One of the catalysts behind launching CEX.IO Exchange Plus was that we wanted to offer our users improved risk management tools, providing them with more control over their trades. Introducing sub-accounts was one of the ways that we realized this goal. By default, customers can create up to five sub-accounts on Exchange Plus.

But why would someone need that many? At first glance, it doesn’t seem like a compelling approach, considering that the average trader is prone to look for simplicity. The short answer is each sub-account may have a different purpose.

Let’s take a look at bank cards as an example. Some people may have several cards with a single bank. For instance, one could be dedicated to daily spending, another one may be used for savings, and a third one might be dedicated to long-term purchases. In essence, separating accounts empowers people to better organize their finances, and diversify risks.

The same may apply to crypto trading. In this article, we explore basic ways of using sub-accounts, and explain how they can help regular traders potentially optimize their trading approach.

Separation of financial results

Example: Imagine a trader who has $1,000 in their main account, and consistently performs trading operations. At the end of each week, they move potential profits to a separate sub-account to maintain $1,000 for another week. If a certain week was unsuccessful, the trader could move funds from a sub-account to the main one to cover losses, and have the same $1,000.

Here are a few reasons why one may choose this approach:

- Budgeting — This may help better track trading performance, and keep financial planning organized. Having potential earnings in a separate sub-account could also provide a sense of accomplishment and motivation.

- Streamlining the tax process — It could be less time-consuming for the trader to calculate their taxes, when they can just report the financial results moved separately to the sub-account.

- Risk management — A sub-account could be used as a buffer to protect potential earnings. When all funds are kept in the main account, it may be more tempting to allocate more funds for specific trades, which could lead to increased risk-taking.

Using multiple trading strategies

Example: Let’s say a trader uses a certain strategy for crypto trading. One day they decide to create several sub-accounts to trade the same crypto, but by using different strategies. The trader may use all trading plans in parallel.

This approach includes the following trading ideas:

- Testing new strategies — One may experiment with different approaches to see how they perform, without affecting the main account.

- Diversification of trades — If one strategy is not performing well, the other one may cover potential losses.

- Finding balance in risk tolerance — The trader can quickly rebalance their capital between conservative and more risky strategies, depending on market developments.

Portfolio diversification

Example: Assume that a trader has a large crypto portfolio. They split this portfolio into various groups, depending upon a certain category (market cap, volatility, trading strategy, etc.). Each group of assets is stored in a separate sub-account.

This use case is a combination of the two above-mentioned approaches, as combined, they may help better organize finances, as well as allow for applying different trading strategies for each category.

For instance, the trader may use dollar-cost averaging (DCA) for Bitcoin and Ethereum, then use swing trading strategies for lower-cap altcoins. When these groups of assets are separated, the trader could potentially affect faster changes in portfolio allocation.

When multiple sub-accounts could be necessary

Sub-accounts are widely considered optional, useful tools that can enrich the trading experience. But in some cases, sub-accounts can be unavoidable.

For example, some crypto platforms, especially those that offer margin, feature separate sub-accounts with different base currencies. This means if you want to allocate Euro for trading, you could be required to use a separate sub-account in Euro. It can be compared with having different bank cards in various base currencies.

Another driver for creating sub-accounts could be a proper separation of funds. For instance, institutional investors who trade on behalf of their clients may need to segregate trading strategies and users’ funds across multiple sub-accounts.

However, on Exchange Plus, you’re not obliged to create separate sub-accounts for different base currencies, because you can have it all in one main account. In addition, if you need more than the five sub-accounts available by default, just contact our team for more information. Exchange Plus is flexible enough to meet your individual needs.

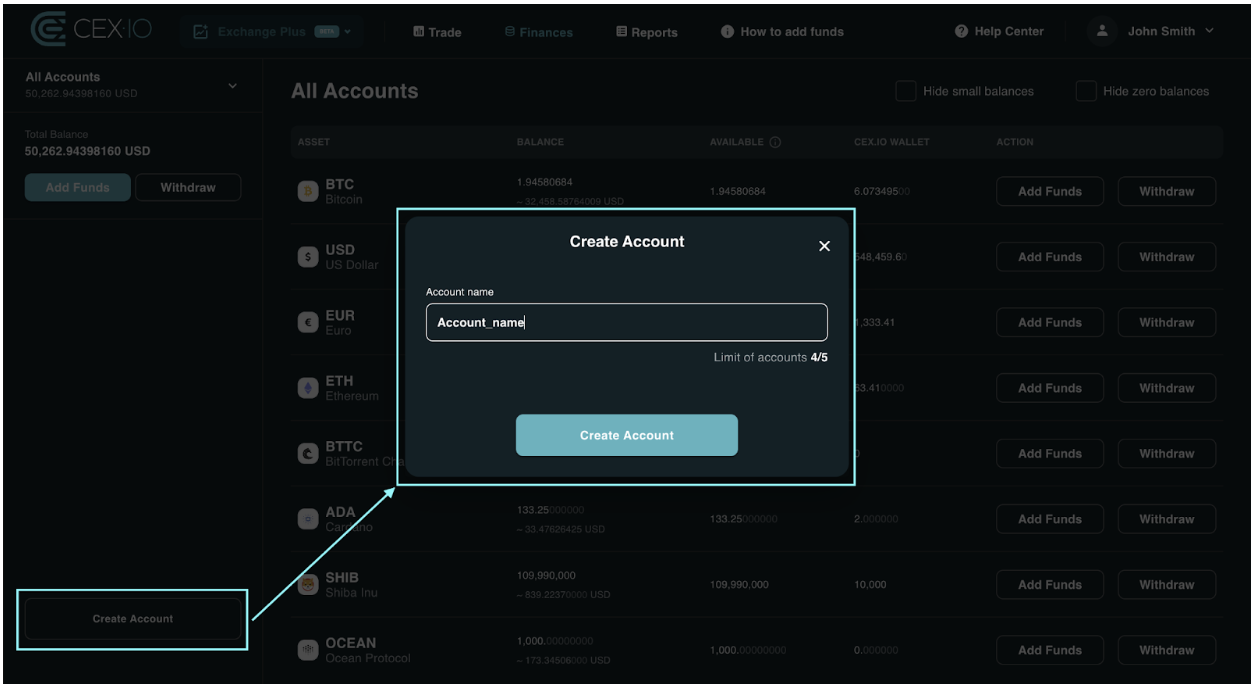

Creating a sub-account on Exchange Plus

On Exchange Plus, you can manage a sub-account, and create a new one, on the Finances page. For that, you just need to:

On Exchange Plus, you can manage a sub-account, and create a new one, on the Finances page. For that, you just need to:

- Click the Create account button in the lower left corner

- Define the account name

- Confirm the operation

Transactions between sub-accounts, as well as from CEX.IO balance to Exchange Plus, are instant and free of charge. More details about managing sub-accounts can be found here.

In addition, Exchange Plus features a flexible system of settings for detailed reports about your trading activities. On the Reports page, you can collect relevant information dedicated to all sub-accounts, or a specific one. Check this guide to find out more about reporting features.

Conclusion

Although sub-accounts may seem like extra effort at first glance, they can become a major time-saver for active traders. Instead of diving into all operations performed in the main account, traders can separate their activities using a few sub-accounts. This could help improve their financial planning, and offer better analysis on the performance of different strategies.

With a straightforward interface available on Exchange Plus, users can set up and manage their sub-accounts in minutes. In turn, our comprehensive reporting system empowers traders to prepare dedicated documentation in a way that best suits their needs. Explore sub-accounts on Exchange Plus, and see what impact they may have on your trading strategy.

Disclaimer: For information purposes only. Not investment or financial advice. Seek professional advice. Digital assets involve risk. Do your own research.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments