Crypto lender Voyager Digital is the latest domino to fall in the tumultuous market for digital assets.

Voyager Digital disclosed on Wednesday that it filed for bankruptcy on Tuesday with the U.S. Bankruptcy Court for the Southern District of New York.

The bankruptcy petition comes a week after the company froze withdrawals, trading, and deposits as it sought further time to consider available options. Since the beginning of 2022, Voyager’s shares have lost over 98 percent of their value.

Suggested Reading | Jordan Belfort, The ‘Wolf Of Wall Street,’ Advises: Buy Bitcoin Today And Make Money

Voyager Digital Cracks Under Pressure

According to the filing, Voyager’s estimated assets are between $1 billion and $10 billion, and its liabilities fall within the same spectrum. The Toronto, Canada-based digital currency lender has more than 100,000 creditors.

Chapter 11 bankruptcy proceedings halt all civil action and permit companies to continue operations while preparing turnaround strategies.

Image: Business 2 Community

Stephen Ehrlich, chief executive officer of Voyager, stated:

“The protracted volatility and contagion in the crypto markets over the past few months, as well as Three Arrows Capital’s default, demand that we take immediate and decisive action… the chapter 11 process provides an efficient and equitable method for maximizing recovery.”

Three Arrows, one of the most prominent investors affected by the rapid sell-off in crypto markets, is being liquidated, according to a report from Reuters last week, citing a source with knowledge of the situation.

Since its November 2017 peak of $3 trillion, the cryptocurrency market has fallen to less than $1 trillion, with the loss intensifying in May after the collapse of Terra, a multibillion-dollar cryptocurrency.

Crypto total market cap at $881 billion on the daily chart | Source: TradingView.com

Crypto Prices Drop After Voyager Bankruptcy Filing

In response to Voyager’s filing, Bitcoin and Ethereum prices declined, with BTC slipping below $20,000. As a significant portion of Voyager’s assets are now expected to be liquidated to satisfy its debts, the move is anticipated to increase market pressure.

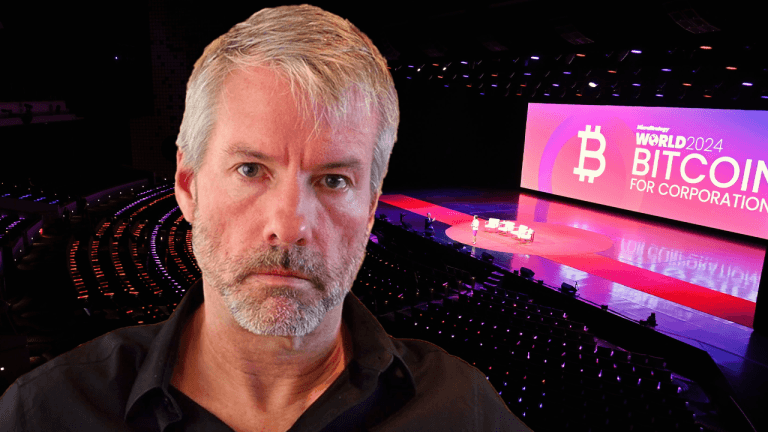

Alameda Research, the quant trading firm of billionaire Sam Bankman-Fried, offered Voyager a credit line of $500 million in cash and cryptocurrencies last month in a vain effort to help the company through its difficult period.

Suggested Reading | Stablecoins Becoming Attractive To Argentines After Economy Minister Quits

Alameda was identified as Voyager’s top creditor on Tuesday’s bankruptcy filing, with a $75 million claim.

This avalanche of bankruptcies coincides with crypto markets’ almost 60 percent decrease in value this year. This exposed a number of overleveraged companies to margin calls, which they failed to fulfill because of the decline in cryptocurrency values.

Featured image from HCL SW Blogs, chart from TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments