by increased volatility, or historically strong trending moves. For instance, in January and April 2023, the BTC price was also locked in a tight range (yellow channels). But soon after that, the asset experienced sufficient price changes.&

One of the catalysts behind BTC’s recent consolidation is likely the U.S. debt ceiling negotiations. At first, these seemed to have reached a dead end, but then developments hinted at a potential resolution. However, reports that “U.S. cash coffers are dwindling faster than expected,” are raising fears that a U.S. default remains a possible outcome.&

On May 24, U.S. Treasury Secretary Janet Yellen reminded officials that a debt ceiling default deadline is early June. Some private forecasters estimated that a default could come between June 6 and June 9. After this news, Bitcoin slightly moved out of the trading range, reaching a lower border of the descending channel (cyan one), and broke the 100-day SMA. This suggests that the path of least resistance could be a downside.

Notably, during the last two debt ceilings, a deal was struck at the last possible minute as well. So as for now, the wider markets stay positive that a deal will be done. If U.S. officials reach an agreement toward a debt ceiling, this could potentially strengthen the U.S. dollar, which may drive BTC lower. There are also arguments for both upward and downward BTC movements in the case of a no-deal scenario. Regardless of the outcome, a resolution of the U.S. debt ceiling issue could potentially bring increased volatility to crypto markets.

While daily and lower timeframes rather show bearish signs, a weekly chart continues to indicate a potential continuation of bullish momentum. The asset remains below the mean level (yellow line), indicating that there is an upward movement potential.&

In addition, the price behavior resembles the 2014-2015 bear market. The asset experienced a similar time period of being underwater (cyan channel), and is showing higher highs (purple line) after breaking a descending resistance (white line). In the longer term, this indicates that the price could reach the mean level (currently near $32,000), and potentially preserve an uptrend before Bitcoin halving takes place.&

The FIL price slightly moved down amid SEC’s comment about the token

In April, Grayscale voluntarily filed a Form 10 to the U.S. Securities and Exchange Commission (SEC) to register its Filecoin Trust investment product. On May 17, Grayscale received news from the regulator that Filecoin’s FIL token meets the definition of a security under federal laws. As a result, SEC asked Grayscale to withdraw its application to make its Filecoin Trust product more like a public company.

Grayscale responded to the SEC, stating that it does not believe FIL is a security, and plans to promptly explain its legal position to the regulator. Protocol Labs, the company behind the Filecoin protocol, tweeted about this event, highlighting that Filecoin is a decentralized file storage network, not a security. The company added that they support Grayscale’s plans to respond to the SEC’s letter.

The FIL price decreased by 3% on the news of the filing, but then rapidly rebounded, continuing to move inside a narrow channel. The asset experienced a bullish crossover of MACD lines on a daily chart, while, on lower timeframes, the asset moved to positive territory.&

This hints that the FIL price may try to move above the 20-day EMA. If successful, the asset could reach a descending resistance, and the 200-day SMA. If failed, this could push the price to the 0.786 Fibonacci point.

Bancor approached a descending resistance line, despite facing a lawsuit

Bancor, a decentralized protocol that introduced liquidity pools powered by automated market makers (AMMs), faced a class-action lawsuit in the U.S. District Court for the Western District of Texas. The lawsuit targets Bancor, its founders, and BProtocol Foundation, alleging that they deceived investors about its impermanent loss protection mechanism (ILP), and operated as an unregistered security.

The plaintiffs assert that the defendants lured them with promises of risk-free investments. Bancor has different versions of its protocol, with v2.1 supporting “ILP as an enticing feature for liquidity providers. With this feature, investors believed their funds were safe. However, the lawsuit alleges that v2.1 has shortfalls, and that Bancor developers knew about them, which led to losses of nearly 50% of plaintiffs’ investments.

The above event was one of the drivers that maintained BNT’s downward movement. However, the asset formed a bullish divergence (white lines). This suggests that a price recovery may follow. Notably, it appeared near the major support level (orange line), which may support a potential rebound. If the price breaks a descending resistance line (blue one), the next potential target for the bulls could be near $0.50.

SNX is trying to sustain above the middle of the Bollinger channel

Synthetix temporarily became one of the top performers, after its price experienced a 15% increase in a few days. The rally appeared amid the announcement of SIPs 2014 and 2015, which imply adding eight top digital assets to Synthetix Perps. This helped the asset bounce off the $2 psychological level, and jump above the middle of the Bollinger channel on a daily chart.

On May 23, Synthetix founder Kane Warwick submitted 12 proposals aimed at improving the project and adding new features. They include passive SNX staking, trading incentives, and the burning of 90 million SNX tokens. After this news, the SNX price moved up by 4%, but rapidly dropped back to the $2.30 support area.

The following price movement could depend on whether the price manages to sustain above the middle of the Bollinger channel. If successful, this could drive the asset to $2.69. If failed, it may reestablish the bearish momentum, and return the price to $2. On lower timeframes, RSI is in negative territory, while MACD crossed the zero point, indicating that bears may have more chances to dominate in the short term.&

Tune in next week, and every week, for the latest CEX.IO crypto highlights. For more information, head over to the Exchange to check current prices, or stop by CEX.IO University to continue expanding your crypto knowledge.

Disclaimer: For information purposes only. Not investment or financial advice. Seek professional advice. Digital assets involve risk. Do your own research.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments