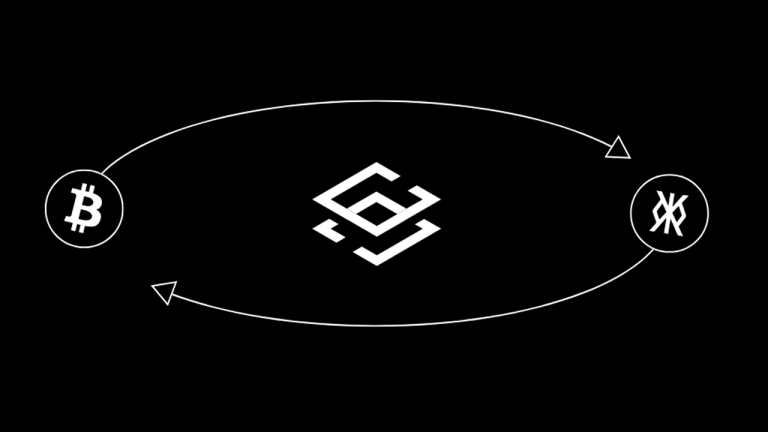

| Hey guys, I recently thought of a simple momentum strategy on ETH and BTC. The strategy is as simple as:

The goal of this strategy is to "optimize" the returns, by holding the most performing crypto between ETH and BTC and continuously switch between them. For example: if ETH is rising faster than BTC, then you hold ETH to capture more returns. The same goes for BTC, if it's performing better than ETH then sell eth and hold btc.

I tested the excess returns of this strategy and they seem quite positive: Also, you can apply the same strategy to whatever crypto you like. For example, you could apply the same concept to DOGE/BTC on smaller time frames, so when DOGE experiences sudden pumps, you are exposed to the upside, but when it falls, your portfolio switches back to BTC. This should mean that by using this strategy you can beat, at least by a bit, both ETH and BTC, am i right? Is everything in my thought process correct? Where are the flaws of this strategy? Let me know what you guys think, and also, if some python developer would like to backtest this, feel free to let me know how the results could be/if it is convenient to actually apply this strategy. I'm very tempted to implement it with a trading algorithm. [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments