On Tuesday, US crypto exchange Coinbase appealed to the Second Circuit Court of Appeals to address a key issue for the industry. The exchange seeks the court to determine whether secondary trades are outside the US Securities and Exchange Commission (SEC) scope.

Coinbase Seeks Clarity On Crypto Trades Classification

Coinbase has filed an appeal asking the US appeals court to rule out that crypto trades are not securities. In the January 21, 2025, filing, the crypto exchange contents that digital assets are “now a permanent fixture of our financial system.”

As such, the industry, including the millions of US users, crypto companies, regulators, and lower courts, “badly need clarity on what federal securities laws require.”

The exchange considers there is “no more pressing issue in securities law today than the scope of the Securities and Exchange Commission’s authority to regulate secondary trades of digital assets.”

Coinbase considers the case “an ideal vehicle” for addressing this issue and providing clear rules for the multi-trillion-dollar industry, which it has lacked over the last few years.

Without it, market participants face different rules before different courts, and neither the Commission nor Congress can be certain who is responsible for the regulation of digital-asset trading.

In the filing, the crypto exchange argues that the trades on its platform are not “securities transactions but asset sales” of digital assets instead of physical ones.

“The parties are anonymous to each other, make no exchange or promise other than the sale of the digital asset itself, and thus have no obligation or continuing commitment to each other past the point of sale,” it added, noting that, unlike bonds or stocks, buyers don’t obtain any rights against the asset issuer.

Regulatory Clarity Remains A Key Issue

Coinbase’s appeal comes after New York Federal Judge Katherine Failla granted a “rare” interlocutory appeal on January 7, which allowed the exchange to contest the SEC’s claims at the Second Circuit Court of Appeals.

As reported by Bitcoinist, Judge Failla considers the “conflicting decisions” on important crypto cases, like Terraform Labs and Ripple, to require the Second Circuit’s guidance, emphasizing the need for clarity on how the Howey test applied to crypto assets.

The SEC sued Coinbase in 2023, alleging that the exchange was an unregistered securities exchange. The US regulator argued that Coinbase operated as an unregistered broker-dealer and was illegally selling unregistered securities through its staking program.

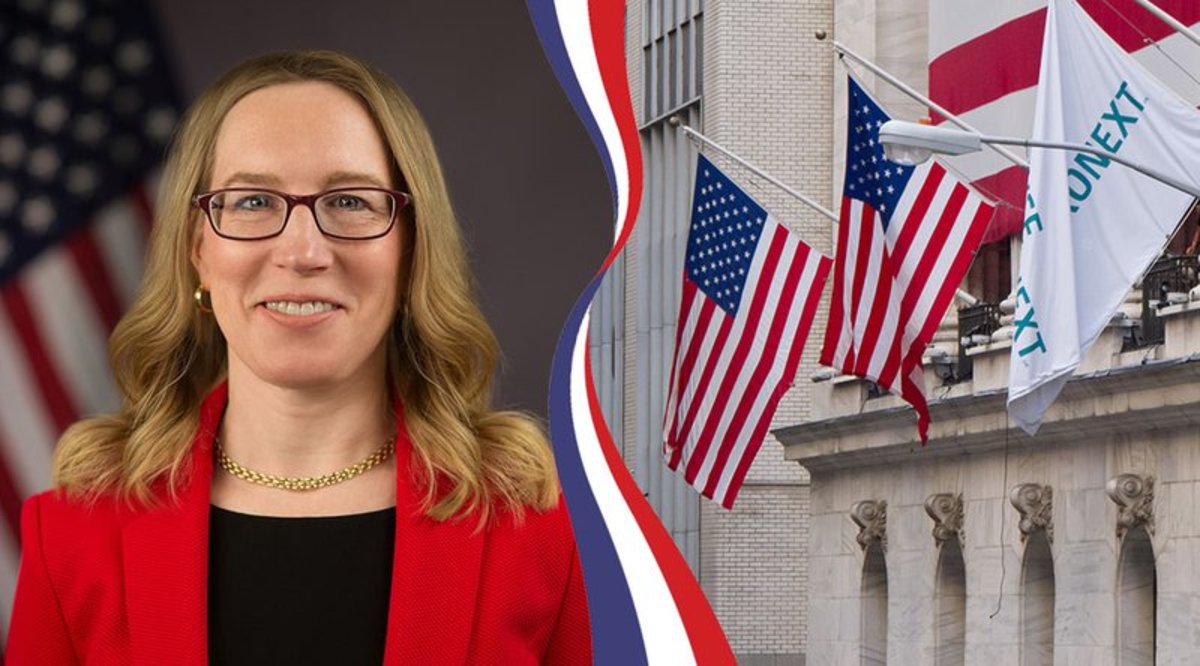

Nonetheless, the Commission is expected to start a new era under the recently installed crypto-friendly Trump administration. Mark Uyeda, acting chairman of the SEC, recently announced that Commissioner Hester Peirce will lead a dedicated Digital Assets Task Force.

The initiative aims to establish a clear regulatory framework and realistic pathways for the industry after years of uncertainty and “regulation by enforcement.”

Recent reports also revealed that the Republican Commissioners are allegedly considering “measures to clarify the criteria under which digital assets are classified as securities” and reviewing various ongoing “crypto enforcement cases.”

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments