Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has been on a remarkable upward trajectory, captivating investors and analysts alike. As of Thursday, December 5, 2024, Ethereum's price has surged to $3,861, testing an intraday high of $3,908—levels not seen since May of this year.

This article delves into the factors driving Ethereum's impressive rally, explores its market position, and examines future prospects for this blockchain giant. I also present some bold Ethereum price predictions for 2024, 2025, and 2030.

Ethereum's Recent Price Analysis: A 66% Monthly Gain

Ethereum's price has skyrocketed by an astonishing 66% over the past month, outpacing many of its cryptocurrency peers. This surge has pushed ETH's market capitalization to a staggering $451 billion, solidifying its position as the second-largest cryptocurrency in the world.

While still over five times smaller than Bitcoin's market cap, Ethereum's valuation dwarfs that of the third-ranked cryptocurrency, Tether, by a factor of three.

However, why is Ethereum's price up today? In addition to the mix of factors I describe below, one reason could be a significant purchase of Ether by BlackRock, one of the largest investment firms in the world.

????BREAKING: BlackRock just bought $230.39 MILLION worth of #Ethereum They know what's coming next... pic.twitter.com/ie3875FDOP

— Armando Pantoja (@_TallGuyTycoon) December 4, 2024

Key Metrics Driving Ethereum's Bull Run

Trading Volume: In the last 24 hours, Ethereum has seen transactions worth $64 billion, indicating robust market activity.

Futures Open Interest: ETH futures open interest on cryptocurrency exchanges has reached an all-time high of nearly $26 billion, with Binance leading the charge, handling over $8 billion.

Price Levels: Ethereum rose by 6.3% on Wednesday, reaching almost $3,900, and continued to climb on Thursday, testing $3,861 with an intraday high of $3,908.

Market Analysis: Why Ethereum is Surging in 2024

Several factors contribute to Ethereum's current price surge:

- Institutional Adoption: The record-breaking futures open interest signals growing institutional involvement in the Ethereum market.

- BlackRock ETH Purchase: BlackRock, one of the biggest investment companies in the world just purchased over $250 million worth of Ethereum

- DeFi Dominance: Ethereum continues to be the backbone of the decentralized finance (DeFi) ecosystem, with over $70 billion in total value locked.

- NFT Market Recovery: The non-fungible token (NFT) market, primarily built on Ethereum, has shown signs of recovery, driving demand for ETH.

- Technical Breakthroughs: Ethereum has broken through key resistance levels, including the 50-day and 200-day moving averages.

- Macro Economic Factors: Anticipation surrounding the effects of the US presidential election and potential changes in monetary policy have influenced crypto markets.

- Gary Gensler Is Out: Investors are optimistic about a potentially more crypto-friendly SEC Chair after Gensler's exit on January 20, 2025.

- Bitcoin New ATH: Ethereum has been rising strongly alongside Bitcoin, which has finally managed to surpass the psychological barrier of $100,000.

Ethereum Technical Analysis: RSI and Price Movements

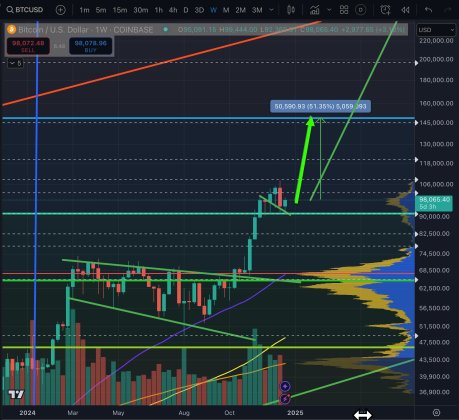

From my technical analysis of Ethereum's chart, the recent upward movements have broken through two important descending trendlines: one drawn from this year’s local peaks and a longer-term one extending from the historical highs of over $5,000 more than three years ago.

While these are very optimistic signals, ETH/USD is currently facing resistance under a broad zone defined by the May highs around $3,900 and the March levels between $4,000 and $4,100. This range is packed with sell orders, which could exert selling pressure on Ethereum's price chart.

On the other hand, Ethereum can count on a broad support zone, marked in green. The lower boundary of this zone is further reinforced by the 61.8% Fibonacci retracement level from the long-term downtrend of 2021–2022.

Additionally, the Relative Strength Index (RSI) for Ethereum remains consistently high, reflecting strong buying momentum. Currently, the RSI stands at 75, which indicates overbought conditions but also highlights the strength of the ongoing trend. This dynamic will be critical in shaping the short-term price action for Ethereum.

Ethereum Long-Term Price Predictions: Ethereum Price in 2025 and 2030

Analysts and market experts have weighed in on Ethereum's potential future value.

Some of the more optimistic forecasts come from the analyst venturefounder on X (formerly Twitter). According to him, “Ethereum about to break out of the 3 years of triangle consolidation, and ETH could break out of the range where it has been for the past 7 yrs.” His target price is nearly $16,000.

#Ethereum about to break out of the 3 years of triangle consolidation, and $ETH could break out of the range where it has been for past 7 yrs.Ethereum to repeat this impulsive breakout it did between 2016-2017 to shoot to new ATH very quicklyPrice Target: $15,937 by May 2025 pic.twitter.com/YpOeWmM03T

— venturefounder (@venturefounder) December 4, 2024

2025 Projections

- Conservative estimate: $5,000–$7,000

- Optimistic forecast: $10,000–$15,000

Another pseudonymous analyst, Elja, claims, “ETH breakout will be legendary,” stating that the cryptocurrency is set to reach five-digit values during this cycle.

$ETH breakout will be legendary $10,000 #Ethereum is programmed this cycle! pic.twitter.com/IFIHdx0Gt0

— Elja (@Eljaboom) December 3, 2024

2030 Outlook

- Standard projections: $15,000–$20,000

- Bullish forecasts: $32,000

The most bullish prediction comes from Ethprofit.eth, who asserts that the bull run “has not even started yet,” projecting Ethereum to ultimately rise to $32,000.

The #Ethereum bull run has not even started yet, $32k $ETH is coming! ???? pic.twitter.com/nzQQvLSqaW

— Ethprofit.eth ???????? (@Ethprofit) December 5, 2024

These predictions are based on factors such as increased adoption, network upgrades, and overall crypto market growth.

Factors Influencing Ethereum's Future Growth

- Ethereum 2.0 Upgrades: Ongoing improvements to scalability and efficiency

- Institutional Adoption: Increasing interest from traditional finance and potential ETH ETFs

- DeFi and dApp Ecosystem: Continued expansion of decentralized applications

- Regulatory Environment: Evolving global cryptocurrency regulations

- Macroeconomic Trends: Inflation, interest rates, and global economic conditions

The Role of Vitalik Buterin and Ethereum's Development Team

Vitalik Buterin, Ethereum's co-founder, continues to play a crucial role in shaping the network's future. His vision for Ethereum includes:

- Improving scalability through layer-2 solutions and sharding

- Enhancing privacy features

- Promoting sustainable and equitable blockchain governance

The Ethereum Foundation and its global community of developers are actively working on these goals, contributing to the network's long-term value proposition.

Ethereum vs. Competitors: A Market Comparison

While Ethereum leads the smart contract platform space, competitors like Solana have gained traction. Here's how Ethereum stacks up against its rivals:

Ethereum vs. Solana

- Market Cap: Ethereum ($451B) vs. Solana ($111B)

- Transaction Speed: Ethereum (15-30 TPS) vs. Solana (65,000 TPS)

- Developer Activity: Ethereum leads in total developers, but Solana is growing rapidly

Ethereum's Position Among Altcoins

Ethereum maintains its dominance among altcoins, with its market cap exceeding the combined value of the next five largest cryptocurrencies (excluding Bitcoin).

Ethereum Overview: From 2015 Launch to 2024 Powerhouse

Launched in 2015 by Vitalik Buterin and a team of co-founders, Ethereum has evolved from an ambitious project to a cornerstone of the cryptocurrency ecosystem. As a decentralized platform, Ethereum introduced the concept of smart contracts, revolutionizing the potential applications of blockchain technology.

Ethereum's Journey: Proof-of-Work to Proof-of-Stake

One of the most significant developments in Ethereum's history was its transition from a proof-of-work (PoW) consensus mechanism to proof-of-stake (PoS) in September 2022. This shift, known as “The Merge,” dramatically reduced Ethereum's energy consumption and laid the groundwork for future scalability improvements.

Investment Considerations: Should You Buy Ethereum?

While Ethereum's recent performance has been impressive, potential investors should consider several factors:

- Volatility: Cryptocurrency markets are known for their high volatility

- Regulatory Risks: Changing regulations could impact Ethereum's adoption and use cases

- Technological Risks: Competing blockchains and potential security vulnerabilities

- Market Cycles: Understanding the broader crypto market trends and cycles

Investors are advised to conduct thorough research and consider their risk tolerance before making any investment decisions.

Ethereum's Bullish Outlook Amidst Market Dynamics

Ethereum's surge to nearly $3,900 in 2024 reflects growing confidence in its technology, ecosystem, and future potential. With its dominant position in DeFi, NFTs, and smart contract capabilities, Ethereum is well-positioned for future growth. However, investors should remain aware of the inherent risks and volatility in the cryptocurrency market.

As Ethereum continues to evolve and adapt, its price movements will likely be influenced by technological advancements, regulatory developments, and broader economic factors. The effect of the US presidential election, global monetary policies, and the potential approval of Ethereum ETFs could all play significant roles in shaping ETH's price trajectory in the coming years.

For those considering investing in Ethereum, it's crucial to stay informed about market trends, technical developments, and regulatory changes. As always in the crypto space, due diligence and risk management are paramount.

Ethereum Price Prediction, FAQ Section

Why are Ethereum prices going up?

Ethereum's price surge can be attributed to several factors: increased institutional adoption (e.g., BlackRock's $230 million ETH purchase), record-breaking futures open interest, a recovery in the NFT market, Ethereum's dominance in DeFi with $70 billion in total value locked, and favorable macroeconomic trends like Bitcoin hitting new highs. Additionally, Ethereum's technical breakthroughs, including surpassing key resistance levels, have driven strong buying momentum.

How much will 1 Ethereum be worth in 2030?

Ethereum price predictions for 2030 vary significantly based on market conditions and adoption rates. Conservative estimates suggest prices between $15,000 and $20,000, while bullish forecasts project values as high as $32,000, supported by network upgrades, increased scalability, and broader adoption across decentralized applications.

How high will Ethereum go in 2024?

Analysts provide a wide range of Ethereum price predictions for 2024. Conservative projections place ETH around $5,000 to $7,000, while optimistic forecasts predict levels up to $15,000. The surge depends on factors such as the broader crypto market, institutional interest, and regulatory developments.

Where will Ethereum be in 5 years?

In five years, Ethereum is expected to solidify its dominance in blockchain technology and decentralized applications. Price estimates for 2029 suggest ETH could range from $10,000 to $20,000, with potential for higher growth depending on global adoption, regulatory clarity, and the expansion of the DeFi and NFT ecosystems.

This article was written by Damian Chmiel at www.financemagnates.com.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments