WisdomTree has launched its spot Bitcoin exchange-traded fund (ETF) in the US. Dubbed WisdomTree Bitcoin Fund (BTCW), this fund has debuted on the Cboe BZX Exchange, providing investors in the US with an avenue to gain exposure to the price of Bitcoin. BTCW offers a zero expense ratio for the first $1.0 billion worth of assets.

Navigating Crypto Regulatory Landscape

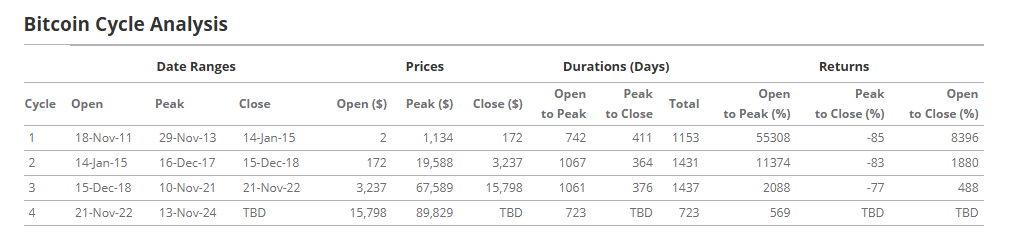

In its official statement, WisdomTree advised investors to trade the fund cautiously, considering the volatility in the price of Bitcoin. The company explained that cryptocurrency and, by extension, the BTCW are highly speculative and involve considerable risk, including the potential for substantial losses.

The WisdomTree Bitcoin Fund (BTCW) makes history in the first wave of Bitcoin ETFs with an anticipated launch tomorrow, January 11. More information is available here: https://t.co/leuba2ToIVSee prospectus here: https://t.co/ug1HpjyeV7

— WisdomTree (@WisdomTreeFunds) January 11, 2024

Last year, WisdomTree sought regulatory approval for the second time from the SEC to list a spot Bitcoin ETF. This step followed a similar application from BlackRock, among several other asset management firms. However, the SEC rejected WisdomTree’s application in 2022.

Despite previous rejections for spot Bitcoin ETF applications by the watchdog, the current regulatory climate and growing industry pressure have led to a different outcome. The heightened interest from regulated financial players has swayed the regulator toward a more favorable view of such instruments. The recent decision is expected to reshape the crypto investment landscape in the United States.

Paving the Way for Bitcoin Adoption?

On Wednesday, the SEC approved 11 spot Bitcoin ETFs to start trading on US stock exchanges today. This historic decision opened new avenues for investors and crypto enthusiasts, signaling a significant shift in the financial landscape. Leading the charge is Bitwise, which is set to list its spot Bitcoin ETF on NYSE Arca, with a strategy of charging no fees for the initial six months until the asset under management hits $1 billion.

Following this approval, the SEC's Chief, Gary Gensler, issued a statement emphasizing that the approval is specific to exchange-traded products (ETPs) holding Bitcoin, not an endorsement for broader crypto asset securities. Gensler highlighted a recent court decision regarding Grayscale’s proposed ETP, reinforcing the SEC's commitment to acting within the law.

This article was written by Jared Kirui at www.financemagnates.com.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments