| So in my opinion, the Profits from selling BTC could match the GDP of European countries like Moldova and Montenegro. No one knows when each selling spree will happen and how much will be sold. However, we can predict how the process may go forward by taking into account previous sales, as well as Bitcoin’s historical price action. Most of the data contained within this article is derived from speculating date sales, the number of coins sold per batch, and Bitcoin’s price at the moment of each sale. Although data points such as date sales are picked purely randomly, the price data we used is based on price fractals stemming from Bitcoin’s market structure in two different scenarios. The first scenario involves the 2020–2022 bull market, while the second scenario involves the 2019 price rally. I hope you enjoy the read! How Much Bitcoin Does the U.S. Government Hold?The U.S. government has seized 215,000 Bitcoin from various cybercriminal groups since 2020. Roughly 57% of the holdings were taken away from the Silk Road and affiliated individuals, while the remaining 43% was taken away from two Bitfinex hackers. The exact distribution goes as follows:

The Silk Road is a former darknet marketplace that became popular by accepting Bitcoin payments. Criminals used the website to sell drugs and other illegal wares to anonymous shoppers in return for BTC. The FBI shut down the Silk Road in 2013, two years after it was launched, after carrying out a long investigation and arresting founder Ross Ulbricht. The government seized its largest BTC batch from Ilya Lichtenstein and his wife Heather Morgan, who conspired to hack Bitfinex in 2016 and steal 94,643 BTC. The two were arrested in January 2022 and charged with money laundering and conspiracy to defraud the United States, which carry a maximum sentence of 20 and 5 five years in prison respectively. James Zhong, an individual from Georgia, stole 51,326 Bitcoin from Ross Ulbricht in 2012 shortly before the Silk Road was shut down. The IRS seized Zhong’s Bitcoin in November 2021 during a home raid. Two years later, the U.S. District Court for the Southern District of New York charged him with wire fraud. The U.S. Government Will Sell Its Bitcoin in 2023Prior to sentencing Zhong, the government sold 9,861 of his Bitcoin for around $21,800 per coin. The government then announced its plans to sell the remaining 41,465 BTC this year.

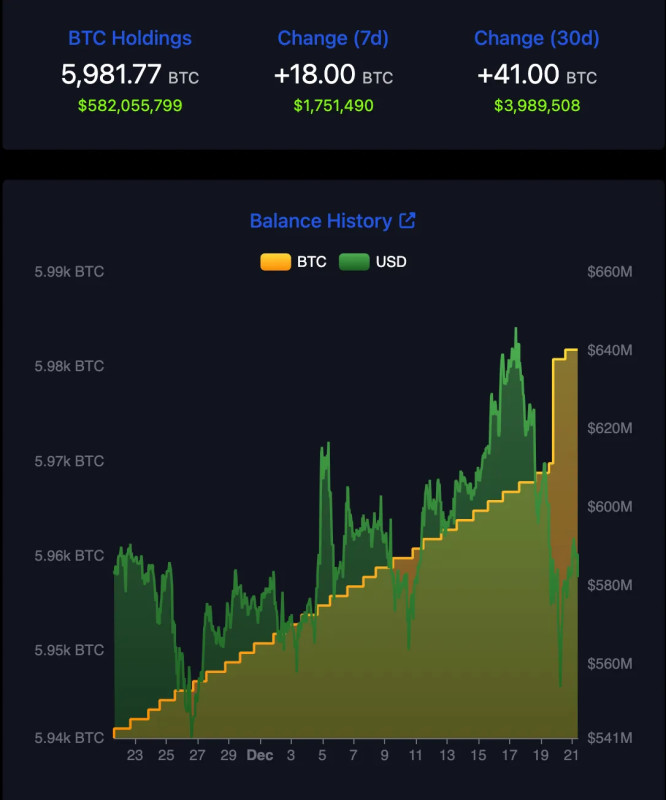

Not much is known regarding how the government sells its Bitcoin and what methodology it uses for planning the date and amount of each sale. The first (out of five) batch was sold without any prior announcement. A court filing revealed that the next batch would be sold after Zhong’s sentence, which already took place on April 14th. The point of this article is to guess how much the U.S. government can potentially earn by selling its remaining Bitcoin stash. Receiving an accurate estimate is difficult because we don’t know any of the variables that affect selling amounts, dates, and more importantly, Bitcoin’s price at the time of each sale. What we can do is speculate how the process will go forward for the sake of conducting a thought experiment that estimates how the government’s ‘portfolio’ would perform under bull market conditions. Scenario #1: The 2020 Bull MarketIf the next sale doesn’t take place by the end of April, we can speculate that the government will sell the four batches every two months, starting from May, until the year’s end. This leaves us with sales taking place in May, July, September, and November. Dividing the remaining BTC holdings (41,465) with the number of sales (4) results in 10,366 BTC per each new liquidation — which closely resembles the amount sold in the first batch (9,861). Because we don’t know when the sales will take place, we have decided to randomly generate the exact date for each month. The results are:

The next important data point for this thought experiment is Bitcoin’s price action. Because Bitcoin has already gone through an extensive period of bearish price movement, we can anticipate that the remainder of 2023 will progress further in a bullish fashion. Bullish price movement is already happening since January, with Bitcoin’s price nearly doubling in less than 4 months. Some on Crypto Twitter hypothesize that Bitcoin’s price action will follow the one of the 2020 market. The asset’s price structure bears similarity to the one of 2020 (indicated by blue boxes on the chart below). Another argument backing this claim is that investors will want to price in the next Bitcoin halving — set to happen in April 2024 — and accumulate now to front-run other investors. By using TradingView’s ‘Bars Pattern’ tool we have drawn a price fractal of the 2020 bull run and overlaid it on the current price, which you can find below. Our next step is to add the dates we received from the RNG tool. We then took the middle point of each candle (for the proposed dates) and used it as the average price point for the batches’ sales. This leaves us with the following sale dates and prices:

Multiplying the price points with the amount sold (10,366 BTC per batch) results in the following dollar value per sale. The chart below shows the cumulative growth of the government’s Bitcoin sales: The U.S. government could therefore own almost $2 billion by selling the Bitcoin it had seized from the Ross Ulbricht-James Zhong case. That’s 68.68% higher than what the total amount (41,464 BTC) is worth at a current market price of $27,300. But what about the remaining coins? If the government were to sell its total amount of 195,148 BTC in four equal batches, and if we add Zhong’s BTC batches into the mix, we’d end up with the following results: The chart above implies that the government could earn up to $10,89 billion by selling its entire Bitcoin stash in a hypothetical bull market that mimics the 2020 market structure. For comparison, the small European countries of Moldova and Montenegro have an estimated GDP of $8.13bn and $4.84bn respectively. Scenario #2: The 2019 ‘Mini Bull Market’Our next, far less optimistic thesis, follows the so-called ‘mini bull market’ of 2019 that happened after Bitcoin bottomed around $3,000 — which happened an entire year after the previous 2017 bull market ended. You can also find some similarities in market structure by comparing Bitcoin’s price action in 2019 and 2023. We end up with the following results after applying a price fractal of 2019 and adding the previous selling dates. This scenario could prove to be more realistic. When you look at the absolute high of the 2019 price fractal, you’ll notice that it aligns with the support level of the 2021–2022 bull market. Because the market has been below this line since August of last year, we can anticipate that this previous zone of support might flip into resistance this time around — marking the top of our current ‘bull market.’ Applying the same selling dates as in the previous scenario results in the following sales:

Multiplying the price points with the amount sold (10,366 BTC per batch) results in the following dollar value per sale. The chart below shows the cumulative growth of the government’s Bitcoin sales: The price appreciation here is much lower than in the previous scenario. The government would earn only 11.35% more compared to selling the total amount in one batch at $27,300. Once again, let’s speculate what the government would earn by selling its total amount of 195,148 BTC in four equal batches. If we combine these results with the sales from if we add Zhong’s BTC batches into the mix, we’d end up with the following results: The chart above implies that the government could earn up to $7,19 billion by selling its entire Bitcoin stash in a hypothetical bull market that mimics the 2019 market structure. If you have time, be sure to check out my overall conclusion, on the above. [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments