The growing demand for regulated cryptocurrency investment tools has prompted CME Group to introduce Solana (SOL) futures. Pending regulatory approval, these new contracts will reportedly launch on March 17 and aim to offer institutional and retail investors an efficient way to trade and hedge against Solana’s price movements.

This addition signals further institutional adoption of Solana, placing it alongside Bitcoin and Ethereum in CME’s expanding crypto derivatives market.

Data from CoinMarketCap shows that Solana(SOL) is on an uptrend despite a general decline in the digital currency space. The altcoin trades for $145, representing a 5% increase in the past day despite an 18% drop in the weekly chart.

Trade regulated, capital-efficient futures on SOL, available in both larger- and micro-sized contracts so you can scale your exposure with greater precision and flexibility.Find out more about SOL☀️ https://t.co/bY0trXWsHe pic.twitter.com/Y1uZTz9iMh

— CME Group (@CMEGroup) February 28, 2025

A New Tool for Institutional and Retail Investors

According to its announcement, CME Group will offer two future SOL contracts: a micro-sized contract at 25 SOL and a larger contract at 500 SOL. These futures will reportedly be cash-settled and based on the CME CF Solana-Dollar Reference Rate, which provides a daily U.S. dollar price for SOL.

Solana futures will join CME’s crypto product suite, which includes Bitcoin and Ether futures and options. According to the group, the demand for these products is evident, with year-to-date trading data showing an average daily volume of 202,000 contracts, marking a 73% increase YoY. The average open interest is 243,600 contracts, up 55% YoY.

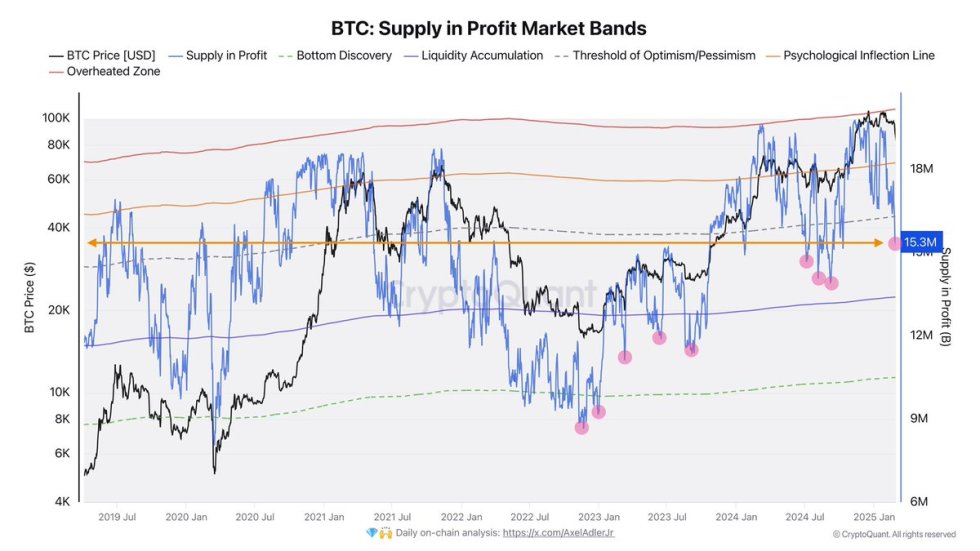

The launch of SOL futures comes at a time of heightened market activity. Solana’s price recently fell below $140 due to a broader crypto market correction, heavy whale sell-offs, and an anticipated token unlock event that could release 11.2 million SOL into circulation on March 1.

Navigating Solana’s Market Volatility

The broader crypto downturn also played a role, with Bitcoin trading at slightly above $82k and over $1.5 billion in liquidations occurring within 24 hours. Solana’s Relative Strength Index (RSI) is currently around the oversold zone, indicating that the digital asset could be due for a rebound.

The introduction of SOL futures reflects CME Group’s ongoing effort to expand crypto investment options for both institutions and active traders. According to the group, the launch of Solana futures could mark a turning point for the asset’s institutional adoption, further embedding it into the mainstream financial landscape.

Whether this translates to price stability or increased volatility remains to be seen, but one thing is certain: Solana’s role in the crypto ecosystem could be on an uptrend.

This article was written by Jared Kirui at www.financemagnates.com.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments