Introduction

Money is something that most of us take for granted, as we use it daily to buy goods and services. We constantly transact in money, think in money and strive to earn more of it. However, few genuinely understand what money is, and even those who do often perceive it in very different ways.

Some say that money is a form of energy that can be transformed and exchanged. Others see it as a technological tool that facilitates trade and commerce. Still others argue that money is a social construct shaped and governed by cultural norms and values. All these views can be correct since the concept of money is much deeper than the way it is commonly framed.

Our perspectives on money shape our views on how we use it. Money assumes various forms, spanning physical tender, precious metals, bank deposits, credit and, more recently, bitcoin. The most recognized form of money today is physical tender, encompassing coins and paper notes, which are distributed by the government.

So, What is Money?

Money is, first and foremost, a means to transact, to purchase goods and services. This function is commonly referred to as a medium of exchange. It is a good you acquire not for its own sake but merely as a means to purchase another good.

- ✅ Money is a market good, a good you acquire in order to acquire other goods. For this to happen, the market (sellers) must accept it as a medium of exchange.

- ❌ Money is not a consumption good, goods that directly satisfy consumer wants and needs. (Examples: a shirt, a pair of shoes, bread, cola, etc.)

- ❌ Money is not a capital good, which are physical assets that an organization uses to manufacture products and services that consumers will use later — e.g., machines, tools, vehicles, buildings, etc.

How we conceptualize and understand money has evolved over time, and different schools of thought have emerged regarding its nature and function.

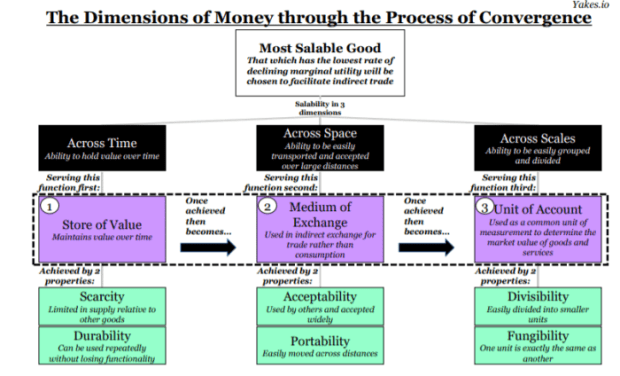

Karl Marx would say that money is the product of a commodity economy, where the source and nature of money are based on the labor theory of value, while Carl Menger, the founder of the Austrian school of economics, defined money as the relative ability for goods to be sold in a given market at a given time and price — a good’s “salability.” The most salable good is the good chosen to facilitate indirect trade based on the lowest rate of declining marginal utility.

Proponents of the Austrian school would say that the supply of money is either extremely durable in relation to current production — as it was under the gold standard. Another view is that money is determined exogenously by a government authority — a position often taken by many of today’s economists, educated in a largely Keynesian paradigm. In recent history, the choice has been either gold or government.

The global economy has undergone significant changes since money’s last fleeting connection to gold ended in 1971. The fiat standard has enabled central banks to print money with complete discretion, leading to inflation and currency devaluation. Digital money ushered in novel opportunities for enhanced global trade and investment while intensifying competition and economic uncertainty. The shift to untethered money has brought forth a plethora of advantages and disadvantages, which shape today’s economic landscape.

Why Do We Need Money?

Money is necessary for a society that wants to trade, as it facilitates exchange and allows us to meet our basic survival needs — like shelter, food and clothing — and enables us to live within specific security and safety standards.

Without the invention of money, people would still be using barter or keeping ledgers of credit and debt. Barter works well when the needs and supplies of two parties match, as they can simply exchange these items directly without any monetary medium.. This is called the coincidence of wants or the double coincidence of wants.

It’s immediately apparent that a barter economy restricts the ability to trade, as it requires people to possess goods (preferably non-perishable) that they are willing to swap. They must also find other people who want the goods you own, and lastly, you must want the goods they possess. The coincidence of wants does not support a scalable monetary system.

The solution is for society — or the market — to agree on an efficient good that will enable the exchange of products and services between all market participants. Money removes the necessity to find a particular person to barter with while offering a market to exchange your goods or services for a common medium of exchange. You will use that medium to buy what you need from others who also accept it as money.

By providing the optionality, money is the best natural mechanism to save for the future. It allows economies to thrive by increasing trade and commerce; modern economies could simply not exist without money.

With little access to money, our freedoms and time are limited as we are forced to spend most of our time working to obtain the money necessary to cover the basic necessities. Having access to more money is empowering, as it allows us to make more informed decisions about the hours we need to work and the goods and services we consume — the neighborhood we live in, the car we drive, the restaurants we eat at and even the healthcare we choose.

It also provides beneficial opportunities for our children, as parents can afford better food, better education and a better way to pass on their wealth, assuming that the money can hold its value through time — which is one of the three universally accepted functions of money.

Functions of Money

Money has taken different forms over the years, from gold and silver to glass beads in Africa or wampum used by Native Americans. What’s remained constant across continents and throughout history is that money must perform the following three functions: a medium of exchange, a unit of account and a store of value.

1.& Medium of exchange: Money serves as a medium of exchange when it allows people to trade goods and services easily without resorting to barter. This simplifies transactions and makes commerce more efficient.

As an intermediary between the products or services people want to trade, money is a suitable medium of exchange. “[money] is not acquired for its own properties, but for its salability.” – “The Bitcoin Standard,” Saifedean Ammous.

2.& Unit of Account: Money provides a standard measure of value, enabling people to compare the worth of different goods and services. A consistent price allows people to measure the market value of goods, services, economic activities, assets and liabilities. The price is what indicates the measurement of a good’s market value relative to other goods on the market.

When goods, services, assets or salaries are quoted in a recognizable unit of account, it allows buyers and sellers to quickly determine if a trade is worthwhile. Prices expressed in a unit of account lets market participants decide to operate complex tasks, accumulate capital or engage in economic calculations.

3.& Store of Value: Money serves as a store of value, allowing individuals and organizations to save and store wealth through time, without its value deteriorating. Current expectations of future supply and demand for an asset drive the ability of something to be a good store of value.

A store of value must be a durable good with limited supply issuance. Consumption goods such as milk and capital goods like machinery or cars are poor stores of value because they can perish, corrode, depreciate or lose value over time.

Andreas Antonopoulos, a long-time Bitcoin educator, argues that technology and network systems in the modern era may have given rise to a darker side of money. He introduced a fourth function:

4.& System of Control (external link): Money as a system of control refers to how money can be manipulated to serve political agendas. This has turned financial services companies into deputies of the system. As deputies, they get certain perks, such as never going to jail, but this has come at the expense of corruption and economic exclusion.

When money is used as a system of control, it corrupts its other functions, including its ability to serve as a medium of exchange and store of value. Money abused in this way works to the advantage of corrupt politicians and dictators, as it ensures that political dissent can be censored very effectively by limiting transactions or blocking purchases.

In the 20th century, governments monopolized the issuance of money and continually undermined its use as a store of value, creating a false narrative that money is primarily a medium of exchange. Money that doesn’t store value into the future results in a society that concerns itself less about the future.

Sound money, in contrast, is defined as money with a purchasing power determined by markets, independent of governments. Market participants, left to their own devices, naturally select a monetary medium that best fulfills the three functions of money. To achieve this status, it needs to have strong monetary properties.

Properties of Money

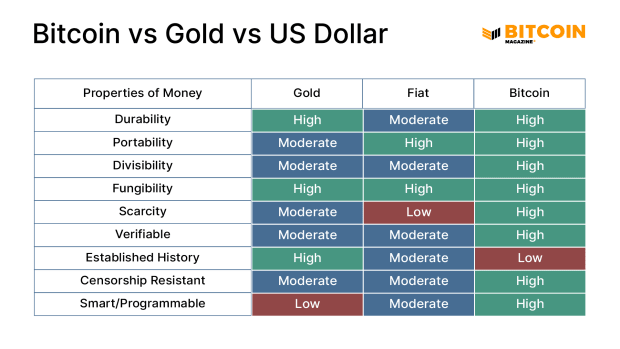

There are six widely accepted properties of money and it has been this way for centuries. So long as an item has these properties, it’s a good candidate for becoming money. Whichever monetary candidate records the highest score against these properties is likely to be used as the de facto unit of trade.

Standard properties:

- Durable — Money must be durable to be passed around and used repeatedly without the danger of wear and damage and the consequent depreciation of its value.

- Portable — Money should be easy to transport, physically or digitally, so that it can be transferred in trade. Cash and gold are portable in small quantities, yet more significant amounts can be challenging to move over long distances or through border controls.

- Divisible — Money must be capable of being divided into smaller parts. For example, a $10 bill can be exchanged for two $5 bills without diminishing its (combined) value. A cow or a stone, on the other hand, is not divisible.

- Fungible — Money should be completely interchangeable: one dollar should always be equal to another dollar, the same way two $5 bills are interchangeable with one $10 bill.

- Scarcity — Scarcity, or limited supply, is another essential property of sound money. Computer scientist Nick Szabo defined scarcity as “unforgeable costliness,” meaning the cost of creating something cannot be faked. If money is too plentiful, it loses value over time as more units can and will be created, and more will be required to purchase a good or service.

- Verifiable — Money should be a verifiable record accepted as a medium of exchange to pay for goods and services or to repay a debt in a specific country. It should be easy to recognize and hard to counterfeit; otherwise, it would lose value for payment purposes and would be rejected by vendors.

Each of these properties underpins the functions of money, encapsulated by Erik Yakes below as well as in his series on the dimensions of money. Clearly, owning a scarce good that’s durable is a good means of storing value through time. But that’s not enough to make something money; it also has to be desirable, or acceptable and portable if it is to be used in exchange for other goods and services. Once this is achieved, it can become a unit of account so long as it’s divisible and fungible.

Since the invention of digital money, three additional monetary properties can be considered, including established history, censorship resistance and programmability, which have significantly impacted how we perceive and use money in the digital age.

Additional Properties:

- Established history — The Lindy effect suggests that the life expectancy of certain non-perishable entities, such as technologies or ideas, is directly related to their current age. In essence, the longer these entities have survived and remained relevant, the greater their chances of continued existence into the future. This longevity indicates resistance to change, obsolescence or competition, which increases their chance of survival over time.

- Censorship resistance — Decentralization ensures that nobody, nowhere, can have their money confiscated or blocked from usage. Censorship resistance is a relatively new monetary property for those who want to be sure their wealth is untouchable.

- Smart/Programmable — Typically refers to blockchain technology systems which allow certain conditions to be met before money can be spent. It’s a mechanism for specifying the automated behavior of that money through a computer program.

Money does not need to be “backed” by anything; it only needs these properties to have value.

The idea that money must be backed by something only exists because paper money was once redeemable or “backed by” gold, where intrinsically useless fiat money piggybacked onto gold’s valuable properties.

Bitcoin promises to be the next step in the evolution of money. It’s built upon the same properties that once made gold the de facto monetary medium for centuries, only it’s been enhanced with the additional properties of extreme portability and fungibility — those very properties that allowed fiat to usurp gold during the last century.

Unlike gold and fiat, bitcoin is built for the digital age. Its supply is strictly regulated by its code and enforced by those who use it. It’s a system of rules without rulers, that allows transactions to be transmitted globally in mere seconds and settled within minutes without incurring the exorbitant expenses and approval typically associated with traditional financial systems.

For the first time in history, we have a monetary system based on a distributed, immutable technology that is transparent, objective, programmable and well suited to move economic value across time and space without relying on a trusted intermediary and the issuance by central banks. Satoshi Nakamoto created peer-to-peer electronic cash that would not require trust in third parties for transactions, and its supply could not be altered by any other player.

It’s often said that gold is the king’s money, and fiat is government money. If so, then bitcoin is undoubtedly the people’s money.

Read more >> What is Bitcoin

Final Thoughts

Many who theorize about money believe that the connection to a commodity at its origin is the real reason any money could initially gain value, or hold that the support of rulers is what establishes monetary value; proponents of those arguments therefore believe that money is a creature of the state.

Money has a considerable history and has evolved numerous times. The last significant evolution marked the end of the gold standard and ushered in the beginning of fiat money. The state — via central banks — eventually destroyed two critical properties of money: soundness and sovereignty. These are the properties that enabled value to be passed down through generations.

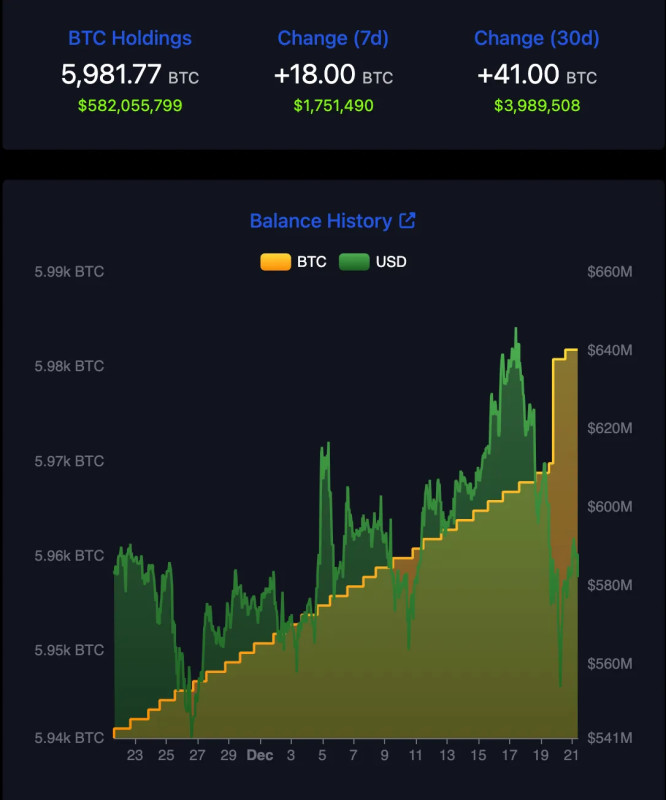

The emergence of Bitcoin should be viewed within this scheme of things. As a medium of exchange, a global unit of account, a store of value, an international and online method for settlement, it’s conducive to individual sovereignty.

Bitcoin emerged as an alternative to government restrictions on individuals who transfer money and as an alternative to the state’s control over the money supply. As long as those premises continue to exist, then demand for bitcoin will continue to increase.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments