The saga of Ethereum ETFs in the US continues with a new twist: cautious optimism. After the US Securities and Exchange Commission’s unexpected green light for spot Ethereum ETFs in May, investors have been eagerly awaiting the launch date. But according to SEC Chair Gary Gensler, patience remains key.

Gensler Throws Cold Water On Rapid Launch Hopes

In a recent interview with CNBC, Gensler tempered expectations, stating that final approvals for individual ETFs “will likely take some time.”

This suggests that the review process will likely take a long time, which could postpone the establishment of Ethereum ETFs, according to Eleanor Terrett, a writer for Fox Business. However, Gensler did offer a glimmer of hope, acknowledging that the process is underway.

NEW: @SECGov Chairman @GaryGensler says the next step in the $ETH ETF approvals “will take some time,” possibly indicating a potential slow-walk of the S-1 approval process. https://t.co/iwfN9vvmt8

— Eleanor Terrett (@EleanorTerrett) June 5, 2024

This wait-and-see approach comes amidst ongoing communication between the SEC and ETF issuers. Several companies have tweaked their applications based on the SEC’s feedback, including removing staking options and disclosing custodian details. These amendments suggest a collaborative effort, potentially expediting the approval process.

Expert Opinions Divided On Timeline

Market experts are divided on the exact timeline for these ETF launches. Eric Balchunas, a Senior ETF Analyst at Bloomberg, remains optimistic. He believes issuers could receive the SEC’s nod by the end of June, with a possible launch date as early as July 4th. James Seyffart, another Bloomberg analyst, is more cautious, avoiding specific dates but suggesting approvals are likely within weeks, not months.

Ethereum ETF: Long-Term Success UncertainGood sign. Prob see rest roll in soon. Then prob one more round of fine-tune comments from Staff. End of June launch a legit possibility altho keeping my o/u date as July 4th https://t.co/WymshkTvat

— Eric Balchunas (@EricBalchunas) May 29, 2024

While the prospect of Ethereum ETFs is exciting for some, experts caution against unrealistic expectations. Unlike Bitcoin, which saw a surge in inflows with its ETF launch, Ethereum’s future might be less meteoric. The market’s overall volatility and the lack of clarity around staking within these ETFs could dampen investor enthusiasm.

A Calculated Move, Not A Gold RushThe approval process for Ethereum ETFs highlights the SEC’s measured approach towards crypto regulation. While the agency seems receptive to innovation, it prioritizes investor protection. This cautious stance might delay the launch, but it could also ensure a more stable and secure entry point for mainstream investors into the Ethereum market.

For now, investors should buckle up for a potentially bumpy ride. While the launch of Ethereum ETFs appears to be on the horizon, it’s likely to be a gradual rollout rather than a sudden explosion. This measured approach, while frustrating for some, could ultimately pave the way for a more sustainable future for Ethereum and cryptocurrency as a whole.

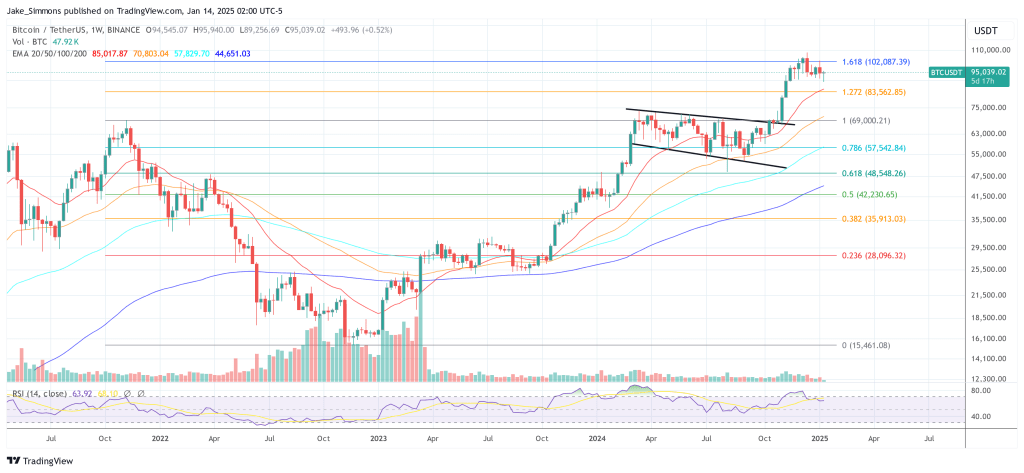

Featured image from Adaptas Training, chart from TradingView

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments