<p class="MsoNormal text-align-justify">Securitize, a digital asset securities company, introduced a tokenized fund

on Tuesday that provides exposure to a global

investment firm, KKR’s Health Care Strategic Growth Fund II (HCSG II).</p><p class="MsoNormal">The HCSG II provides investment capital to

innovative healthcare companies in North America and Europe to go commercial and scale their growth. </p><p class="MsoNormal">Securitize said the new tokenized fund, which

was launched on the smart contract platform, <a href="https://www.financemagnates.com/cryptocurrency/news/avalanche-foundation-introduces-290-million-incentive-program/">Avalanche</a>, is the first time

KKR’s institutional-grade fund was made available to individual investors

in the United States through a digital format.</p><p class="MsoNormal">Additionally, the firm noted that the launch marks “a

major step toward making institutional private market strategies more

accessible to individual investors.”</p><p class="MsoNormal">Securitize in <a href="https://securitize.io/press-releases/securitize-kkr-tokenized-fund">a press statement</a> disclosed that

the fund will be managed by Securitize Capital, which is its digital asset management

arm.</p><p class="MsoNormal text-align-justify">Carlos Domingo, the Co-Founder and CEO of Securitize,

told CoinDesk that the tokenized fund is “a feeder fund of the main KKR healthcare

fund.”</p><p class="MsoNormal text-align-justify">‘A Long-Standing Challenge’</p><p class="MsoNormal text-align-justify">Securitize in the statement explained that

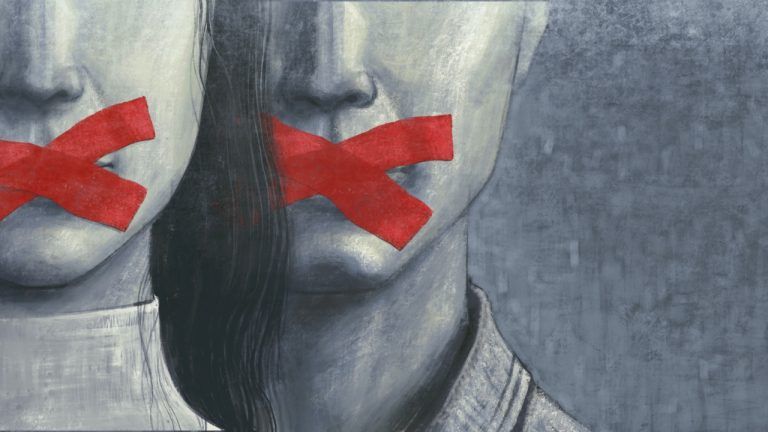

private market funds have historically been inaccessible to individual

investors as only <a href="https://www.financemagnates.com/tag/institutional/">large institutional investors</a> and ultra-high-net-worth

individuals could afford them.</p><p class="MsoNormal text-align-justify">“Unlocking broader access to private market

investing has been a long-standing challenge for the industry,” the digital

asset securities firm noted.</p><p class="MsoNormal text-align-justify">“Tokenization helps solve this by enabling

technology to deliver lower investment minimums, improved digital investor

onboarding and compliance protocols and increased potential for liquidity

through a regulated alternative trading system,” Securitize explained.</p><p class="MsoNormal">On top of that, Domingo explained that tokenization

provides potential solutions to several challenges blocking individual

investors from participating in private market investments. </p><p class="MsoNormal">Tokenization powers technological and product

innovations that were previously inconceivable, he further noted.</p><p class="MsoNormal">“This new fund is an important step towards

democratizing access to private equity investments by delivering more efficient

access to institutional quality products,” the CEO said.</p><p class="MsoNormal text-align-justify">Also, speaking in the statement, Dan Parant, the

Managing Director and Co-Head of US Private Wealth at KKR, noted that the top

investment firm is glad to be an early adopter of <a href="https://www.financemagnates.com/tag/blockchain-technology/">blockchain technology</a>.</p><p class="MsoNormal">“With its ability to digitize operational

inefficiencies and increase ease of use for individual investors, blockchain

technology has the potential to play an important role in the future of private

markets,” Parant said.</p>

This article was written by Solomon Oladipupo at www.financemagnates.com.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments