Most people think you can only contribute $6k/year in an IRA ($7,000 if you're 50+). That's not true! You can in fact contribute as much as you want. From the IRS website:

"Excess contributions are taxed at 6% per year for each year the excess amounts remain in the IRA."

Here's why this is important, if I'm reading the IRS website right.

Contributing in excess CAN be very profitable if you intend to HODL or trade in that account until after the 59.5yo tax-free distribution age. Pay 6%/year tax on the excess contribution (not gains - must ensure this is the case) then withdraw tax-free, vs. paying 15%-20% capital gains, or worse if you traded/held short-term.

Let's say you're 49.5yo, and have $106k in cash to buy BTC with, and intend to let it sit for 10 years. Let's say BTC is $50k.

- If you open a Bitcoin Self-Directed Roth IRA (which means you can hold the BTC in your wallet if you want), you'll pay 6% tax on $100k, for 10 years. That's $6000 * 10 = $60k. Then you sell those 2 BTC in the SDIRA, and withdraw the USD tax-free.

- In a regular account, you'd HODL the 2 BTC, then in 10 years you incur a 15% (and 20% for the amount above ~$450k; the threshold will increase with inflation) long-term capital gains tax when you do anything with it.

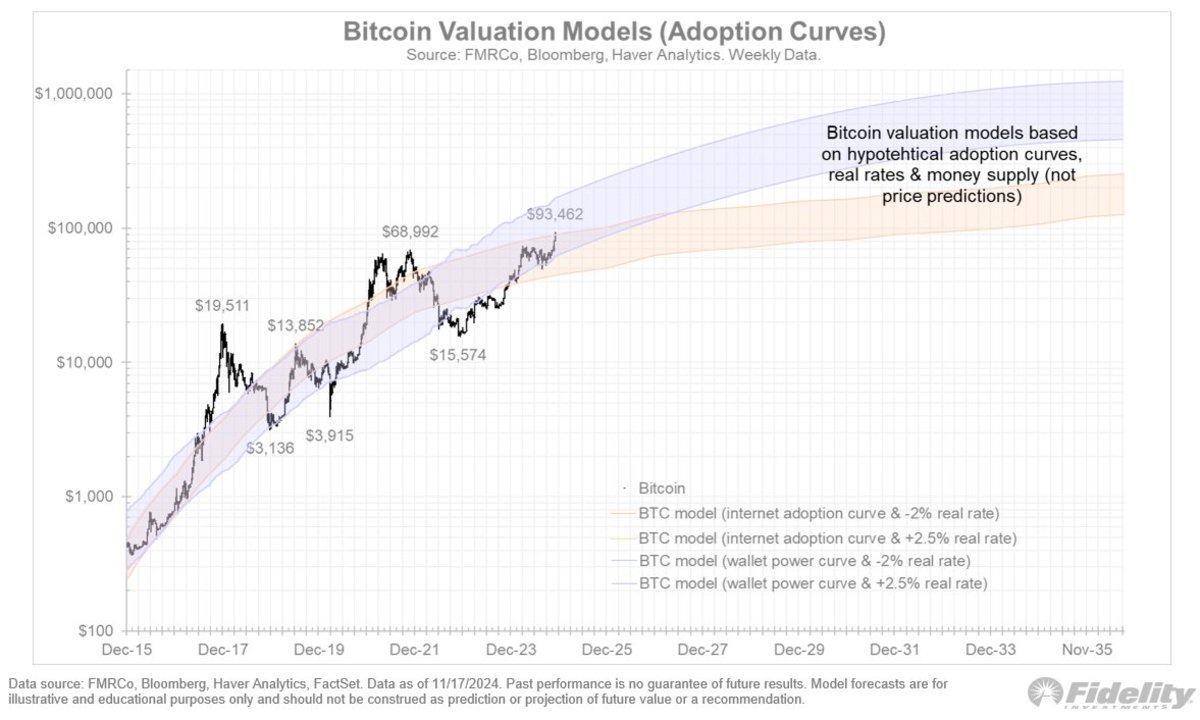

So if 15% of (2 * Bitcoin_Price_In_10_years - $100k) is greater than $60k, you should have contributed the $100k into the SDIRA. Which means your gain needs to be over $400k ($60k / 0.15), which means 2 BTC must be over $500k, which means BTC must be $250k in 10 years, i.e. go 5x.

The younger you are, and the more years you have until 59.5, the more this strategy pays off, because Bitcoin gains are exponential, while the 6%/year tax is fixed.

Has anyone done this? Anyone plans to?

If you don't have $100k in cash,

- you could sell $100k (or whatever amount) of coins (contributions to IRA accounts must be in USD; you can't roll crypto into them)

- you can contribute smaller amounts annually, but still over $6k. In that case you'll pay less tax than in the scenario above, but BTC will also appreciate over time.

In other words, if you want to DCA into Bitcoin until you're 59.5yo, you might want to do so in a Bitcoin SDIRA. Forget about the $6k/year "limit".

See the linked post above for some restrictions (basically, you can't self-deal, because that would mean you withdrew early).

If you suspect you might withdraw early though, then the SDIRA is a bad choice vs. HODL-ing in a wallet or regular account, because of the 10% early withdrawal fee, AND ordinary income tax rates instead of long-term capital gains (15-20%). Only throw into that account what you want to HODL until you're 59.5.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments