The host of Mad Money, Jim Cramer, has challenged crypto investors to bet against him. “You do not do this for 42 years and lose money every year,” he said. His statement followed a filing with the U.S. Securities and Exchange Commission (SEC) for “Inverse Cramer ETF.”

Jim Cramer to Crypto Investors: Bet Against Me

The host of CNBC’s Mad Money show, Jim Cramer, challenged cryptocurrency investors to bet against him in a tweet Friday. Cramer is a former hedge fund manager who co-founded Thestreet.com, a financial news and literacy website.

While discussing the Advanced Micro Devices stock (Nasdaq: AMD), he wrote: “As always I welcome people betting against me. I have done this for 42 years. Those who know me know that you would have been betting against Apple at $5, Google since inception, Meta at $18, Amazon at $10, Nvidia at $25, and AMD at $5. I welcome all comers.”

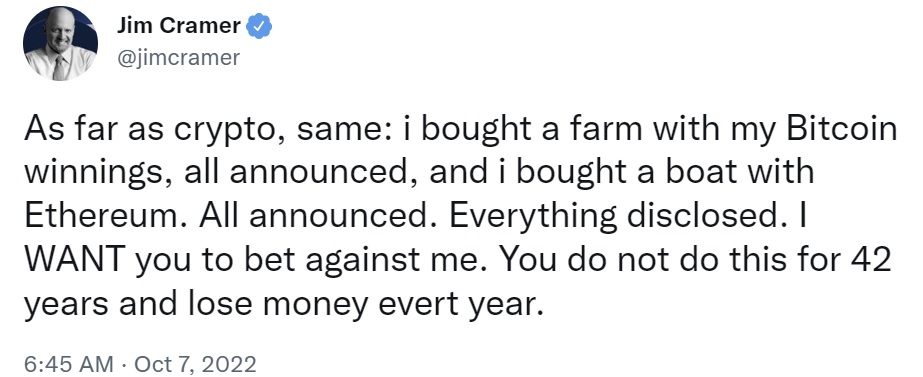

Cramer then followed up with another tweet about crypto. Noting that he bought a farm with his bitcoin profits and a boat with ether gains, the Mad Money host proceeded to challenge crypto investors: “I want you to bet against me. You do not do this for 42 years and lose money every year.”

Many people have been attacking Cramer for making recommendations that resulted in losing trades.

Last year, he praised Ark Investment Management CEO Cathie Wood just before her flagship fund plummeted. He also tweeted a buy recommendation for AMC Entertainment Holdings just before the stock plunged 30%. The Mad Money host also said in April last year: “We like Coinbase to $475.” At the time of writing, Coinbase Global (Nasdaq: COIN) is trading at $67.

‘Inverse Cramer ETF’ Prospectus Filed With SEC

Cramer’s tweets followed a prospectus filing with the U.S. Securities and Exchange Commission (SEC) by Tuttle Capital Management for two exchange-traded funds (ETFs) — Inverse Cramer ETF and Long Cramer ETF. The filing explains:

The Inverse Cramer ETF (the ‘Fund’) seeks to provide investments results that are approximately the opposite of, before fees and expenses, the results of the investments recommended by television personality Jim Cramer.

Tuttle Capital Management also previously launched an ETF betting against Cathie Wood’s stock picks.

Cramer became a fan of bitcoin in 2020 after he spoke with crypto investor and entrepreneur Anthony Pompliano, who convinced him to buy some BTC. The Mad Money host then began advising investors to put 5% of their portfolios in bitcoin. However, concerns over the Chinese bitcoin mining crackdown, ransomware attacks, and tether (USDT) made him dump his BTC for ether in June last year.

A few months later, he begged crypto investors to take profits. In October, he said he invested in crypto because “there could be millions of greater fools out there.” In June this year, he said bitcoin could fall to $12,000 and in August, he recommended avoiding crypto and other speculative investments altogether.

What do you think about the Inverse Cramer ETF and Jim Cramer’s response? Let us know in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments