We're always told to DYOR when it comes to investing, especially on this subreddit ! But for newcomers it's really hard to understand what research you should actually make before investing your money or yourself in a crypto project. This post is rather lengthy, here's a quick summary of what I'll cover

Summary

- Understanding the Project

- Who ?

- What ?

- Why ?

- Tokenomics

- Supply, Scarcity, FDV

- Burn and Deflation

- Rewards

- Social Media

- Collaborations and Regulations

- Market Analysis

- Conclusion

1. Understanding the Project

You need to understand what you're investing your money into. It's your money after all, you don't want to lose it to rugpulls or scams. I will separate this in 3 parts, the Who, the What, and the Why of the project. Prepare yourself to be asked a lot of questions, after all, you will be doing the research

1.1 Who ?

You'll need to research the team behind the project. In crypto, you'll find projects with anonymous teams too. After all, Bitcoin has an anonymous creator and it's the king of crypto, right ?!

Nowadays, you shouldn't trust anonymous creators! It's way easier for them to steal your money, to rugpull a project, if you don't even know who they are. If you're inexperienced, do not invest in a project with no self-KYC team.

Now, you have a project and the team is not anonymous. You'll need to do some research on them too. Try to look for their backgrounds, what job did they held before (or currently!), what kind of experience do they have in they cryptocurrency space ? Anyone can create a token with minimal funds now, be aware of that !

Look into the development of the project. Is there a lot of contributions on GitHub or similar platform? Is there a reasonable timeline for the project, new features still in development ? If they promise too much, too quickly, without a sizable team, it's probably not going to happen like they promised you in their project road map !

1.2 What ?

Every cryptocurrency project should have a whitepaper. It's the fundamentals of that project. Read it ! It might be scary at first, but it's usually easy to understand. Ever read the bitcoin whitepaper? You might think you don't need to because, well, it's Bitcoin we're talking about. Read the Bitcoin Whitepaper if you never did before ! It'll help you understand what a whitepaper is, and what are the good things to look for.

Look into the project architecture : how the fee system works ? Is it PoW or PoS ? Is it a Layer 2 solution, or is it a new blockchain entirely ? We'll talk about Tokenomics later !

Is it a centralized project or not ? Is there a wallet that can allow you to self custody your coins ?

1.3 Why ?

Is there a reason for that coin to exist ? What can they bring to the world that doesn't already exists or is already used a lot ?

What are the use cases ? You might have heard of shitcoins, well it's pretty simple, they don't have any use case, that's why they're shit ! So what are the ways this particular crypto project can be used, does it offer a solution to a problem ?

If you can't see why people would use that coin, don't invest your money into it ! You shouldn't invest in $PEPE, not because you might get used as exit liquidity, but rather because there isn't any reason anyone would use that coin to do anything. It serves no purpose.

2. Tokenomics

Not every cryptocurrency is built the same. Let's look at a few things that are very important for understand a token.

2.1 Supply, Scarcity, FDV

Quick recap :

- The circulating supply is the number of coins that have been created.

- The maximum supply is the maximum number of coins that can be created

- The Marker Cap is the price times the circulating supply

- The Fully Diluted Valuation (FDV) is the price times maximum supply

It's important to understand what those number means !

That's why DOGE will never reach $10 because it would make its Market Cap way higher than it could ever achieve. There isn't going to be trillions of dollars worth of DOGE in circulation, so FDV is not realistic. I might get downvoted by Elon minions for this perspective.

Worldcoin is infamously know in here because of the dystopian nightmare they're promising us, but the worst thing about investing in them is that they have only distribution 1% of the maximum supply. Meaning $10 worth of WLC will be worth $1 when the maximum supply will be reached (without taking price movements within that period into account, but it won't offset this issue and you get my point)

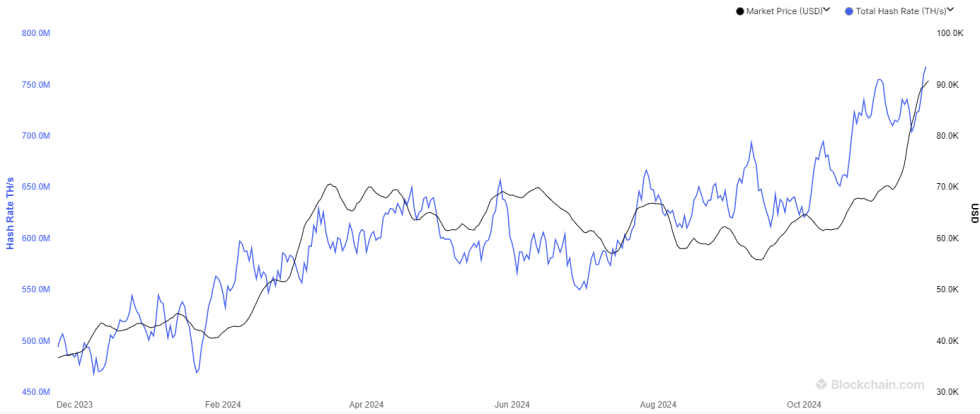

Bitcoin had already distributed a bit more than 92.5% of its maximum supply. And it's distribution is scheduled, and it will take a very long time until we get there !

2.2 Burn and Deflation

Going thing we talked about scarcity before, because it's directly related to that !

Some projects might burn their own token through different mechanism. A bit of ETH is burned at every transaction for example. It helps reduce the supply, therefore increasing scarcity. It means that ETH is deflationary now, the amount of available ETH is slowly decreasing even though the maximum supply is infinite.

This is an important part of a project, it's a very important part of how the coin works, what future it holds. Again if you take a look at Worldcoin, there isn't any burning mechanism in place, they only create new tokens instead

2.3 Rewards

Some project will offer rewards to encourage people to use their crypto. You'll most probably need to stake your funds in exchange of those rewards. Beware of high APR/APY ! If you can't understand where the rewards are coming from, you are getting scammed ! You can look at Celsius for a real life example of that.

Check how staking is implemented, is it native ? Do people have to trust a centralized system or not ?*

3. Social Media

Doing your research means also checking how the world is reacting to that project ! Social Media is a good way to gauge the engagement around a project !

You should try to learn how to recognize bot behaviours and scammers, because you'll see a lot of that on Twitter(X), IG, Reddit, etc.. A crypto project often has a forum for discussions and improvements. Look for such forums, read posts, try to look for metrics. Is there a lot of real engagement with that project ? Or is it just a dead coin traded by bots ?

Follow the team behind the project, look at what they're producing on social media. Is there an active community and enthusiasm about the project online ?

4. Collaborations and Regulations

Some projects might have partnerships with big brands or other crypto projects! Recently we heard news about VISA wanting to partner with Ethereum for helping people paying gas fee with their credit card. It's a good collaboration that will probably be favourable to ETH

Is your project alone in a void or is it interacting with other companies ? If it's a Layer 2 solution, on which blockchain is it based on ? The future of that L2 solution is tied to the future of the L1 solution, doing research on both is recommended !

As for Regulations, be aware of the current shenanigans with the SEC for example. Check if a project is compliant with laws or not, a project might be illegal in your country because of their tokenomics ! Privacy coins can be illegal where you live, you might not be able to declare your gains (or losses), but that's another discussion.

5. Market Analysis

First, you'll need to understand that a crypto project might be wonderful in theory, but reality is often disappointing. If every project was valued by utility, we wouldn't have fiat anymore, would we?

Second, your project might be incredible, but if the market if already filled with existing solutions it will be difficult for your project to thrive ! Competition is good for the end users, but you're not trying to chose the next platform you're going to use, you're trying to invest in the future of a project !

Are their goals achievable or not ? Is there enough interest in the field for that kind of project ? Does a token already exists for the exact same purpose ?

6. Conclusion

Doing Your Own Research can be quite bothersome, it takes a long time to properly do it. It might be discouraging because of that, but you got to remember that it's your money on the line. You probably worked really hard for that money, and losing it to bad investments just because you tried to become rich quick is one of the worst feeling you could have. Being smart with your money means taking time to understand what you're doing with it !

I really hope this guide helped people understand what to actually do when we hear "DYOR!". It's not an exhaustive list, and I'm sure that I missed a lot of things. Crypto is a very vast subject, I'll be glad to hear more advice from all of you guys !

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments