On-chain data shows the Bitcoin supply on exchanges has fallen to a value of just 6.4%, which is the lowest level in more than five years.

Bitcoin Supply On Exchanges Has Continued Its Downtrend Recently

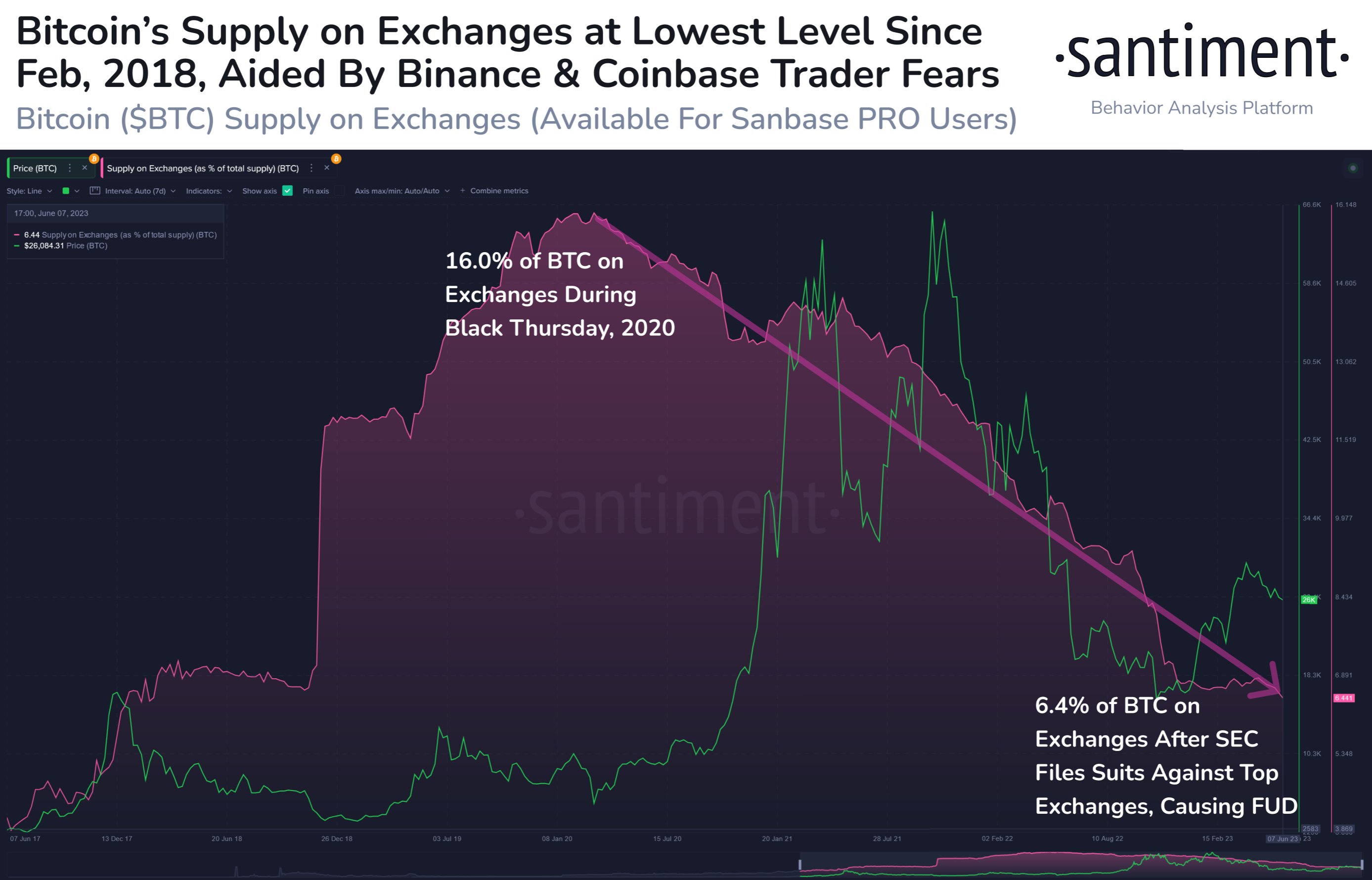

According to data from the on-chain analytics firm Santiment, investors have continued to move their coins to self-custody recently. The “supply on exchanges” is an indicator that measures the percentage of the total Bitcoin supply that’s currently sitting in the wallets of all centralized exchanges.

When the value of this metric rises, it means that a net number of coins are entering these platforms right now. As one of the main reasons why an investor may deposit their coins to exchanges is for selling-related purposes, this kind of trend can have bearish implications for the asset in the short term.

On the other hand, lowering values of the indicator imply the holders are withdrawing their BTC from the exchanges currently. Such a trend, when prolonged, can be a sign of accumulation from the investors, and hence, can be bearish for the value of the cryptocurrency.

Now, here is a chart that shows the trend in the Bitcoin supply on exchanges over the last few years:

As displayed in the above graph, the Bitcoin supply on exchanges has been in a constant downtrend for a few years now. This means that investors have been constantly transferring their coins out of these centralized entities.

During the latest rally, however, the metric had been moving sideways instead as some investors were depositing their coins to these platforms for selling to take advantage of the profit-taking opportunity.

Recently, though, the indicator has again resumed its downward trajectory. The likely reason behind this renewed decline in the metric is the FUD around the market that has spread after the US SEC sued Binance and Coinbase.

The users of these platforms have made large Bitcoin withdrawals, although the decline in the reserve has been much more pronounced on Binance than on Coinbase.

While the short-term changes in the supply on exchanges can have direct implications for the asset’s price, the long-term view can have a more complex significance for the market.

This downtrend that has now been going on for years means that investors have been making a constant push toward self-custody. Holders keeping their coins away from central custody is a positive development for the asset, as it leads to the supply being spread out over different entities, rather than being locked with a few big players.

As events like the 3AC bankruptcy or the FTX collapse have already shown, any destabilization in these large central platforms can also destabilize the entire market. If there is only a low number of coins being stored on such platforms, then their influence on the sector, and hence, any domino effect caused by them, will be small as well.

Back during 2020’s Black Thursday, 16% of the entire circulating Bitcoin supply was in the custody of centralized exchanges. Today, this value has come down to just 6.4% of supply.

BTC Price

At the time of writing, Bitcoin is trading around $25,900, down 2% in the last week.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments