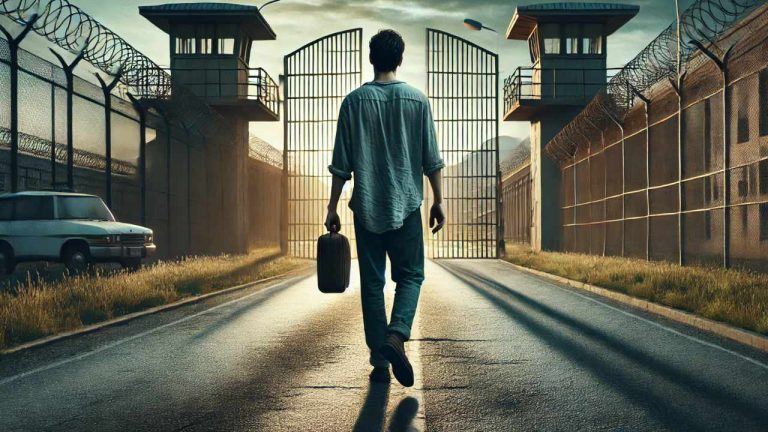

<p class="MsoNormal text-align-justify">Beleaguered Bahamian cryptocurrency exchange, FTX, has filed for <a href="https://www.financemagnates.com/terms/b/bankruptcy/" target="_blank" id="41b3ef0d-d805-441d-8443-121890264e94_1" class="terms__main-term">bankruptcy</a> protection in the United States, and Sam Bankman-Fried, its Founder and CEO, has resigned.</p><p class="MsoNormal">The crypto exchange disclosed these on Friday, announcing on Twitter that the FTX Group has kick-started voluntary proceedings under Chapter 11 of the United States Bankruptcy Code in the District of Delaware. </p><blockquote class="twitter-tweet"><p dir="ltr" lang="en">Press Release <a href="https://t.co/rgxq3QSBqm">pic.twitter.com/rgxq3QSBqm</a></p>— FTX (@FTX_Official) <a href="https://twitter.com/FTX_Official/status/1591071832823959552?ref_src=twsrc%5Etfw">November 11, 2022</a></blockquote><p class="MsoNormal">The Group involved in the bankruptcy protection proceedings includes FTX.com, the exchange's United States subsidiary, FTX.US, Hong Kong-based subsidiary Alameda Research Limited, and “approximately 130 additional affiliated companies.” The goal of the proceeding is to “review and monetize assets for the benefit of all global stakeholders,” FTX said.</p><p class="MsoNormal text-align-justify">A New Chief</p><p class="MsoNormal text-align-justify">Also, the Bahamian exchange, whose collapse was precipitated by its <a href="https://www.financemagnates.com/cryptocurrency/ftx-the-rise-the-fall-and-the-reaction/" target="_blank">recent liquidity crisis</a>, has appointed John J. Ray III to take over from Bankman-Fried as the CEO. However, FTX said Bankman-Fried will remain in the organization to provide assistance for a smooth transition.</p><p class="MsoNormal">Speaking on the bankruptcy proceedings, Ray noted that the process is important because “the FTX Group has valuable assets that can only be effectively administered in an organized, joint process.”</p><p class="MsoNormal">“The immediate relief of Chapter 11 is appropriate to provide the FTX Group the opportunity to asset its situation and develop a process to maximize recoveries for stakeholders,” Ray explained, adding that the exchange would conduct the process “with diligence, thoroughness and transparency.”</p><p class="MsoNormal">However, in the press statement published on Twitter, FTX pointed out that some of its subsidiaries were excluded from the proceedings. These are LedgerX LLC, FTX Digital markets Limited, FTX Australia Pty Limited and FTX Express Pay Limited.</p><p class="MsoNormal">FTX: From Crypto Giant to Bankruptcy</p><p class="MsoNormal">FTX was established in 2019 and is headquartered in the Bahamas. The firm initially offered alt-coin-based derivatives contracts to its clients but gained massive popularity and expanded its services into other areas including spot trading.</p><p class="MsoNormal">In 2021, the crypto exchange recorded <a href="https://www.financemagnates.com/cryptocurrency/news/ftxs-2021-revenue-jumped-1000-to-1-billion/" target="_blank">a 1000%+ jump</a> in its revenue, generating $1.02 billion, which is up from only $89 million in 2020. During the recent crypto market turmoil, FTX shone brightly, <a href="https://www.financemagnates.com/cryptocurrency/ftx-ventures-to-acquire-30-stake-in-skybridge-capital/" target="_blank">proposing</a> deals to troubled crypto-focused firms. The exchange <a href="https://www.financemagnates.com/cryptocurrency/ftx-us-wins-bid-to-acquire-voyager-digitals-crypto-assets/" target="_blank">won the bid</a> to acquire Voyager Digital, a digital asset lender that ran bankrupt.</p><p class="MsoNormal">However, trouble started for FTX last Sunday when the CEO of Binance, Changpeng Zhao announced the crypto exchange's plan to withdraw the remainder of its $530 million FTX Tokens (FTT) "due to recent revelations that have come to light." The announcement, in addition to a recent CoinDesk report that revealed that FTT constituted <a href="https://www.financemagnates.com/cryptocurrency/ftx-and-binance-an-epic-drama/" target="_blank">the largest single entry</a> on FTX sister trading firm, Alameda Research's balance sheet, sparked a withdrawal frenzy among FTX's users, resulting in a "liquidity crunch."</p><p class="MsoNormal">Although Binance originally offered to <a href="https://www.financemagnates.com/cryptocurrency/binance-to-acquire-ftxs-non-us-assets-to-clear-out-liquidity-crunches/" target="_blank">fully acquire FTX</a>, the world's largest cryptocurrency exchange later pulled out of the deal, citing FTX's financial impropriety, thereby throwing the beleaguered exchange into <a href="https://www.financemagnates.com/cryptocurrency/ftx-opts-for-capital-raise-as-alameda-research-winds-down-on-trading/" target="_blank">a scramble for funds</a>. </p><p class="MsoNormal">However, with a new CEO at the helm of affairs at FTX, it remains to be seen how much willpower Ray can amass to pull back into stability that the crypto exchange once considered the industry's fastest-growing.</p>

This article was written by Solomon Oladipupo at www.financemagnates.com.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments